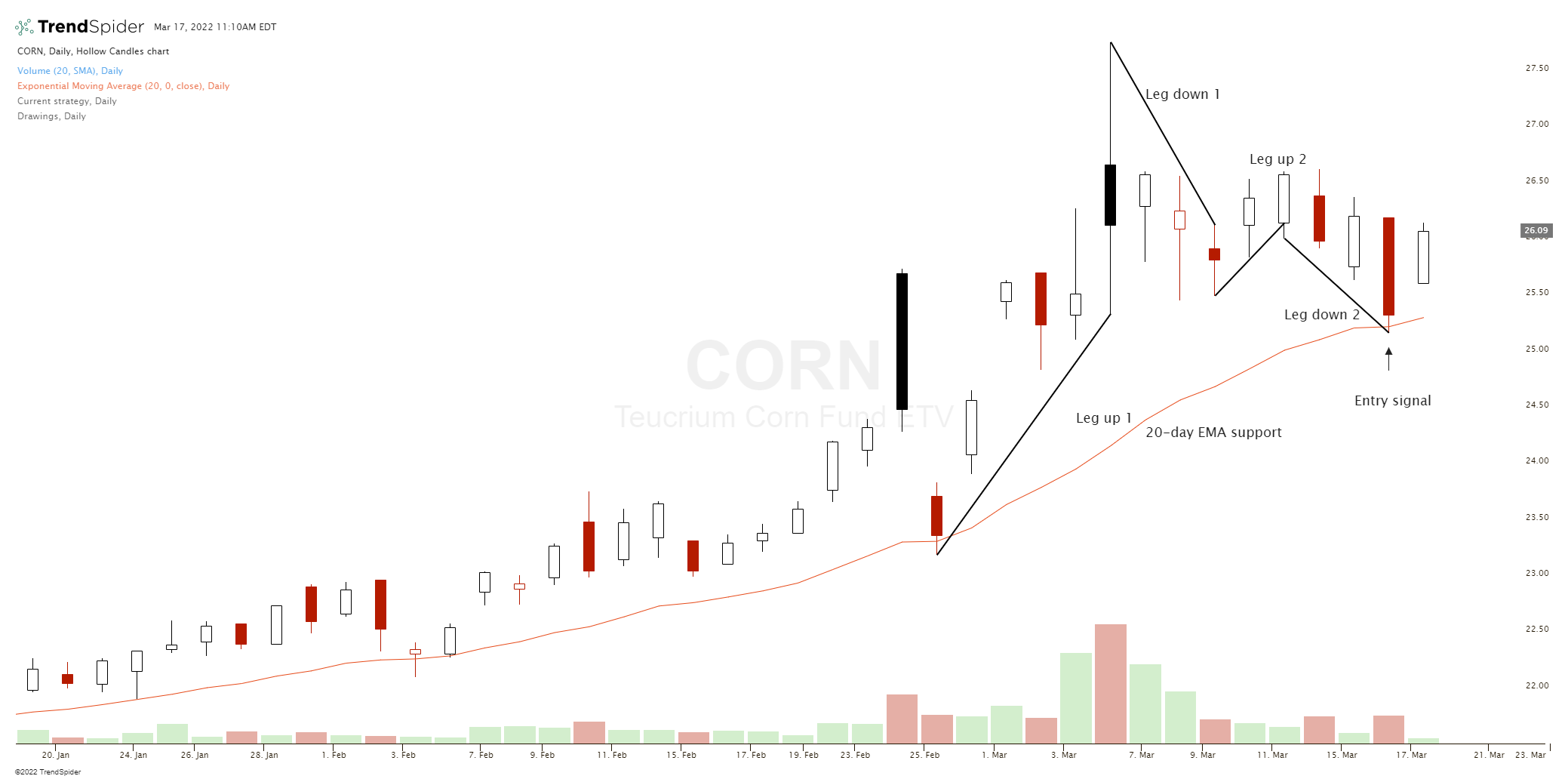

A two-legged pullback to the 20-period exponential moving average is a high probability trade entry set up inside a strong uptrend for buying a dip in price action. It can also be a short selling opportunity on a rally back to the 20-EMA during a downtrend in price action.

Any candle that goes higher than the previous candle begins a new leg up in price. Any candle that goes lower than the previous candle begins a new leg down in price.

Trading rules for the two-legged pullback to the 20-EMA

Dip buy signal

- Strong uptrend in price action on a chart.

- Two-legged pullback down to the 20-EMA.

- Enter at the close of the candle that bounced back from the 20-EMA.

Short sell setup signal

- Strong down trend in price action on a chart.

- Two-legged rally back up to the 20-EMA.

- Enter on the candle that tested and was rejected off the 20-EMA resistance.

Continuation pattern trades work out as the trend traps counter-trend traders that fade the primary move in price. Two-legged pullbacks are tempting entries to counter-trend traders to fade the primary move.

On a trending chart, the two-legged pullback pattern to the 20-period moving average is a high probability trading setup entry before a continuation of the trend. This is primary a signal for the daily chart but the principles can work on other time frames.