A common misunderstanding among new option traders is that 80% to 90% of all option contracts expire worthless, so a seller of option premium will have a higher win rate than a trader that buys options. This belief misinterprets a statistic published by the Chicago Board Options Exchange (CBOE) that only 10% of option contracts are held until expiration and then exercised.

Just because 10% of option contracts are held and exercised doesn’t automatically mean the other 90% expire worthless. This doesn’t take into account how options are traded profitably between when they are opened and closed. According to the CBOE, between 55% and 60% of options contracts are simply closed out prior to expiration. In other words, a seller who sold-to-open or bought-to-open a contract will, on average, buy-to-close or sell-to-close it 55-60% of the time before expiration, which could be at a profit or a loss.

Very few option sellers are holding the short contract through to expiration, they are closing their position when the risk/reward ratio favors buying it back for a profit or cutting a loss if the move went against them instead of holding the open risk until expiration. So the options that are closed prior to expiration are removed from the expired for a loss statistic. They could have been closed for a loss or a gain before expiration. The data shows that more than 30% of option contracts expire worthless, which is a lot less than the 80% – 90% that is commonly believed.

If only 10% of open options contracts ever end up being exercised, and 55-60% get closed out before expiration, then only 30%-60% of contracts expire worthless. So the expiration rate could be really closer to 45% if the middle of the range is considered which is closer to 50% than 90% and would make sense in a zero sum market. Since buyers and sellers are always equal in a contract market that would mean that directionally their is little edge whether short or long options. Since this considers both puts and calls and all ranges of in-the-money and out-of-the-money options it could show that the options pricing model is accurate most of the time.

It is important to consider that options can be traded back and forth for profits or losses for the entire time before expiration. Expiration only marks one day out of a month for most options. The real question that new option traders have to ask themselves is not how many options expire worthless, but of the 55-60% that actually get closed out before expiration, how many times did the option seller profit and how often did they buy back their short option to close for a loss?

The majority of losing short side option trades would be closed before expiration for a loss to stop the risk exposure of a short contract that is going deeper in-the-money. Option sellers could be closing their short option trades before expiration to cut their losses short. The question about what side of an option trade is the most profitable the short or the long side can’t be answered by how they expired in or out-of-the-money but how options traded over the full life of the contract. Options can fluctuate wildly in price over their life span and the open interest always fluctuates. Long side traders could be selling options for wins long before expiration. I know of almost no long side option trader that holds options until expiration whether it is a winner or loser. Options are so volatile that option traders must take their profits off the table while they are there, not leave their profits exposed to loss until expiration.

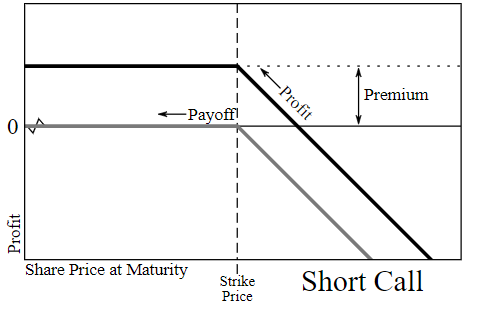

Options are a zero sum game; for every long there is a short. For every option profit there is an option loss. Options are fungible and interchangeable so they are traded back and forth as they march toward expiration. Options will change hands many times before expiration and these trades are where option buyers can profit before their time runs outs. Options can be traded profitably from the long side by taking the profits while they are there. Option profits are not just determined at expiration, but are determined as they occur everyday. Option premium sellers can be hurt during trends.

Very few traders hold a put option contract into expiration and have the stock put on them. Also few call option sellers hold through expiration and have their stock called away from them. Options are used for trading and hedging other positions 90% of the time that is where that number really comes from.

The risk and probabilities play out about even over the long run with option sellers collecting a lot of small wins and some big losses and the option buyers having a lot of small losses and some big wins. The winners are not on the long or short side exclusively but with the option traders with an edge, risk management, and discipline. Consider this the next time the expiration statistic is tossed around in favor of selling option premium.

For more information about option trading you can check out my book Options 101 or my more in depth eCourse Options 101.