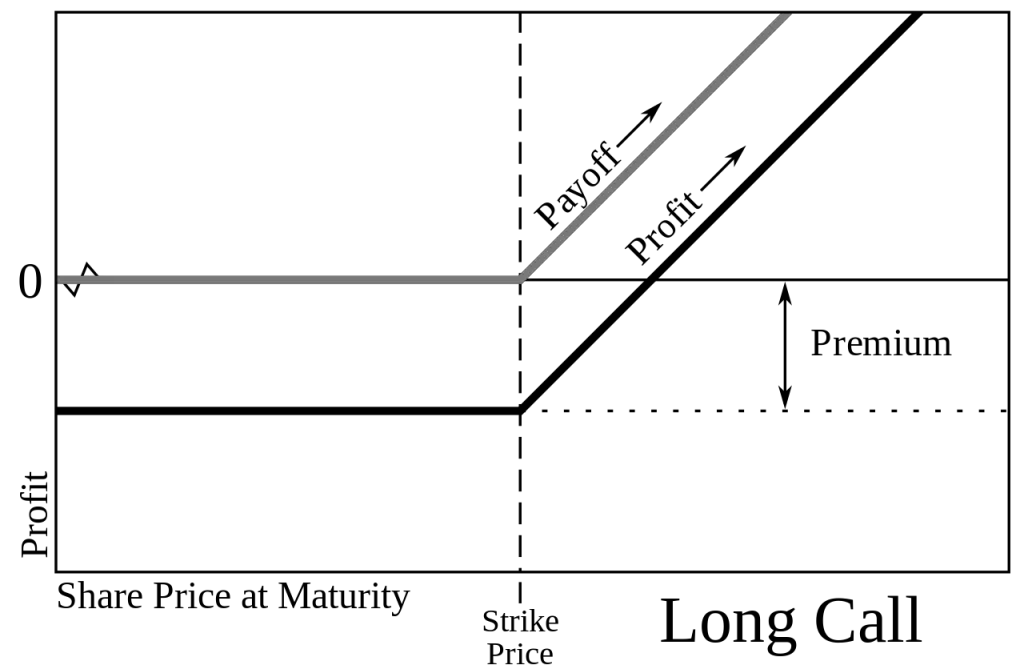

Call options are in the money when the underlying stock that it is written on has a price higher than a the call option strike price. A call option can be used to call away a stock at the price of the strike with the profits being how much higher the stock was trading at the time it was called.

A call option is a contract that is created by an option trader selling to open a financial contract that gives the buyer of the call option the right to buy a stock at a set price before or on a specific expiration date. The asset that the call option value is written on is called the underlier.

The call option buyer does not have to hold the contract to expiration and exercise it. During the life of the call option contract the buyer can trade the option on price fluctuations at higher or lower prices as it moves based on the price of the underlying asset.

The call option buyer makes money when the underlying asset goes up in price increasing enough to drive the value of the option higher.

Call options can be great trading tools for income generation on existing stock positions by selling covered calls repeatedly. Calls can also be bought to create leverage on long positions in stocks in place of equity. Call options can bring in the dynamics of, leverage, time, and the magnitude of price change as new strategies for stock traders.

With option contracts, moneyness is the relationship of the current price of an underlying asset to the strike price of an option contract written on that asset.

With options trading, the difference between in-the-money and out-of-the-money is entirely based on the relationship between the strike price from the current market price of the underlying stock and the magnitude of this position is known as moneyness.

There are three types of classifications for the moneyness of an option contract:

An option is in-the-money if the contract would have intrinsic value if it were exercised today.

An option is out-of-the-money if the contract would have zero intrinsic value if it were exercised today.

An option is said to be at-the-money if the current strike price is exactly the same as the current market price.

A call option is in-the-money if the strike price is less than the current price of the asset it is written on. The reverse is true for an out-of-the-money call option if the strike price is more than the current price of the stock it is written on. Intrinsic value is measured by how deep in-the-money an option strike is versus the stock price.

The call option delta is the amount the price should move based on a $1 move in the underlying asset. This is determined by the changing probability of the option expiring in-the-money. The amount of the move a call option captures starts at 50% for an at-the-money option when the strike price and the asset price are equal in value and expands as an option goes deeper in-the-money and declines as an option goes farther away from the strike price. This is called option Delta. When a call option goes so deep in-the-money that there is almost a 100% chance that the call option will expire with intrinsic value the delta can become 1.00 with each $1 move in the underlying stock leading to a $1 move in the option premium also.

With in-the-money call options having some level of intrinsic value they are priced higher than out-of-the-money call options in the same option chain as their delta is higher and captures more of the move in the underlying asset. While in-the-money call options have a higher probability of expiring in-the-money and capturing intrinsic value, the out-of-the-money options have a higher gain in percentage if they start moving closer to being at-the-money as the gamma increases the price in the growing chance of them expiring in-the-money.

Many times you will see options abbreviated as ITM, OTM, or ATM designating their relationship to their current strike price.

Image by Gxti wilkimedia.org

I have created the Options 101 eCourse for a shortcut to learning how to trade options.