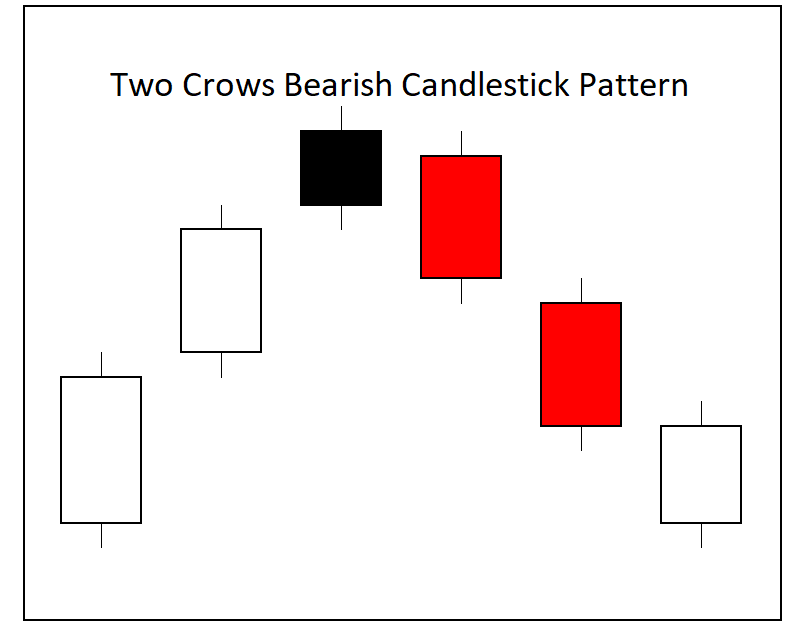

The two crows candlestick pattern is a bearish reversal pattern that appears during uptrends and upswings in price action. It is a three candle pattern that starts with a big bullish candle followed by a second candle that shows a gap up in price action and move higher before reversing and closing lower than the high of the day but still higher than the previous close. The final third candle opens inside the range of the second candle but goes lower on the day finishing both lower than its high of day and lower than the previous day low to confirm the full two crow pattern.

The two crow candle pattern is bearish and can signal slowing momentum, a reversal of the trend, or a chart beginning to trade sideways in a range. Many swing traders look at this pattern as a signal to lock in gains on long positions on a chart. While the pattern confirms on the third candle some traders wait for the loss of the low of the first bullish candle or the third bearish candle in the pattern to confirm a sell short signal.

The similar three crows pattern occurs primarily in a downtrend and is usually a continuation pattern while the two crows patterns is a reversal pattern that occurs near the peak of an uptrend in price.