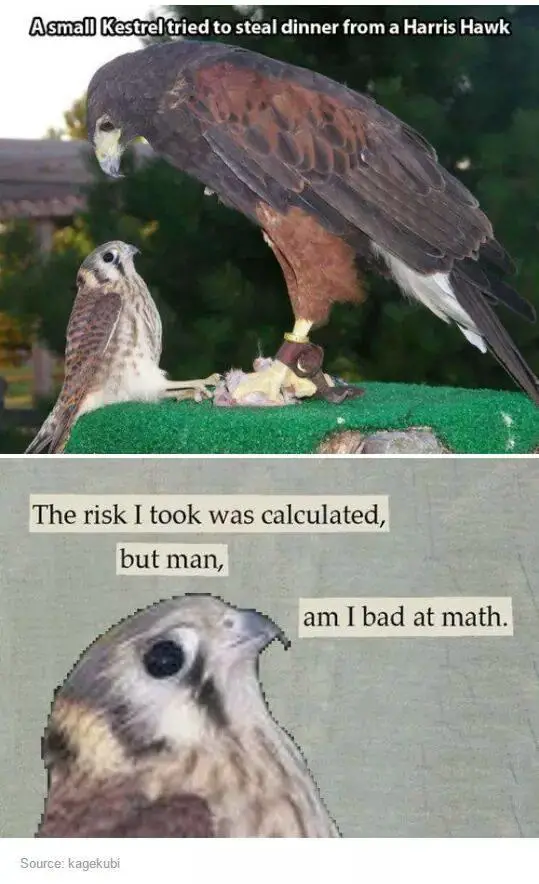

A calculated risk is taken when the probability and size of potential success is estimated along with the magnitude of a possible loss is considered before a decision is made involving the potential of failure. A calculated risk tries to determine if the risk is worth the reward based on the probabilities between success and failure. It’s an undertaking whose potential for failure has already been estimated before any action is taken.

A calculated risk is taken when the probability and size of potential success is estimated along with the magnitude of a possible loss is considered before a decision is made involving the potential of failure. A calculated risk tries to determine if the risk is worth the reward based on the probabilities between success and failure. It’s an undertaking whose potential for failure has already been estimated before any action is taken.

Calculated risk-taking is defined as the skill of making decisions based on incomplete information and an unknown future. The skill requires the ability to act decisively based on all options available while filtering the decision making through the process of risk management and gain optimization. Traders, investors, professional gamblers, entrepreneurs, and executives must all make risky decisions to optimize returns on capital while considering the potential risk of failure.

Calculated risk questions:

-

- What will be gained if maximum success is achieved?

- What will be lost in the worst case scenario?

- What is the risk/reward ratio on this bet?

- What is the probability of success?

- What are the consequences of failure?

- What are the odds of the risk or ruin?

- How will I know the attempt failed?

- When will I know that the attempt failed?

- What lesson will I learn through the results either way?

- What long-term damage could the attempt do?

- How many times do I have to try for a high probability of success?

- How many times can I attempt to succeed?