A diagonal spread options play is a modified calendar spread that is built with different strike prices. It is opened by entering into a long and short position in two options of the same type at the same time. An option trader can use two call options or two put options but they must have different strike prices and also expiration dates must be different.

This option play can be opened when the trader has a bullish or bearish sentiment using the structure and the options to express the belief about future price action.

Diagonal spreads let traders create an option trade structure that reduces the effects of time decay and also takes a bullish or bearish directional position.

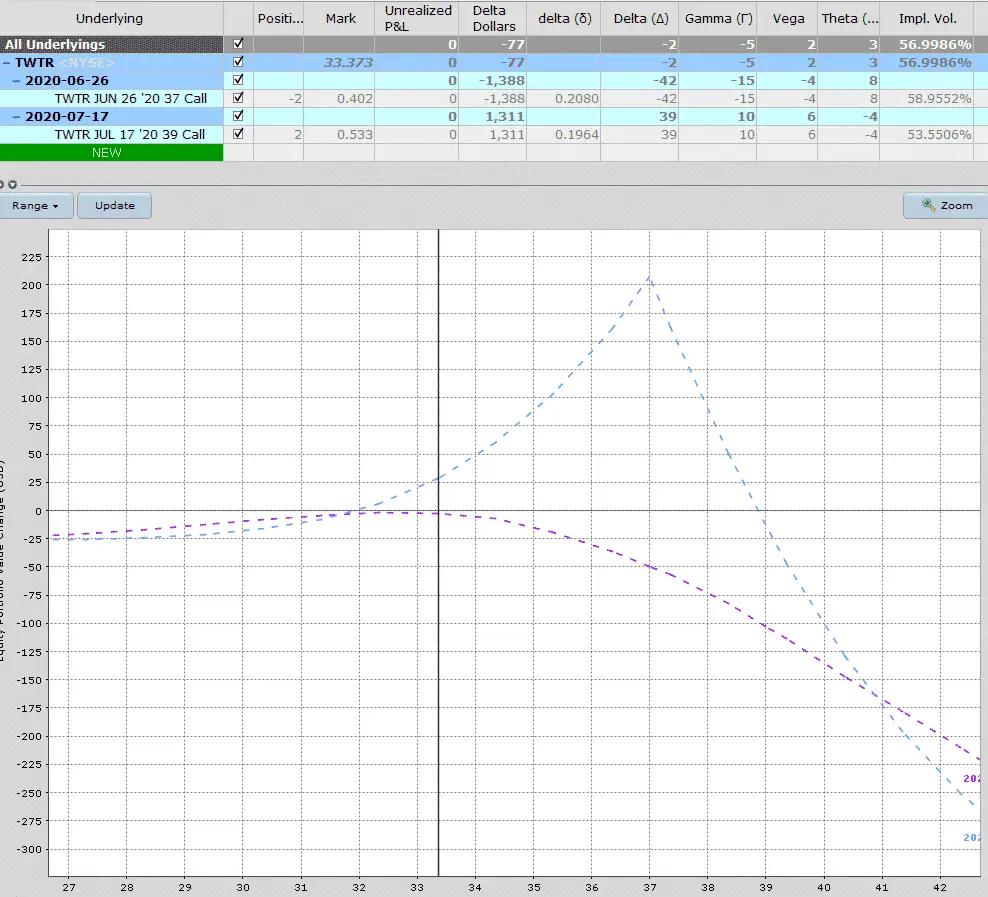

Below is an example of a diagonal call spread when an option trader sells a near-term out-of-the-money call and then buys a longer-term call that is further out-of-the-money.

If the stock falls, the maximum loss is capped to the debit paid to open the trade. At times the near-term option is sold for a higher price than the longer dated option.

In this example there isn’t a loss on the downside and if the stock is below both call strikes at expiration, they will both expire worthless and the option play would be profitable by the total sum of the credit received for opening the trade.

If the stock goes higher, the most that could be lost to the upside would be equivalent to the difference in the two strike prices plus/minus the option premium paid/received.

Image source: OptionTradingIQ.com

I have created the Options 101 eCourse for a shortcut to learning how to trade options.