The Golden Butterfly portfolio is constructed to perform at or above the same high return level of the stock market as a whole with less volatility over the long term. The Golden Butterfly combines the best dynamics of other equity and bond asset allocations into a steady and safe investment strategy for both capital preservation and growth. It is designed to optimize performance and safety under all market environments in both returns and draw downs.

Asset allocation parameters for this portfolio can be expressed in ETFs.

20% Total Stock Market: VTI

20% Small Cap Value: IJS

20% Long Term Bonds: TLT

20% Short Term Bonds: SHY

20% Gold: GLD

The Golden Butterfly portfolio is weighted toward economic prosperity with the 40% invested in the total stock market. Over the long term the U.S. has spent more time having economic growth than time spent in contraction, recession, or depressions. The 20% in gold is a hedge against inflation and exposure to any strong commodity uptrend. The 40% in bonds is for safety and can come in handy if the portfolio is rebalanced quarterly or annually to lock in profits in the equities by moving it to bonds or buying the dip in equities by moving from bonds back to stocks when the bond weighting grows during drawdowns in the stock market. The rebalancing is one of the keys to its performance over the long term.

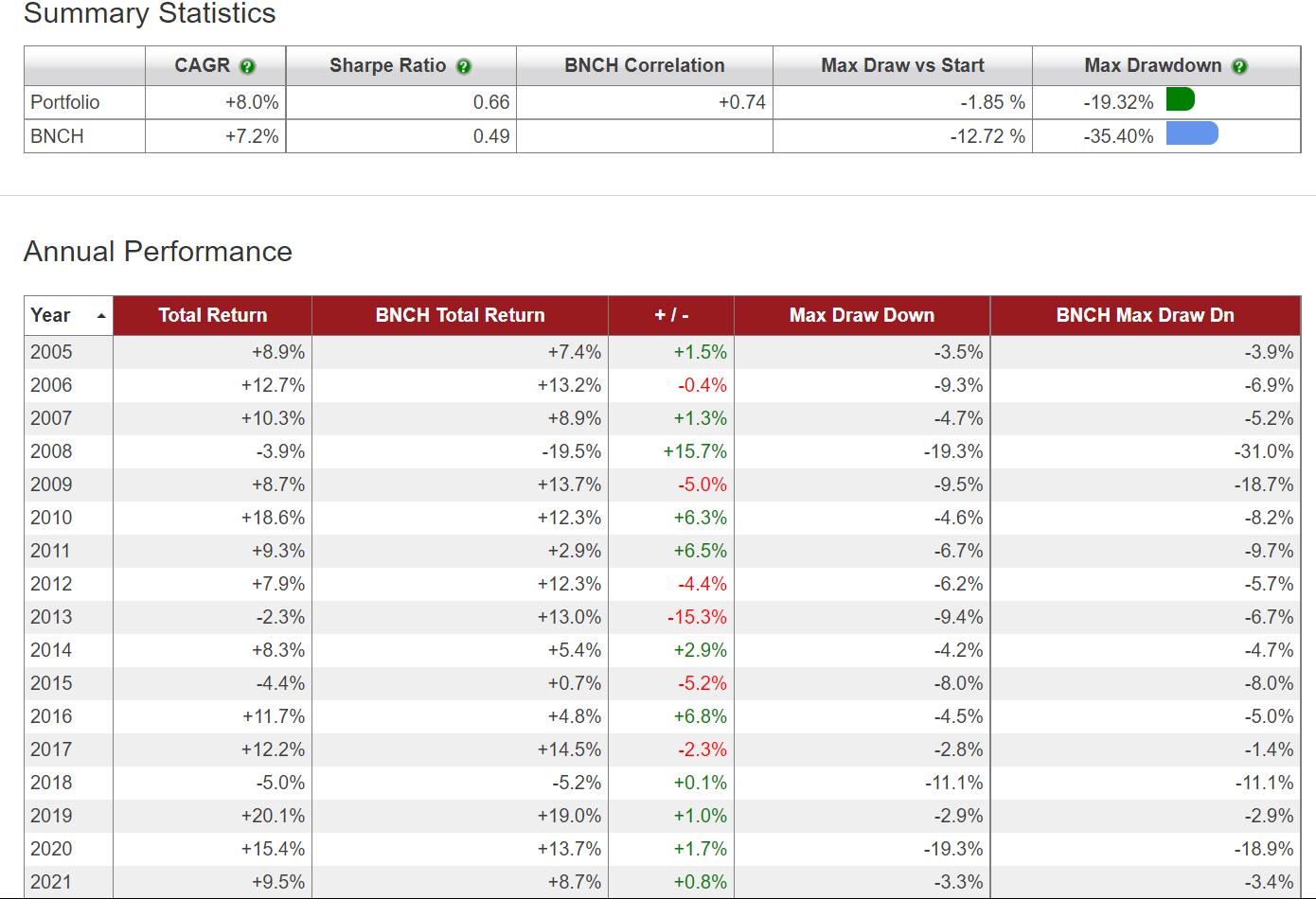

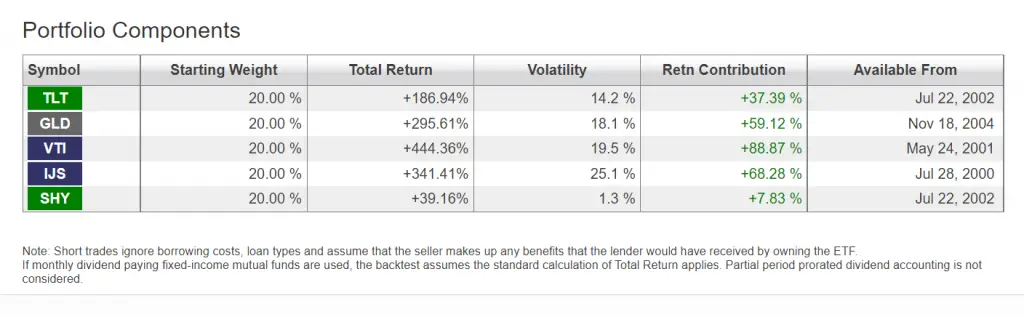

Here is the straight Golden Butterfly performance with no rebalancing from January 2005 to August 2021. The comparison benchmark is the BNCH, the ETFreplay All-World 60-40 Benchmark is a monthly rebalanced portfolio of IEF 40%, EFA 30% and VTI 30%.

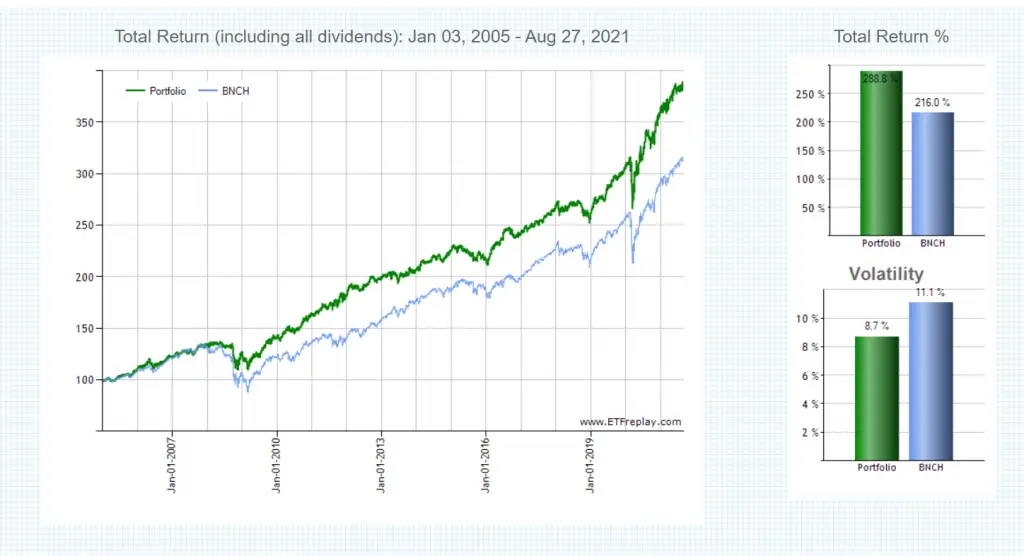

Here is the Golden Butterfly Portfolio performance with quarterly rebalancing.

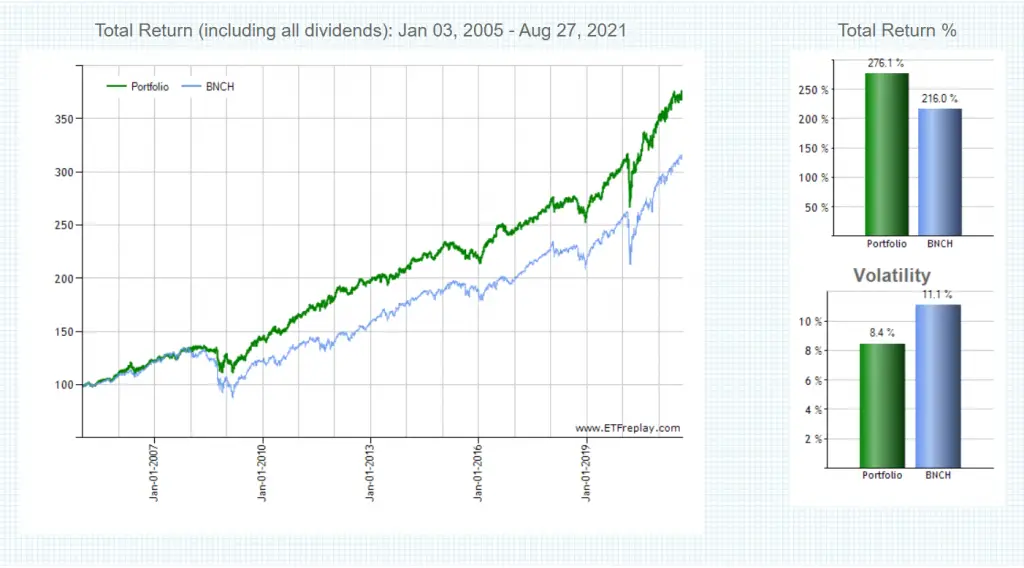

Here is the Golden Butterfly portfolio performance with annually rebalancing.

Backtesting Data Courtesy of ETFreplay.com