Gamma is the measurement of the rate of change of the delta.

Gamma In Options Explained

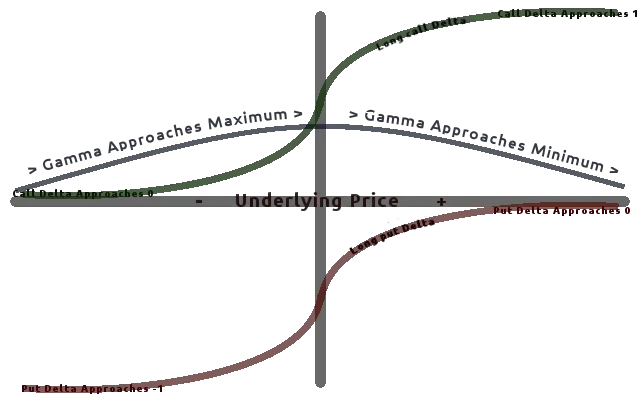

Gamma is the Greek that shows how delta will change with the underlier’s price moves. It is the rate of change of an option’s delta based on a $1.00 move in price of the underlier.

Gamma describes how much the options delta changes as the price of the underlying stock changes. The option’s gamma value is a measurement of the speed of change of the option’s delta. The gamma value of an option contract is a percentage and shows the change in the delta when there is a one point move in the price of the underlying stock. The options gamma value measures the magnitude and the direction of a change in the option’s delta.

When a long call option contract has a gamma of 0.10 and a corresponding delta of 0.50, When the underlier goes up $1.00 in price, that specific option will have an option Greek delta of 0.60 as one dynamic of its price movement in correlation with the underlier. It is important to understand the gamma of a stock as it can show the risk and benefits of the rate of change as an option moves closer or farther from being in or out-of-the-money. Short option risks is one of the most important dynamics to consider with gamma as the option price can move strongly against you quickly during a trend or gap in price with the underlier.

Deltas expand and become higher as price moves in favor of your option’s strike price. Options capture more intrinsic value as price moves closer to being in-the-money versus your options strike price. Deltas become smaller as price moves away from your option positions strike price needed for the option to go in-the-money. As price moves away from your strike price needed for profitability the movement becomes smaller on the option as the delta declines the gamma also declines.

A Gamma scalper of options is simply trying to buy an out-of-the-money option with nothing but time value and a very low delta and profit by the option delta expanding and increasing in value. An out-of- the-money option with very little premium value can go up in price as the odds of it going in-the-money increases and the delta capture rapidly expands.

A Gamma scalper will buy an option with only Theta value and profit from the gamma of a rapidly increasing delta. These types of trades usually have lower win percentages but can be profitable with wins that are 100% or more of price value. The key with these types of trades which many new option traders love is to trade them with a small amount of trading capital. 0.25% or 0.5% of total trading capital at risk is a good position size for these types of high reward but low probability of success trades. A gamma scalper does not need his option to go in-the-money to be profitable, he only needs the odds of it going into the money to increase so he can sell it for a profit.

Benefits of Gamma

Gamma can be most profitable for long option trades as it can grow profits fast when an out-of-the-money option gets close to being in-the-money. This can cause triple digit gains in option price on the long side. Losses also get smaller as an option moves farther away from being in-the-money to create a favorable risk/reward ratio. Gamma will increase until an option goes deep-in-the-money with a delta at 1.00. The ideal long option gamma trade is a far-out-of-the-money option becoming a deep-in-the-money option that maximizes gains.

Short Options Gamma Risk

Gamma presents the single biggest risk to option sellers as the attempt to write options for the small gain from theta can lead to big losses from gamma, especially for short unhedged option plays.

Options Expiration and Gamma

The risk to long option gamma traders is limited to the price of the option contract while the upside profit potential is theoretically unlimited. The maximum risk on the long side is that the option contract becomes worthless on expiration. The maximum risk for an option trader writing contracts short is theoretically unlimited with no hedge and the primary risk is the gamma growing exponentially.

The gamma curve plunges as expiration approaches as the odds of expiring in-the-money drops to lower probabilities. As the odds of delta expansion declines gamma declines along with it. Gamma expansion is great for option buyers but can cause option sellers large losses. Gamma growth can turn a losing long option trade into a winner quickly and also turn a winning short option trade into a loser just as quick.

I created my Options 101 eCourse to give a new option traders a shortcut to a quick and easy way to learn how stock options work.