“A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable and rapidly changing world.” – Seth Klarman

For investors the margin of safety is the variance between the fundamental value of the underlying company of a stock and its current price. It is a principle in investing where an investor only buys stocks when its price is much lower than the company’s intrinsic value. When price is trading far lower than the quantified intrinsic value metrics, the difference between the true value and the current price is the margin of safety. This safety margin gives an investment position room to be wrong with the timing of a purchase and minimizes the size of the risk of loss to the downside.

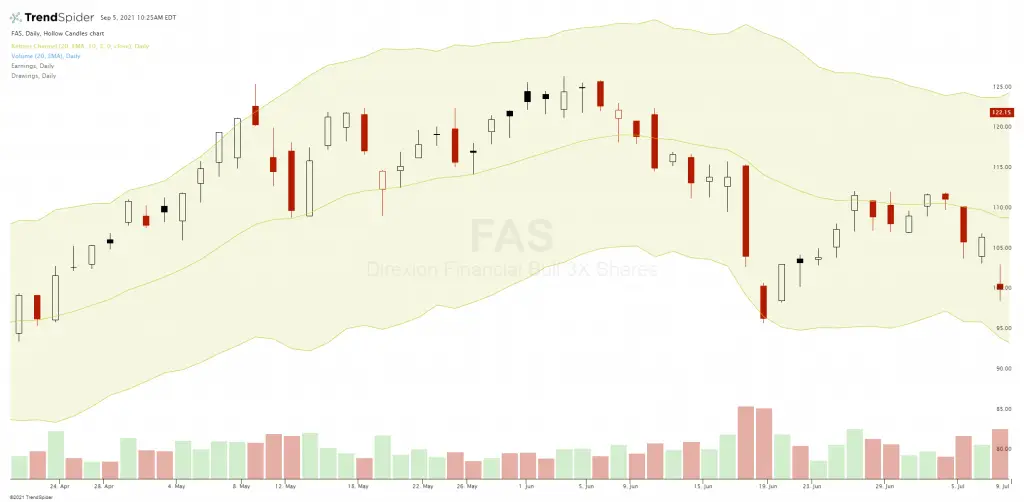

For traders the margin of safety is the variance price is from the technical value zone on a chart. If the value zone for a chart is the 20-day exponential moving average for example then the lower a stock is below this line the better the margin of safety for a deep dip buy and a reversion to the mean of the 20-day EMA. Price can be measured in average true range or deviations from this central line using Bollinger Bands or Keltner Channels. Shorting at the 3rd upper band or channel or buying at the 3rd lower band or channel can create a margin of safety for a trader of the price continuing to move against the position. Margin of safety is used in trading to short extremely overbought levels or buy very oversold levels on a chart.

“You have to have the knowledge to enable you to make a very general estimate about the value of the underlying business. But you do not cut it close. That is what Ben Graham meant by having a margin of safety. You don’t try to buy businesses worth $83 million for $80 million. You leave yourself an enormous margin. When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000 pound trucks across it. And that same principle works in investing.” – Warren Buffett