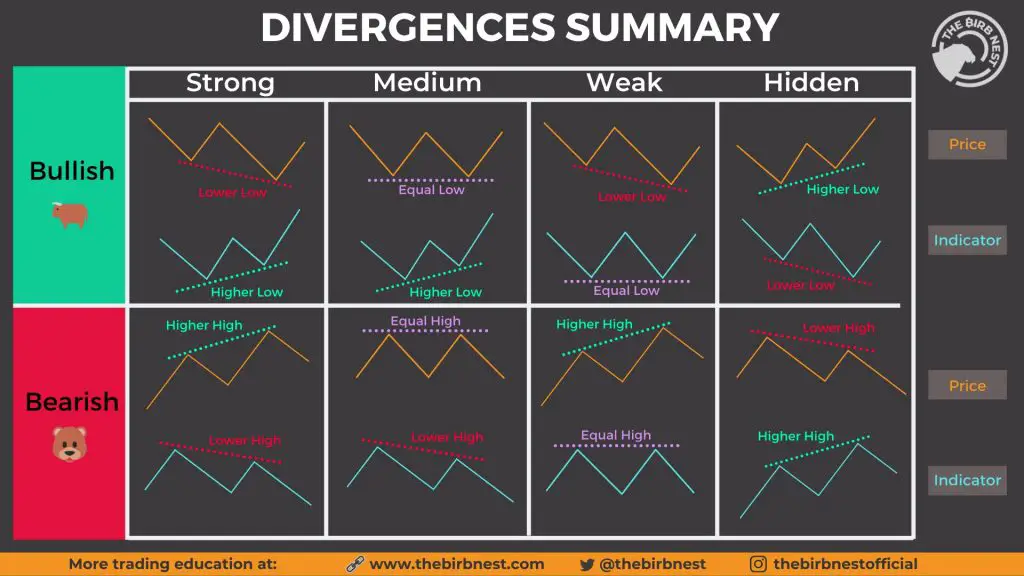

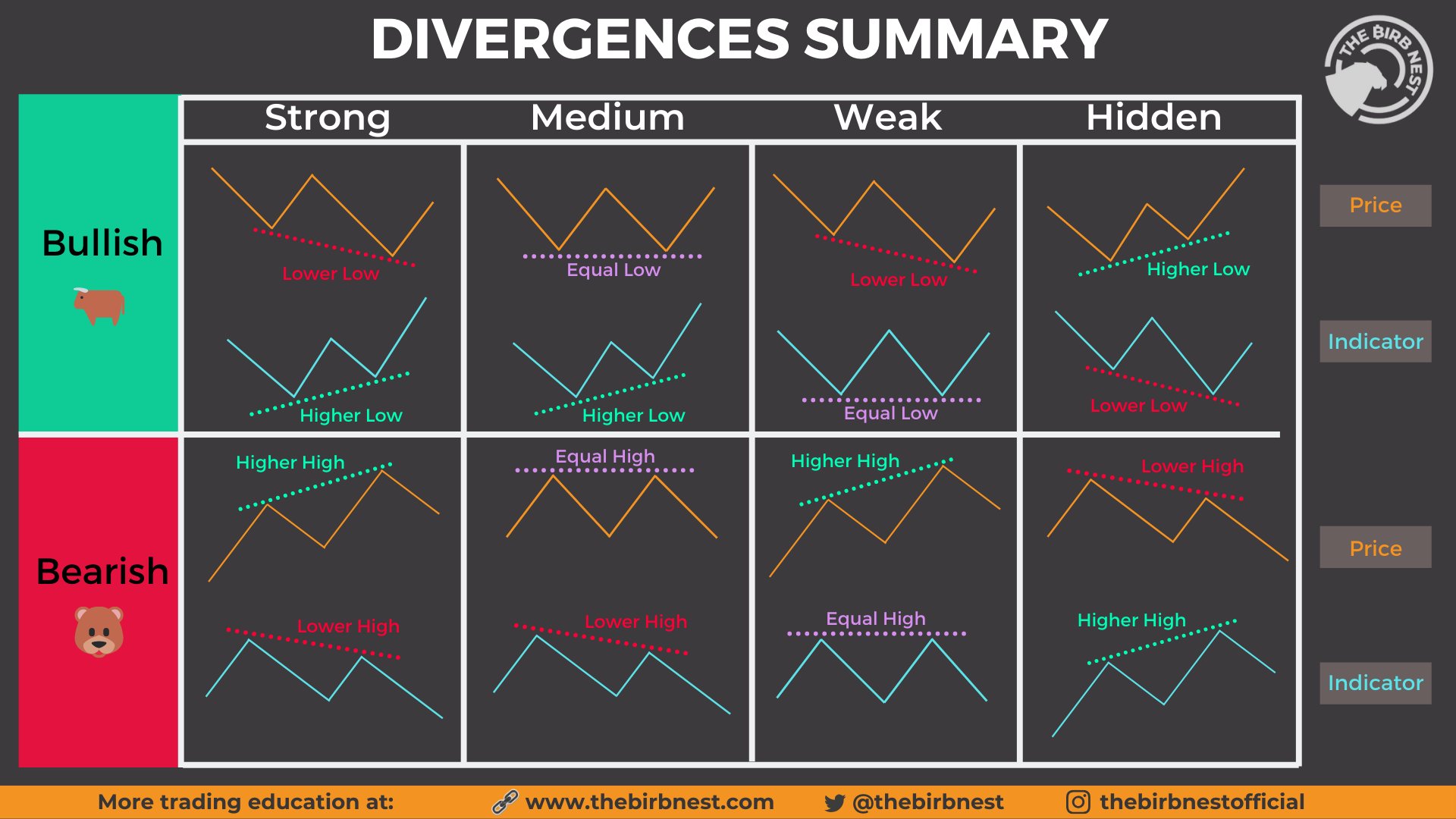

RSI Divergence Cheat Sheet

Bullish RSI Divergence

A bullish RSI divergence pattern is defined on a chart when price makes new lower lows but the RSI technical indicator doesn’t make a new low at the same time. This is a signal that bearish sentiment is losing momentum with the high probability that buyers are stepping in and the market may be near a bottom on the chart’s time frame. In many instances a bullish divergence can be the key indication on a chart that signals the end of a downtrend and that the risk/reward ratio has shifted in the favor of the bulls.

The RSI not only measures the extremes of an oversold 30 reading but can also show divergences between it making lower lows and price not making lower lows.

The RSI can be used as one way to filter price action and momentum and be used in comparison with price as traders look at direction of the indicators momentum versus the trend in price action. The divergence between the technical indicator and the price movement can signal changes in a trend and the probabilities of a reversal and show a technically valid price level to buy the dip in price action on a chart.

A bullish divergence is signaled when prices move lower but the RSI doesn’t move lower in correlation with price or even moves higher. This is a valid technical signal to go long based on technical analysis. Of course it’s just a high probability of a reversal, it doesn’t always work so proper position sizing is still required and stop losses must be used if price continues to fall. Also the profitability is not in the entry it is in the exit so it is crucial to have a strategy in place for how you will both maximize wins by locking in profits during rallies when it does work out as a big win with a swing or trend higher.

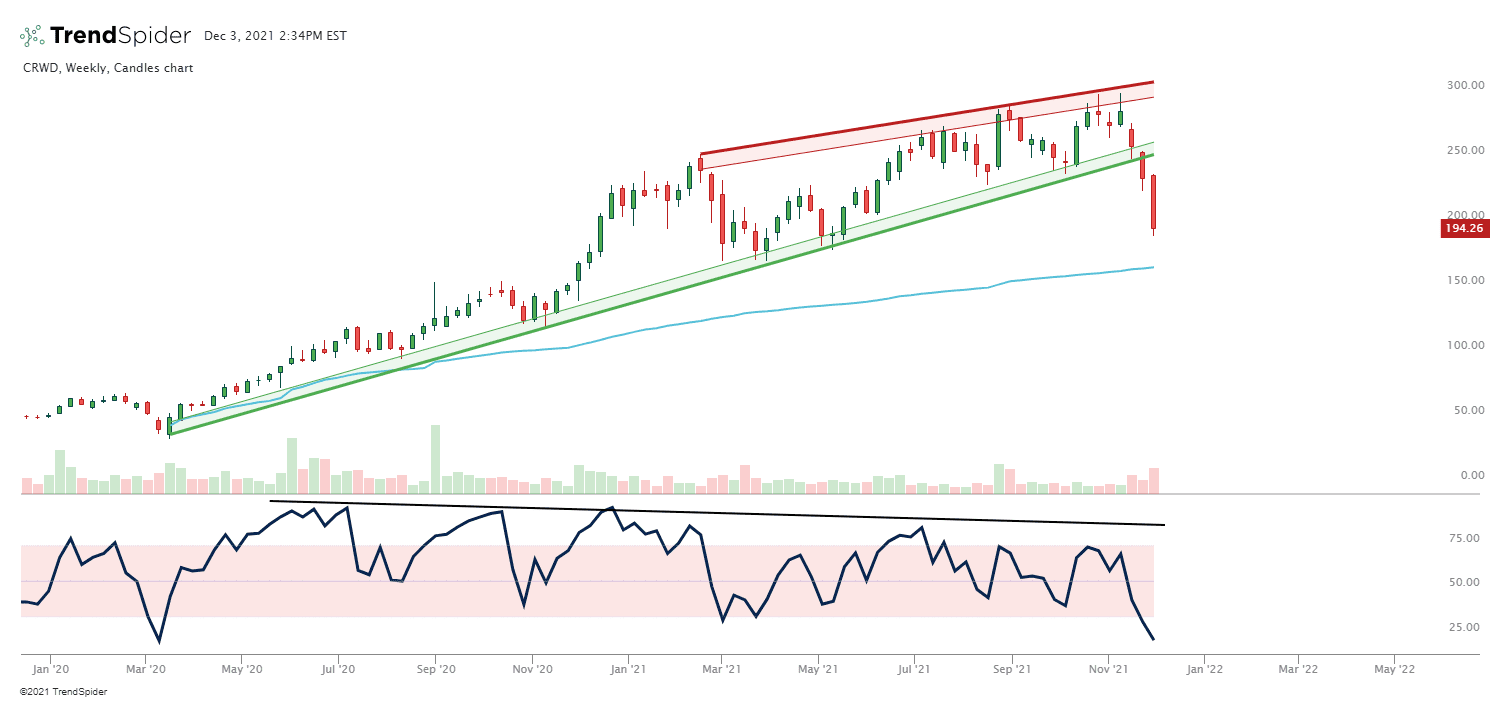

Bullish RSI divergence chart example:

Bearish RSI Divergence

A bearish RSI divergence pattern is defined on a chart when prices make new higher highs but the RSI technical indicator doesn’t make a new high at the same time. This is a signal that bullish sentiment is losing momentum with the high probability that sellers are stepping in and the market may be near a top on the chart’s time frame. In many instances a bearish divergence can be the key indication on a chart that signals the end of an uptrend and that the risk/reward ratio has shifted in the favor of the bears.

Technical oscillators used in identifying a divergence include the popular Relative Strength Index (RSI). The RSI not only measures the extremes of overbought (70) or oversold (30) but can also show divergences between it making lower lows while price is making higher highs. RSI can not only signal bullish or bearish levels to enter or exit after extreme moves but also its divergence with price action shows a lack of momentum in a move.

The RSI can be used as one way to identify extreme price action moves in one direction and momentum but it can also be used in comparison with price as you look at direction of the indicators momentum versus the trend in price action. The divergence between the technical indicator and the price movement can signal changes in a trend and the probabilities of a reversal.

A bearish divergence is signaled when price makes a new high but the RSI fails to make a new high. This is a valid technical signal to possibly go short based on technical analysis. Of course it is just a high probability, it doesn’t always work so proper position sizing is still required and stop losses must be used. Also the profitability is not in the entry it is in the exit so it is crucial to have a strategy in place for how you will both maximize wins by locking in profits or have a signal to cut your loss short if it does work out as a winning trade.

Bearish RSI divergence chart example:

RSI Divergence Cheat Sheet