The Treynor ratio is a measurement of the returns earned in excess of what could’ve been earned on an investment that has no diversifiable risk per unit (like U.S. Bonds) of market risk assumed. The Treynor reward to volatility model is also called the reward-to-volatility ratio or Treynor measure it was named for Jack L. Treynor an economist who was a co-inventor of the Capital Asset Pricing Model (CAPM).

The Treynor ratio relates to the metric of the excess return over the risk-free rate for the additional risk taken using systematic risk instead of total risk. The higher the Treynor ratio is, the better the performance of a portfolio using this as an analysis filter.

Excess return in this context considers the amount earned above what could have been made in a risk-free investment like U.S. treasuries.

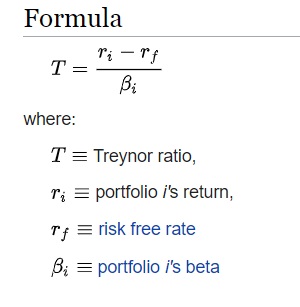

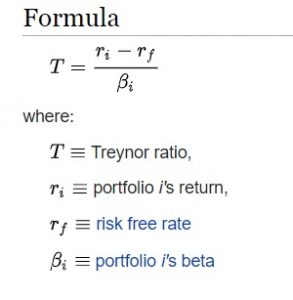

Treynor ratio risk refers to systematic risk as quantified by a portfolio’s beta. Beta is the measurement of a portfolio’s return change in correlation to changes in return for the market as a whole.

Treynor Ratio Formula

While there is no 100% risk-free investment, U.S. treasury bills are primarily used to represent the risk-free return in the Treynor ratio formula.

- The Treynor ratio is a risk/return metric used by investors and traders to adjust a portfolio’s returns based on systematic risk.

- The greater the Treynor ratio shows a portfolio is a more stable investment on a risk adjusted basis.

- The Treynor ratio is like the Sharpe ratio, however the Sharpe ratio uses the portfolio’s standard deviation to quantify risk.