The U.S. stock market has three different tiers of stock quotes, there are Level 1, Level 2, and Level 3 price depth that can be viewed. Each level allows a trader to see quotes for their stock drilled down to a deeper degree in the queue.

Level 1 quotes show the best current bid and ask price along with volume for a stock for those prices in real-time. Level 1 quotes display the most basic current price and volume information for any stock, it is what a stock trader sees when they go in to make a trade with their broker on the trade execution screen.

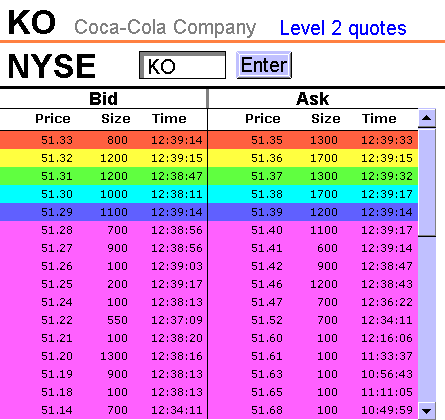

Level 2 quotes add more information than Level 1 quotes by showing the market depth of outstanding orders for a stock. Level 2 shows market depth typically up to the 5-10 best bid and offer prices. Level 2 quotes display deeper looks into a stock’s potential future price action inside the order book for their market. It can show different order sizes from traders that are waiting to buy or sell a stock at different price levels through limit orders.

Level 2 quotes show the order book for Nasdaq stocks, the best bid and ask prices by market makers along with other traders in the stock. The level 2 view can also show what type of market participant has entered a potential trade, whether they are waiting to buy or sell, along with the size of the potential order, and the purchase or sale price offered.

Level 2 quotes can help show where a stock price could be going in the near term if certain orders are filled. Level 2 quotes can show order flow and the short term directional bias for an intraday chart based on supply and demand.

Narnia205, Public domain, via Wikimedia Commons

Level 3 quotes add the greatest view of a stock’s potential future prices with the most market order depth by showing up to twenty of the best bid and ask price offers in the market. Users of level 3 quotes can also enter data directly. Level 3 quotes are mostly used by stockbrokers and market makers.