A synthetic share of a stock is created by buying and selling stock options to simulate an options play that moves the same way that holding shares in the stock would move without the same amount of capital needed to buy the same amount of shares.

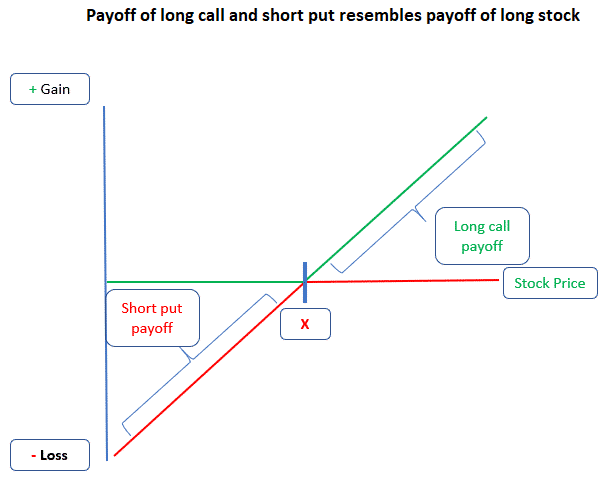

A synthetic long stock position is created by buying a deep-in-the-money call option and also selling the same amount of put option contracts with the same strike price both at the same time. Both of the option legs in the play must be inside the exact same expiration cycle to maintain the delta movement parallel to the stock position it represents. One contract one each side of the synthetic long stock position mirrors and tracks holding 100 shares of they underlying stock.

When an option trader holds both a deep-in-the-money call option and sells a put option with the same strike price, the total option play’s delta should be approximately +100. An option trader should be able to open both sides of a long synthetic shares play with less margin requirement or capital needed for buying the stock position outright.

The potential maximum profit for the play is theoretically the unlimited side of the stock price captured by the call option before expiration plus any net credit from selling the put option minus buying the call option.

The potential maximum loss for the play is the stock going to zero and it being put on the option trader near that loss minus any net credit for opening the trade.

This is a bullish option play betting on the delta of the upside of the stock dollar for dollar.

This option play can have a 50% win rate as the stock can go either up or down and that the bet is on the upside.

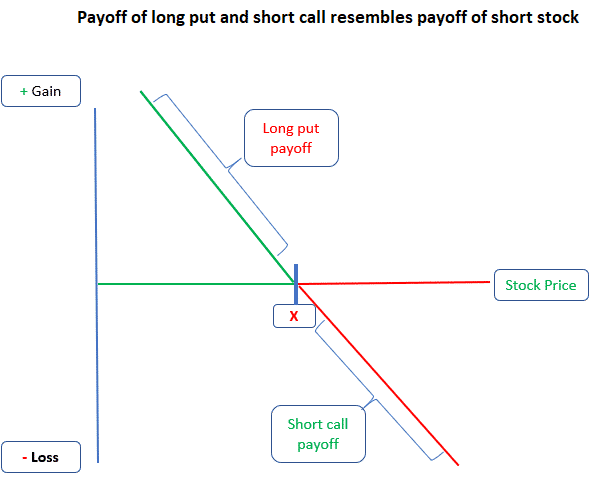

A synthetic short stock position is created by buying a deep-in-the-money put option and also selling the same amount of call option contracts with the same strike price both at the same time. Both of the option legs in the play must be inside the exact same expiration cycle to maintain the delta movement parallel to the stock position it represents. One contract on each side of the synthetic short stock position mirrors and tracks shorting 100 shares of they underlying stock.

When an option trader holds both a deep-in-the-money put option and sells a call option with the same strike price, the total option play’s delta should be approximately -100. An option trader should be able to open both sides of a long synthetic shares play with less margin requirement or capital needed for buying the stock position outright.

The potential maximum profit for the play is theoretically limited to the downside of the stock price captured to zero by the put option before expiration plus any net credit from selling the call option versus buying the put option price.

The potential maximum loss for the play is the stock going to infinity and it being put on the option trader minus any net credit for opening the trade.

This is a bearish option play betting on the delta of the downside of the stock dollar for dollar.

This option play can have a 50% win rate as the stock can go either up or down and the bet is on the downside.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.