Here are two of the best crypto trading signals using moving average crossovers to swing trade and trend trade the ^BTCUSD and ^ETHUSD pair. These are examples of trading signals for capturing moves to the upside and going to cash if price starts moving down.

5 day / 10 day ema crossover: Laser Hands signal. 5 day / 10 day ema crossunder: Paper Hands signal.

5 day / 20 day ema crossover: Flying Eagle signal. 5 day / 20 day ema crossunder: Wounded Duck signal.

The above chart shows the Steve Burns Moving Average Ribbon and all of the following crossover signals.

Below is a backtest based on buying the ^BTCUSD and ^ETHUSD when the 5 day EMA crosses and closes over the 10 day EMA and then selling when the 5 day EMA closes back under the 10 day EMA:

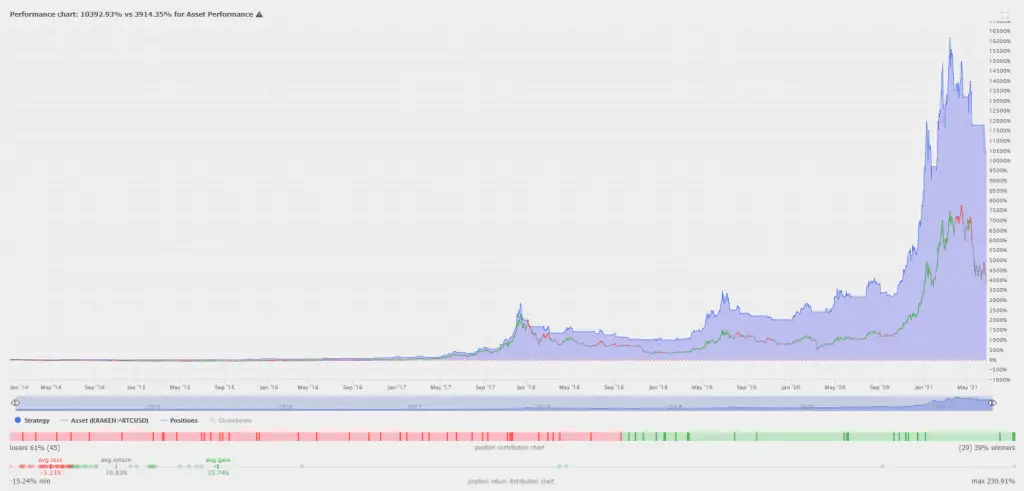

^BTCUSD chart and 5/10 day ema crossover entry and crossunder exit backtest data:

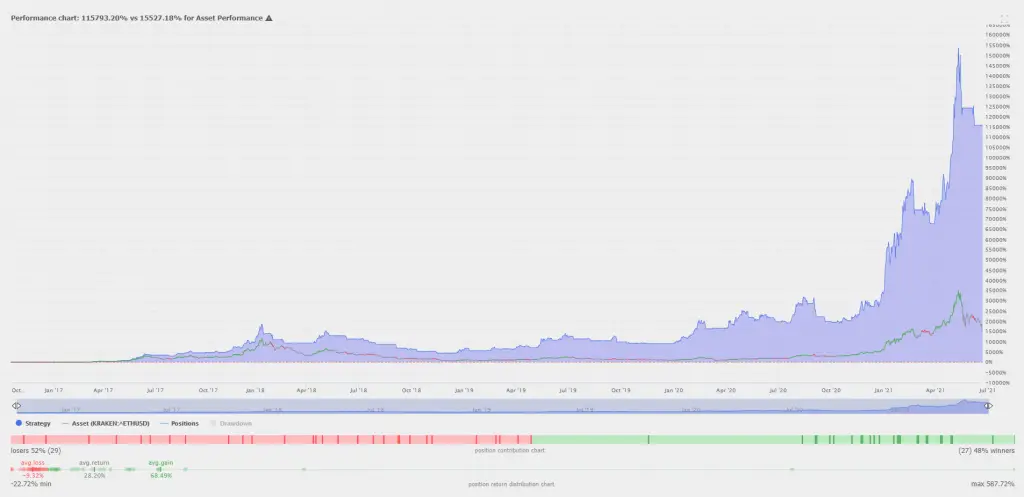

^ETHUSD chart and 5/10 day ema crossover entry and crossunder exit backtest data:

Below is a backtest based on buying the ^BTCUSD and ^ETHUSD when the 5 day EMA crosses and closes over the 20 day EMA and then selling when the 5 day EMA closes back under the 20 day EMA:

^BTCUSD chart and 5/20 day ema crossover entry and crossunder exit backtest data:

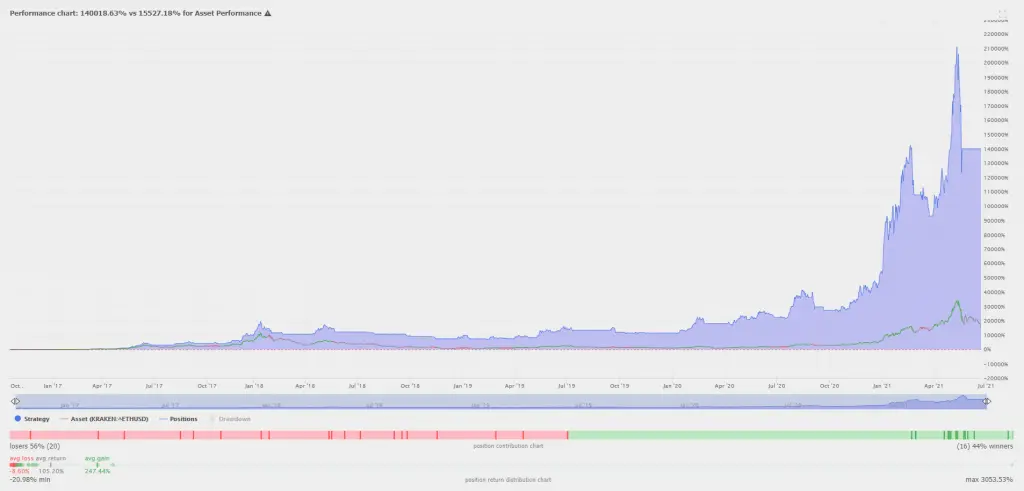

^ETHUSD chart and 5/20 day ema crossover entry and crossunder exit backtest data:

(All charts and backtesting data courtesy of TrendSpider.com. Price data used from the Kraken platform).

These backtested signals show how Bitcoin can be a great asset for trend trading and used to diversify your trading system. The primary edge in the above signals is that it keeps a trader long to capture the upside and then takes the trader back to cash derivatives/stable coins during crypto downtrends in price and avoids the bulk of crashes and downtrends. These signals can also give new traders timing parameters on when to first get into a cryptocurrency and avoid buying near a top in most cases.

This post is for informational purposes and is not investment advice.