Open interest and the volume traded in options are two different metrics that show the liquidity and trading activity of options contracts at different strike prices and expiration dates. Volume is the quantity of contracts traded in a period, while the open interest shows the number of contracts that currently exist and are active in the market and not closed yet. These two metrics show the interest and activity in the options market and are important to consider because liquidity can be the most important fundamental in options trading. Wide bid/ask spreads can make entering and exiting trades very expensive and put the option trader at the mercy of trading against the option market maker, this is usually a losing battle for retail option traders.

- Open interest and option contract volume both show the liquidity through activity of specific options contracts.

- Volume shows the quantity of trades each day and is the metric of activity in an option contract.

- Open interest shows the number of contracts that currently exist on the option exchange. Be aware that each of these contracts have someone short and someone else long as the buyer and seller are always equal in contract markets. They must be written to open and also sold to close before coming out of open interest or executed before or at expiration to call from or put the stock on the option writer.

- Volume reflects the amount of option contracts traded during the day while the open interest is only updated once per day.

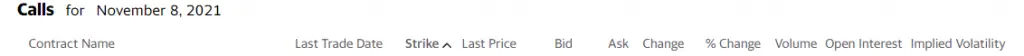

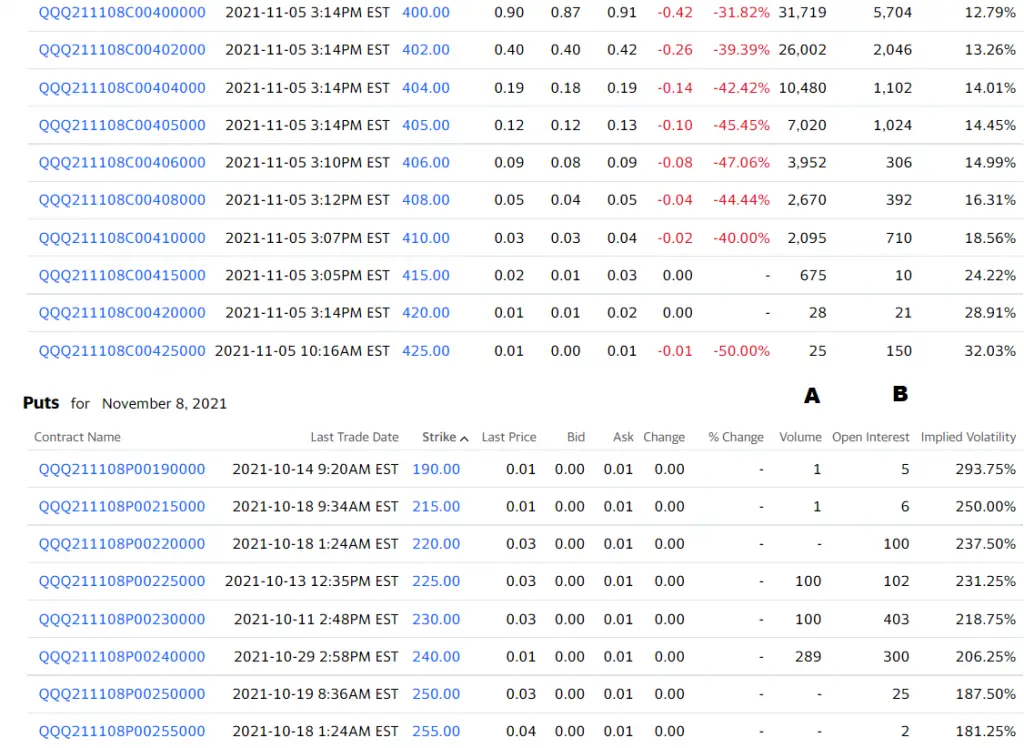

Below is an option chain for the QQQ ETF. Column A shows the volume traded for each strike price currently while Column B shows the open interest for each strike price as of the last daily update.