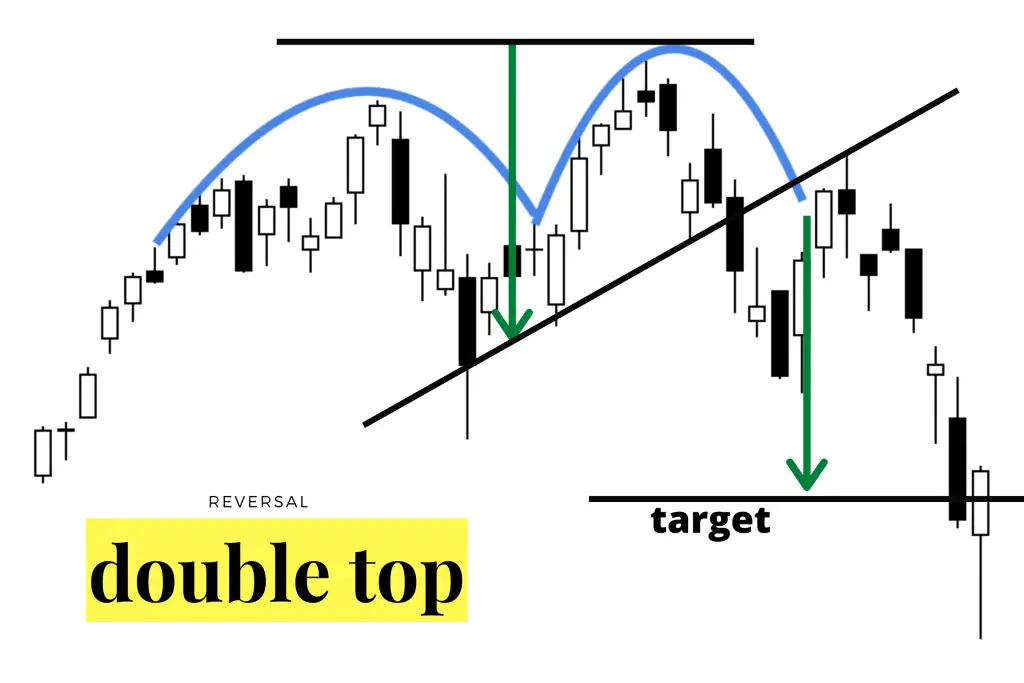

The M chart pattern is a double top pattern with tall sides with big uptrends before and long downtrends after the M. Price action many times approaches the low of the original left side launch area of the chart where the trend started before putting in a low and swinging higher.

Chart Facts:

The M chart pattern is a reversal pattern that is bearish. It is also called the double top pattern. This pattern is created when a key price resistance level on a chart is tested twice with a pullback between the two high prices creates a price support level zone.

- An M chart pattern happens near the end of an uptrend that has likely gone on for weeks or months.

- The rejection at resistance at the second attempt to go higher is where price stops going up is the level of price resistance.

- The first rejection and reversal in the uptrend is small and the short-term pullback is usually approximately 5% to 10% off the resistance highs.

- The first pullback from the highs bounces in the support zone and later price returns once again close to the previous resistance zone but is usually a little lower than the previous high price.

- The previous price resistance highs hold on the second test.

- The second test of resistance must be confirmed by a reversal and pullback to price support between the two peaks. There is only a potential pattern when price resistance holds and price is rejected off the previous high price area with higher volume and sometimes a large bearish candlestick or a gap down in price.

- If there is a close in price above the previous high the double top is invalidated and the odds are that the uptrend continues.

- A breakdown under the low price that occurred in the middle between the double top resistance levels is a full confirmation momentum signal of the double top reversal pattern. This is the level where a signal to sell or sell short is given.

- Selling short at a higher price after the rejection of resistance at the second top has a high probability of success and a good risk/reward ratio. Stop losses should be set on a close above the previous high of the first top where the pattern is invalidated.

- An M chart pattern can take weeks or months to play out with the middle pullback to support taking many different sizes and shapes.

Below is an example of the M chart pattern on the Marathon oil weekly chart before a sell off to the downside. The first price top failed to break above resistance after three attempts in late July and early August and then failed again to break out higher on two attempts in late November. The neckline of the pattern did not break down and provided support as the chart began to go sideways. The old support between the double tops became the same support zone in the new trading range after the double top pattern in this example.

Chart via @Jake_Wujastyk

Chart Summary: This pattern is one way to locate high probability short selling opportunities after an extended uptrend in price. It also gives you a way to quantify your stop loss if you choose to take the short sell off the second resistance level your stop would be a close above the first price level of resistance. If you short sell a trend line breakdown of the middle line of support, then the stop loss can be set with a break back above the middle support line. A profit target can be at a previous long-term support level, an oversold reading on the chart, or a trailing stop can be used to lock in profits after a reversal higher in price. An M chart pattern can be followed by a downtrend or a trading range.

This has been a sample chapter from my book The Ultimate Guide to Chart Patterns.