Negative correlation in markets, also known as an inverse correlation, indicates that two securities have a relationship where their prices move in opposite directions from each other most of the time. As an example, if gold and the U.S. dollar have a negative correlation, as the dollar goes up in value then gold will go down in value. Also the opposite; if the dollar decreases in value, gold will increase.

The correlation coefficient is used to calculate a statistical measurement of how strong movements in two markets are historically in relation to one each other. The correlation is expressed in a range of values between 1.0 and -1.0. All the readings of the formula are inside the 1.0 to -1.0 range. So any calculations that come out to more than 1.0 or less than -1.0 are an error.

A -1.0 shows a perfect inverse correlation in movement. One market goes up by the same percentage that another one goes down.

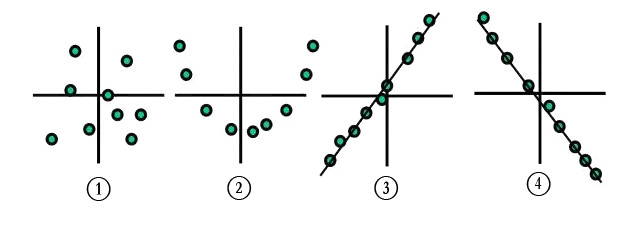

There are four potential types of correlations between securities as seen in the below image.

- There is no correlation r ~ 0

- There is a nonlinear correlation r ~ 0

- Positive correlation r ~ + 1

- Linear negative correlation r ~ -1

Talgraf777, Public domain, via Wikimedia Commons

Negative correlation is used by investors in portfolio construction to offset concentrated risks through diversification of assets and markets. Negative correlation between sectors, market caps, commodities, currencies and countries is used for the building of diversified portfolios that can lower risks and smooth out performance through market volatility over the long term.

The higher the correlation between positions the greater the chance of large returns as well as the bigger the risk of drawdowns.

“Diversification is the only free lunch” in investing, says the quote attributed to Nobel Prize laureate Harry Markowitz.