The jade lizard is an option play that is created by opening a bearish vertical spread using call options and adding a put option sold at a strike price lower than the call spread strike prices.

Using one underlying stock with the same expiration date, the jade lizard strategy buys a call option at one strike price, sells another call option at a lower strike price, then sells an out-of-the-money put option at a strike price lower than both call options. The additional sale of a put option is consistent with the movement expectations of the underlying stock and it adds to the total premium collected.

The jade lizard has the advantage of the volatility skew that is priced into option chains with naked puts trading for more option premium than naked call options and short call spreads trading for higher premium than short put spreads. The volatility skew effect allows the option trader to collect more premium for the option play and increase the position’s probability to be profitable. The term jade lizard was first used by Liz Dierking and Jenny Andrews on the Tastytrade Network. [1].

This option play sentiment is neutral or bullish.

The jade lizard construction:

– Sell out-of-the-money put options.

– Sell an out-of-the-money vertical call spread.

Best implied volatility environment to open this play would be when it is high.

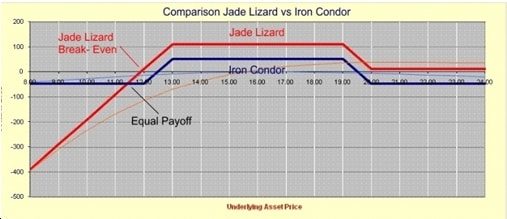

The maximum potential profit is the credit received when the option play is opened. Maximum profit is realized if the stock price expires between the short strike prices.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.