Options are traded on contract markets and unlike stocks there is someone short and someone long every option at all times. Options are a zero sum market as there is always a winner and a loser in every price move. Someone has to write every contract and there must be a buyer and they both hold opposite positions until the contract is closed or expires. Options are very commonly used as both hedges for stocks in portfolios and option contracts are also bought to hedge other short option positions. A lot of option volume is in insurance to hedge other positions from large losses.

There is a misunderstanding among traders that 90% of all options expire worthless. It is commonly thought that a seller of option premium has a higher win rate and a higher probability of making consistent money. This belief doesn’t take into account a statistic published by the Chicago Board Options Exchange (CBOE) that only 10% of option contracts are actually held until expiration and then exercised. 90% of all options are sold and bought back and closed before expiration so they are removed from the expired for a loss statistic. They could have been closed for a loss or a gain before expiration. Options are trading vehicles and hedge insurance so very few are held to play out at expiration.

Option contract prices are primarily determined using the Black-Scholes pricing model for time, volatility, and the distance from the strike price. The odds that an option will expire in-the-money with intrinsic value is the main factor that goes into the mathematical model to determine the price of a specific option. Ultimately it is the bid/ask prices in the market that sets value for what price people are willing to buy and sell an option contract for. Options tend to go up as volatility increases and go down as volatility decreases due to Vega values. Option sellers want to be compensated for the risk they are taking when selling options during high volatility environments.

Option contracts are not investments in a company. Options are diminishing bets correlated to probabilities. They are bets on an asset reaching a specific price within a specific time frame.

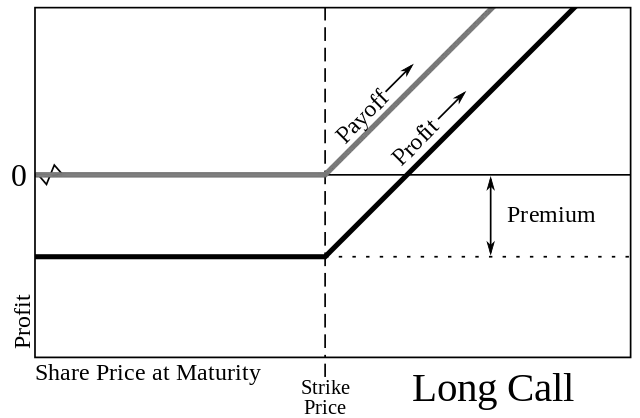

A call option gives the buyer of the contract the right but not the obligation to purchase the underlying asset at a set price before expiration. The call buyer has the right to call the asset away from the option seller at the strike price of the option on or before the date of expiration for American options. European style options allow execution only on the day of expiration.

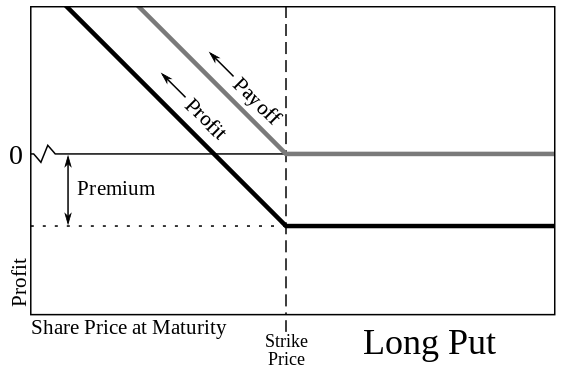

A put option gives the buyer of the contract the right but not the obligation to sell the underlying asset to the seller of the option at the strike price on the day of expiration. The put buyer has the right to “put” or sell the asset to the option writer for the strike price on or before the date of expiration. European style options allow execution only on the day of expiration.

An option trader has to be careful to only trade option chains that are liquid and have tight bid/ask spreads to avoid losing money in getting in and getting out of trades. Liquidity is the most important fundamental in options trading.

Options generally trade in contracts that control 100 shares of stock but this can be different if a stock splits or reverse splits and changes the price of 100 share blocks.

Option plays can be structured to bet on many different types of scenarios and not just direction. An option trader can bet on price trends in any direction, the magnitude of that trend, price ranges and the time periods, increasing volatility, decreasing volatility, specific prices being reached or not reached by a date, and many other scenarios. Put options can be sold at the strike price that a trader wants to buy a stock for. Call options can be sold on a stock holding at the price a trader of investor wants to sell their stock for. Options open up many new scenarios for traders.

Options trading explained:

A buyer wants an option to go higher and be able to sell it for more than they bought it for before expiration or have it exercised with intrinsic value for more than the purchase price. An option seller wants the option that they sold to open to go down in value before expiration so they can buy it back cheaper or for it to expire worthless.

Call options explained:

A call option is a contract that is created by an option trader selling to open a financial contract that gives the buyer of the call option the right to buy a stock or commodity at a set price before a specific expiration date. The asset that the option price value is written on is called the underlying.

For stock options, contracts are written for 100 shares of stock. So an option price quote is multiplied by 100 to get the price of a stock option contract.

The call option buyer does not have to hold the contract to expiration and exercise it. During the life of the call option contract the buyer can trade the option on price fluctuations at higher or lower prices as it fluctuates based on the price of the underlying contract.

The call option buyer makes money when the underlying asset goes up in price increasing enough to drive the value of the option higher.

Call options are the opposite of put options, a put option buyer as the right to sell the underlying asset at the strike price before the expiration date.

Call options can be sold as a covered call when the underlying asset that the contract is written on is owned by the seller. The buyer pays the cost of the call option for the right to profits of the underlying stock by expiration.

Call options are not investments they are a bet and a speculation on the magnitude of the price movement of the underlying within a specific time period.

The call option delta is the amount the price should move based on a $1 move in the underlying asset. This is determined by the changing probability of the option expiring in-the-money.

Gamma is the amount that delta should change on a $1 move in the underlying asset price. Delta is the speed at which option prices adjust to the underlying, Gamma as the rate of acceleration of that change.

Theta is the time decay or the amount that the option contract drops in value each day as expiration of the call approaches. Theta decay drops the value for the option buyer and goes in favor of the option seller that is short the call option.

Vega is the amount a call option price should move for each $1 change in implied volatility. Vega tries to price in the risk to the seller of a big price move before expiration.

Call options can be great trading tools for income generation on existing stock positions by selling covered calls repeatedly. Calls can also be bought to create leverage on long positions in stocks in place of equity. Call options can bring in the dynamics of, leverage, time, and the magnitude of price change as new elements for stock traders.

Call options are neither good nor bad they can be a part of any trading strategy if the risk is fully understood.

Put options explained:

A put option contract gives the buyer of the contract the right to sell the underlying asset at the strike price of the put on the day of expiration and assignment.

When writing a put option you create a ‘sell to open’ order with your option broker. This is how you sell put options short as a way to get paid a premium to buy a stock at the lower price you want if your put option strike price is reached before expiration. If your buy price is not reached then you keep the premium you collected to sell the put option contract.

A put option contract seller is paid when they “sell to open” a put option and receives a premium for agreeing to have stock “put” on them at a set price by a specific date. The put writer has agreed to buy a stock at the strike price of the put option they sold.

The buyer of the put has the right but not the obligation to exercise the option and “put” the underlying asset on the put option seller by assignment. This would create a long position in the put option sellers account. The buyer of a put option is making a bearish bet on when a stock will close below a certain price.

The put option buyer makes money if the underlying stock closes below the strike price by expiration and adds more in intrinsic value than the option cost in extrinsic value. At anytime in the life of the put option it can go higher in value with a strong move down in the stock and be sold for a profit before expiration.

Put option contracts usually trade in contracts of 100 shares of stock. Also mini-contracts in some option chains have traded in the past that were written on less than 100 shares.

Put options are not financial assets like bonds, stocks, or commodities they are simply trading vehicles. A put option is a bet that a stock will go down to an approximate price in a set time period.

While put options do provide leverage with the ability to control much more stock than if you just bought the shares the level of risk is correlated to your position size. The probability of an option getting to its strike price in your timeframe before the contract expiration should also be a major consideration of the risk of loss.

Similar principles of profitable trading apply to options that apply to other financial markets. The difference is that with long put option contracts you can capture the full downside move of an underlying asset during a trend while the risk of loss is capped to the price you paid for the option contract versus the theoretical unlimited risk of a short position that can theoretically go up to any price.

Put options increase in value as the underlying stock goes lower and gets closer to the option strike price increasing Delta and extrinsic value. If volatility increases the value of Vega the put option price goes higher. If a put option goes in the money then it can increase in intrinsic value.

A put option can drop a little in value each day as time goes by and Theta is priced out unless the underlying stock moves down far enough to offset the time decay with growing extrinsic or intrinsic value.

Traders that are bullish sell put options short. Traders that are bearish buy put options.

Put options are great tools for both leveraging more buying power and at the same time quantifying the risk.

Options can be sold at any time at their current value and don’t have to be held until expiration.

Options are fungible assets and the option contracts are interchangeable and not specific to the original buyer and seller but traded on the open market among different buyers and sellers.

To save a lot of time and searching you can learn more about the basics of trading options by checking out my Options 101 book or Options 101 eCourse.