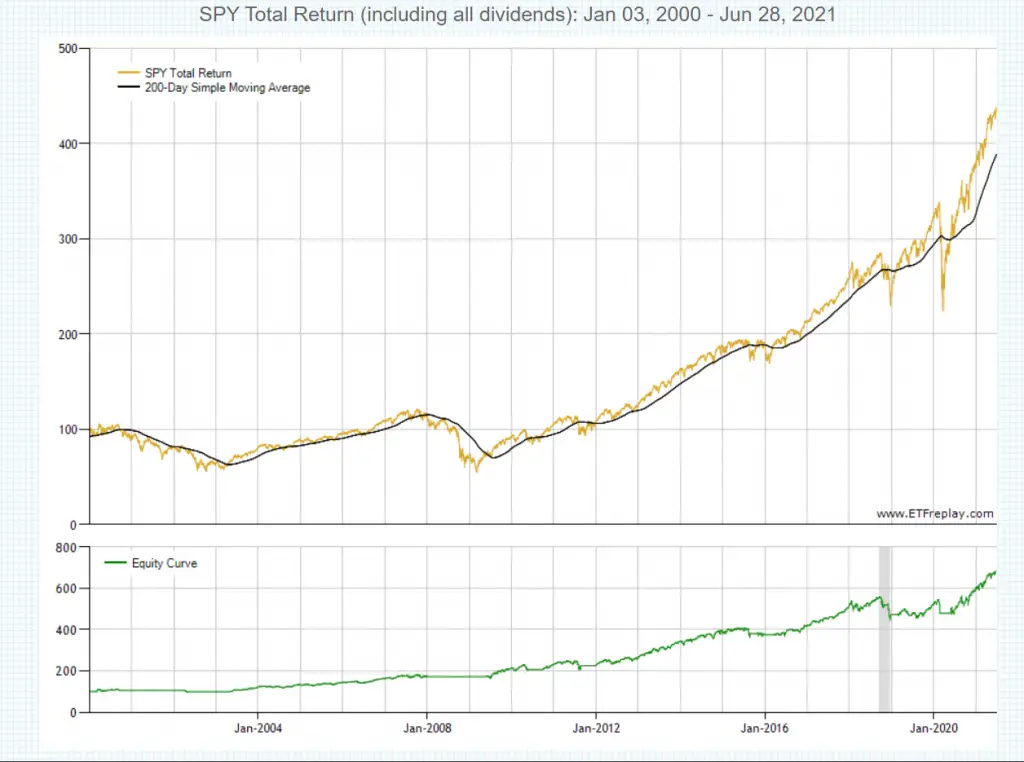

Is there a simple moving average trading strategy that crushes buy and hold investing? If so, what moving average and time frame combination would accomplish this going back at least 20 years? The 200-day simple moving average as an end of month signal on the SPY ETF accomplishes this feat.

Buy and hold investing on the S&P 500 index with an exchange traded fund or a low cost mutual fund is a top performing system that few money managers and traders can beat. This is a good core strategy for a trader or investor to start with and then find an edge to help outperform it over time and beat it. If you can’t outperform it in returns or at least on a risk adjusted basis you might as well be a buy and hold investor.

The downside of buy and hold investing is the pain that has to be endured during bear market drawdowns and market crashes, finding a way to decrease the drawdowns in capital could also help increase the returns. Few investment gurus want to admit when you begin to buy and hold and when you need to take out your money dramatically affect your returns. All investing strategies have an element of timing.

Supporters of buy and hold investing and money managers like to use the market bottom of March 2009 or March 2020 as the beginning for projecting returns. If you are already in the market during a crash you don’t benefit from a lower cost basis with capital trapped in the plunge.

A buy and hold investor that started in March 2000 or January 2008 with a large position will not think it is the holy grail of investing for many years after their entry. Also the returns of people lucky enough to be buy and hold investors from 1982-1999 were very different from those that experienced it from 1929-1954. It took the DJIA 25 years to get back to even in price after the 1929 peak. There are historical quantified signals that can improve returns over just buying and hoping.

Here is a simple moving average strategy that beats buy and hold investing over the past 20 years using the principles of trend following. On the last day of each month you take one of the actions:

- On the last day of the month if you are long the SPY ETF and price is going to close over the 200-day simple moving average you stay long.

- On the last day of the month if you are long the SPY ETF and price is going to close under the 200-day simple moving average you sell your position and go to cash.

- On the last day of the month if your in a cash position and price is going to close over the 200-day simple moving average you buy the SPY ETF and go long.

- On the last day of the month if you in a cash position and price is going to close under the 200-day simple moving average you stay in cash.

It is not complex and only takes one action on the last day of the month for buy and sell signals. It beat the returns of holding the S&P 500 index by over +220% and cut the drawdown of capital by almost one third.

Unlike mutual funds and hedge funds, a good systematic moving average strategy used consistently can beat the S&P 500 index over time by staying long during bull markets and going to cash during bear markets the majority of the time. With this type of strategy investors are acting like buy and hold investors during bull market uptrends but staying in a cash position when investors are taking their drawdowns in capital during bear markets and crashes. One of the most important things is that it has a signal to get an investor back in after a downtrend ends. Many people that make big money in uptrends don’t know when to get out, and many times those that are smart enough to avoid big downtrends don’t know when to get back in.

This is not the holy grail of trend trading the SPY ETF, it is just math. The 2oo-day SMA is eventually lost during bear markets and crashes and price stays above the 200-day SMA during bull markets. The end of month signal avoids all the intra-month false signals when price chops under and over this line. For a swing trader or position trader the signals will seem like a long time frame but for a buy and hold investor this will seem like an active short term strategy.

The 200-day simple moving average of prices is one of the most popular stock market signals and backtesting shows since the year 2000 it has worked as an end of month signal. One frustration with this system is when you miss some upside intra-month waiting for the signal to enter and have to wait until the end of the month to get out of a downswing, however this is the price paid to avoid many false signals. The most frustrating thing is when a whipsaw happens and you exit before an upswing or enter during a downswing but this frustration is far less frustrating historically than buy and hold investing.

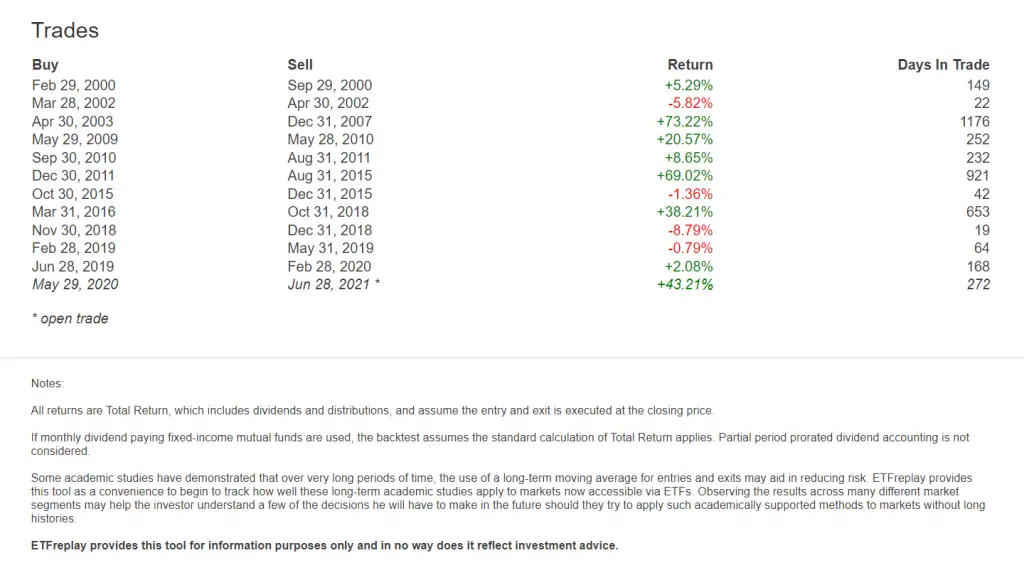

The trading signals for this system had 12 buy signals and 11 sell signals and is currently long as of the day of the backtest data. The signals avoided all three of the major bear markets of the past 20 years but captured almost all the bull market profits. It has a 66.7% win rate and a risk/reward ratio of approximately 3.5/30, few trading systems have this high of a positive expectancy.

Chart and backtest data courtesy of ETFreplay.com

This is not investment advice just as an example to get readers thinking about alternatives to buy and hold investing. Everyone has to find a strategy that fits their own timeframe, risk tolerance, and return goals.