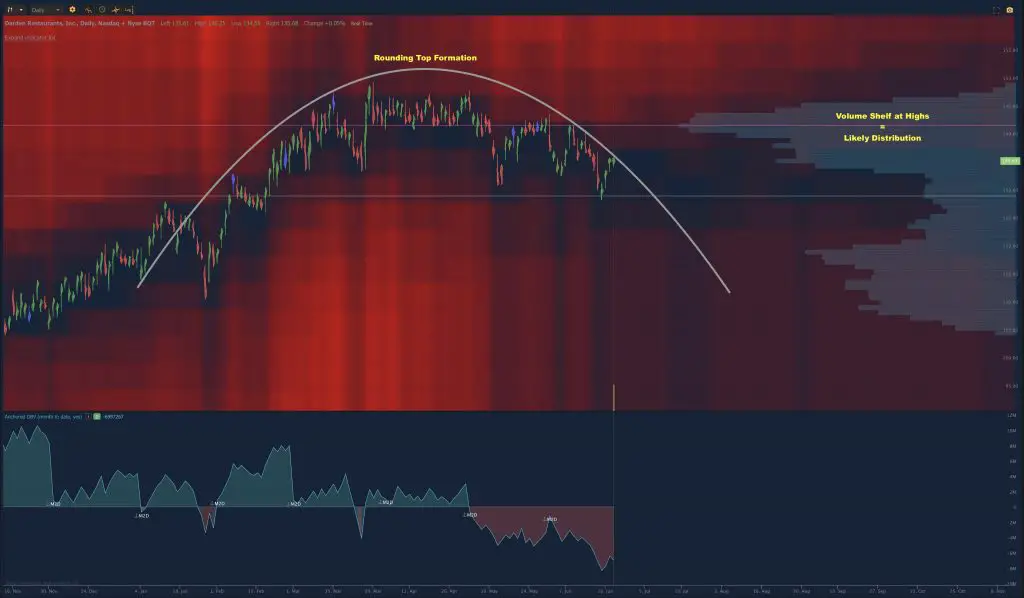

The rounding top chart pattern is a bearish reversal that occurs after an uptrend on a chart. The rounded top is formed after an uptrend in price action stalls out near a peak and goes sideways into a range before slowly going lower to create lower highs and lower lows. The pattern forms a downward sloping curve from the top and downward on both sides of the chart. A rounding top formed on a chart looks like the shape of a wide upside-down letter U.

Rounding tops are patterns used in technical analysis to identify price levels to exit long positions and can also be short selling set ups. This pattern signals a potential top may be put in on a chart. This pattern can signal the end of the previous uptrend and the beginning of a move lower.

Rounding tops are found at the end of extended upward trends and may signify a reversal in long-term price movements. This is a very slow pattern that can take many candles to form with a slow motion uptrend on the left side and a slow motion downtrend on right side of the chart. Traders should be aware of the slow nature of this pattern and how price spends most of its time in a range before finally rolling over into an eventual downswing.

Rounding top patterns can form on any time frame but the traditional pattern interpretation develops over weeks and months on the daily chart on longer time frames. The inverse of the bearish rounding top is the bullish rounding bottom that shows the opposite price action pattern.

Chart courtesy of TrendSpider.com

You can study all the major chart patterns in my book: The Ultimate Guide to Chart Patterns here.