A price action trading system is a process for using price data to make buy and sell decisions on a watch list of charts. Price action trading attempts to use entry and exit signals that have an edge by creating good risk/reward ratios that lead to profitable trading with wins that add up to more than losses.

Price action trading is the opposite of using opinions, predictions, and emotions to make trading decisions. Price action trading is the process of using what is happening in the market to determine whether you buy, sell, or hold a position.

There are four primary dynamics in price action trading:

- An entry signal based on a breakout, breakdown, or technical indicator.

- A stop loss set at the price level a trade should not go if it is going to work out.

- A trailing stop that moves up a stop loss to lock in profits if a winning trade reverses.

- A profit target on where a maximum reward will be locked in if the price level is reached.

Whether it is pure price action itself or technical indicators that are derivatives of price action, this is the process of making decisions based on reactive technical analysis not predictive technical analysis.

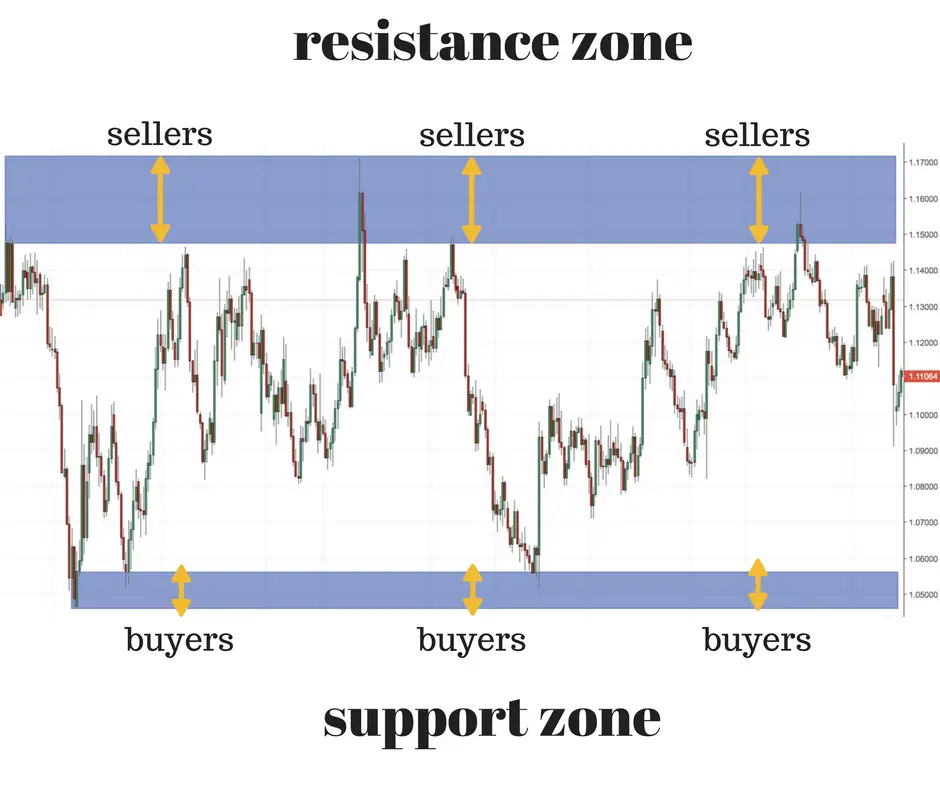

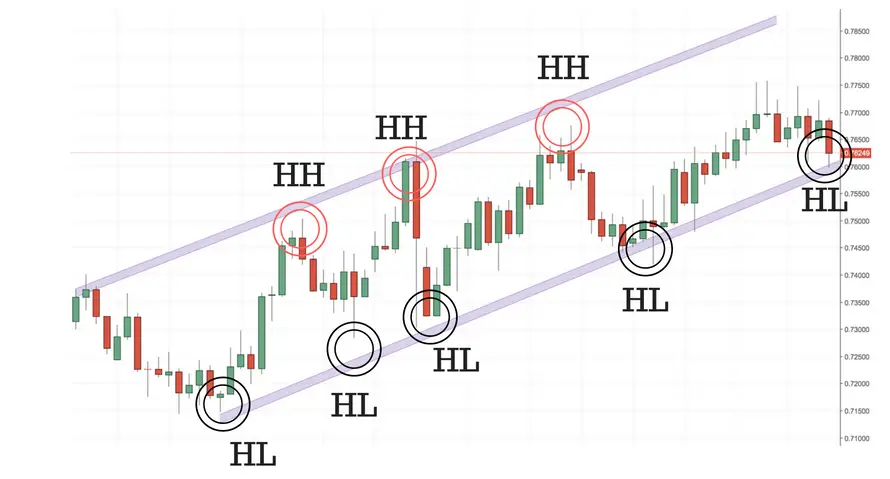

Price action traders can use chart patterns, candlesticks, or backtested data to plan their trades and trade their plans.

Images created by Colibri Trader @PriceInAction.