Selling put options is one way to get paid to buy the stock you want at the price you are waiting on.

How does selling put options work?

The way to use this strategy to buy stocks for less is to sell put options at strike prices at the lower level on a chart where you want to buy the stock at anyway so you are paid to buy a stock at the price you want if it goes in-the-money by expiration.

Selling cash-secured puts is like setting a limit order on a stock you want to buy. You receive the option premium for selling the put options, and if the put option is assigned to you, the premium you already received can be used in part to buy the stock.

If the stock doesn’t dip to the strike price of the put option by expiration then you will not get to buy the stock at your chosen price but you will have been paid the option premium for waiting.

Note that option contracts come in increments of 100 shares so you must have enough money in your options trading account to purchase 100 shares of the stock the put option is written on. You must be authorized by your broker for the right options risk level for your account to sell put options short if they are cash secured.

The risks of selling puts

It is not a free lunch as you are taking on downside risk of the stock when you sell the put option so you still want to have a buy to close stop loss in place if the stock plunges. However, if you have chosen a great technical support zone then your risk should be minimal and your trade should be a high probability of a win whether you have the stock put on you for later equity profits on a rally or the put option will likely expire worthless as the technical price level is never reached.

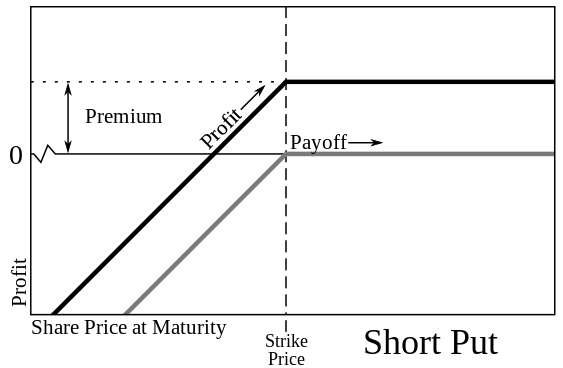

Selling to open short put options is an option play with a very similar risk profile as a covered call. You get paid a premium for taking on downside risk in a stock position. You keep the premium if the stock goes up, if a covered call option goes in-the-money your stock is called from you, if your short put option goes in-the-money the stock is put on you and you must buy it.

Selling put options for income

It is also possible to sell put options for income if technical price levels are chosen repeatedly for weekly or monthly strike prices that are not reached.

Selling put options can create immediate and repeatable income in an options trading account to the option writer. You keep the option premium if the short put option is not exercised by the buyer and it ends up being out-of-the-money at expiration.

An option trader who sells put options on stocks at the price levels that they want to own them at will increase the probabilities of being profitable. It should be a low probability that the put option ends at the strike price chosen and even it it does the stock is bought at the dip buy zone that the trader wanted to buy it at anyway. The odds are that the stocks goes higher and creates profits on the stock that the trader was paid to buy.