In economics, stagflation also known as recession-inflation is a situation in which both the inflation rate is high while the economic growth rate slows at the same time the unemployment remains high over time. It creates a problem for monetary and economic policy makers because actions taken that are intended to lower inflation may make unemployment worse.

The term is a blend of words, stagnation and inflation together and is attributed to Iain Macleod, a British politician. He said in a 1965 speech to Parliament: “We now have the worst of both worlds—not just inflation on the one side or stagnation on the other, but both of them together. We have a sort of ‘stagflation’ situation. And history, in modern terms, is indeed being made.”

Economists offer two explanations for why stagflation happens. First, stagflation can result when the economy encounters a supply shock, such as a rapid increase in the price of oil or other primary commodities. A situation where price increases dramatically on a core energy or transportation commodity can cause an increase in prices simultaneously as it slows economic growth by making production, energy, or transportation costs higher and business less profitable.

Second, the government can create stagflation if it has policies that hurt businesses and commerce while increasing the money supply too fast. These two things need to occur simultaneously because policies that slow economic growth don’t usually cause inflation, and policies that cause inflation don’t usually slow economic growth.

Stagflation can began with a huge rise in prices of a core business cost like wages, electricity. or gasoline, and then be created as central banks use loose monetary policy like money printing or a national government borrows and spends large amount of money to counteract a possible recession and causes a price spiral higher at the same time along with increasing unemployment.[1]

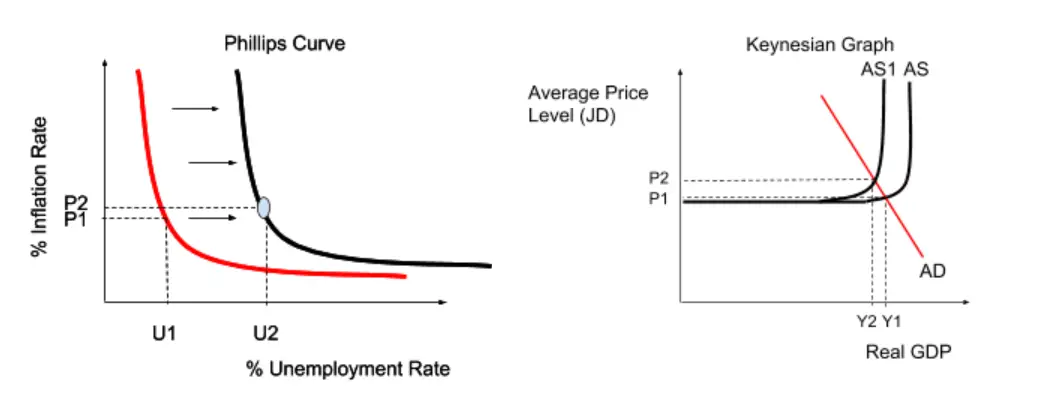

The unemployment rate and inflation are both usually inversely proportional to one another, but in this situation both inflation and unemployment are increasing at the same time. This causes an outward shift of the Phillip’s curve and is known as stagflation that is caused by a supply shock. This is also known as cost-push inflation as there is a sustained increase in prices due to a lack of supply. The Phillip’s curve shift shows that as inflation is increasing, the unemployment rate will also increase despite them being inversely proportional. The inflation is increasing from P1 to P2 and the unemployment rate goes from U1 to U2. The Keynesian macro diagram graph below shows a shift of AS to AS1 due to supply shock. This causes an increase in price levels from P1 to P2 which shows the inflation. The AD intersects with AS at P1 and intersects with AS1 at P2. The economy is additionally at the point of the blue dot on the Phillip’s curve and approaching the normal range on the Keynesian curve. [2]