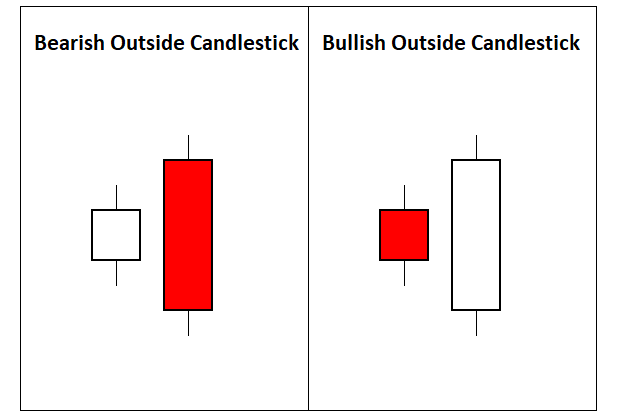

An outside bar pattern is a two candle pattern that has a large candle engulf a previous smaller candle on a chart by both going above and below the previous candle highs and lows. A bullish outside bar candlestick goes lower than the previous candle lows and then closes higher than the previous candle highs. A bearish outside bar candlestick goes higher than the previous candle highs and then closes lower than the previous candle lows. Sometimes the large candle in the pattern is also called the mother bar candle and the smaller candle is called the baby candle.

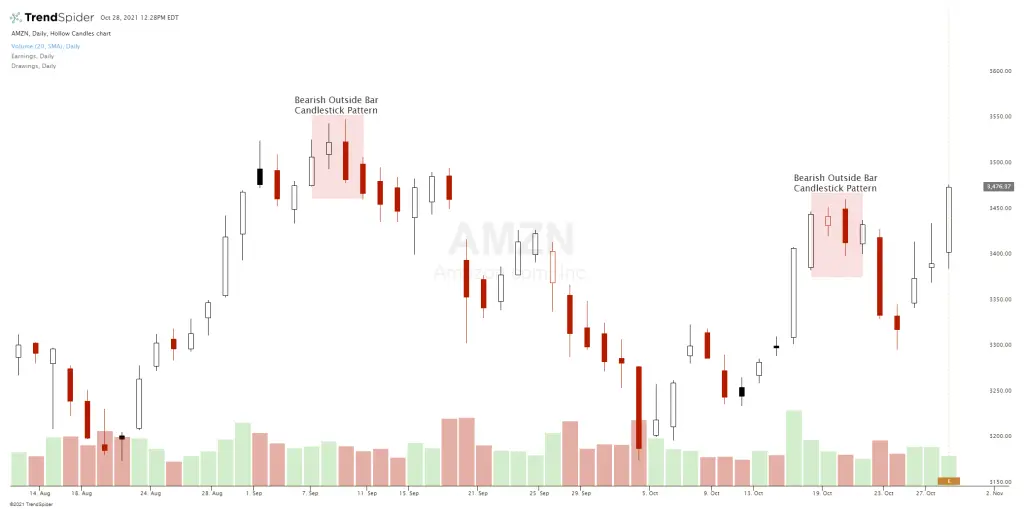

Outside candlestick patterns are reversal patterns on a chart when the occur at key turning points on a chart in a trend. Bearish outside candles that happen near overbought readings or resistance levels in a chart pattern have a high probability of a reversal taking place from a previous uptrend or upswing in price action. Bullish outside candles that happen near oversold readings or support levels in a chart pattern have a high probability of a reversal taking place from a previous downtrend or downswing in price action. Higher volume on the chart at the candlestick pattern area versus the average volume on a chart increases the odds of the reversal signal being meaningful.

If a long entry is taken on the bullish outside candlestick pattern the stop loss could be on a close below the lows of the large candle. If a short sell entry is taken on the bearish outside candlestick pattern the buy to cover stop loss could be on a close back above the highs of the large candle. The best use of this pattern in trading is to create a good risk/reward ratio on entry with a tight stop loss versus a larger profit target or letting a trade run with a trailing stop.