Cryptocurrency Chart Patterns

Cryptocurrency Chart Patterns

Cryptocurrency price action creates chart patterns like any other market. The patterns formed are simply visual representations of the prices buyers and sellers bought and sold a token at in the past. There is no magic in chart patterns they just show what happened in the past and what has a higher probability of happening in the future.

A chart pattern can show that a cryptocurrency is in a trading range with defined resistance and support around reoccurring price levels. This means that it is simply being traded back and forth inside defined parameters where there is not enough buy and holders to drive it higher but it is also has enough demand to not be allowed to fall into distribution in a downtrend.

A chart pattern can also show an uptrend of higher highs and higher lows or a downtrend of lower highs and lower lows. In uptrends holding is the best strategy along with buying the dips. In downtrends it is best to be in a stable coin as it is not simple to sell most cryptocurrencies short and holding through downtrends in crypto can cause large and quick losses.

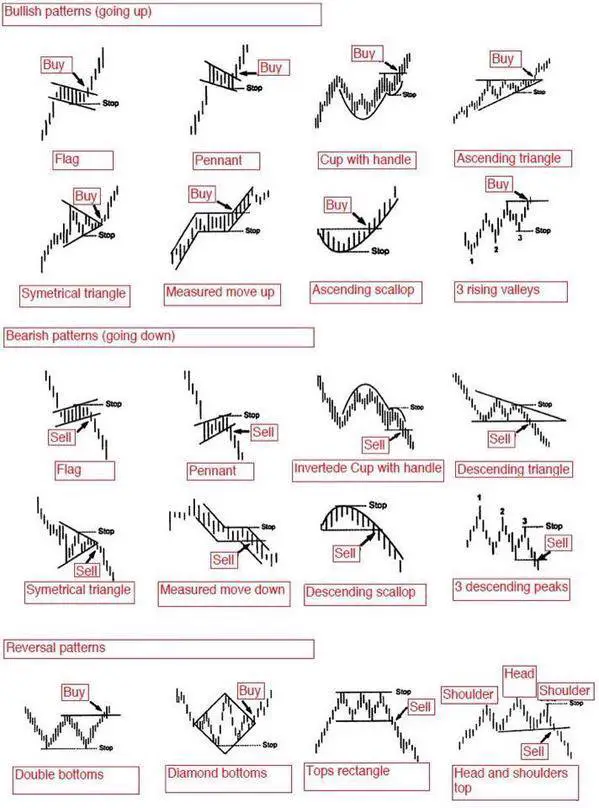

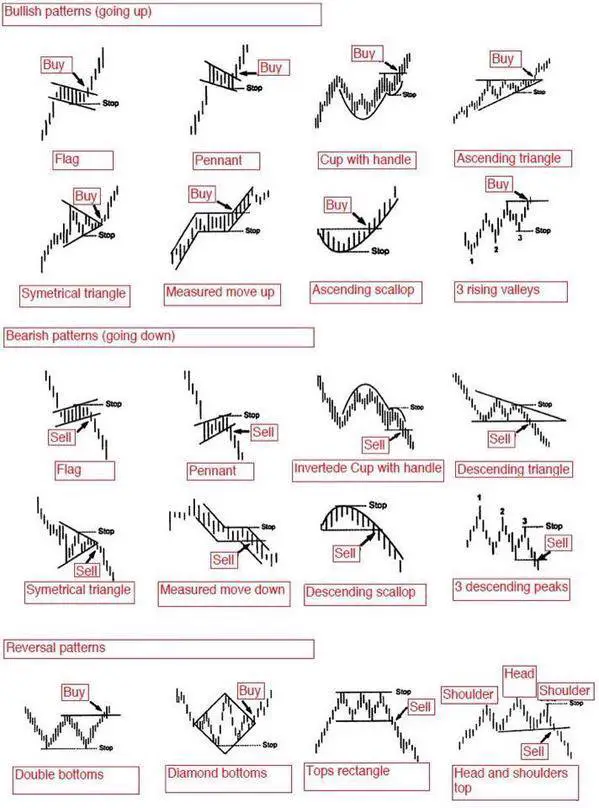

The most popular use of chart patterns is for breakout trading signals as the probability increases of a move in a specific direction after a price breakout of a previous support or resistance level quantified with a trend line on a chart.

Chart patterns can be bullish, bearish, or show a price reversal depending on the direction of the momentum. They can also be used as risk management tools showing where to set stop losses if a breakout fails or set profit targets for a continuation.

A chart pattern is a visual tool for seeing which direction a market is moving in. Cryptocurrencies tend to move very fast and with strong momentum in one direction so crypto traders must stay open minded about direction and go with the flow of least resistance and following their signals. The exit is just as important as the entry and all crypto traders must have stop losses in place to limit losses at key technical levels where price shouldn’t go and also use trailing stops to lock in profits as a winning move starts to reverse.