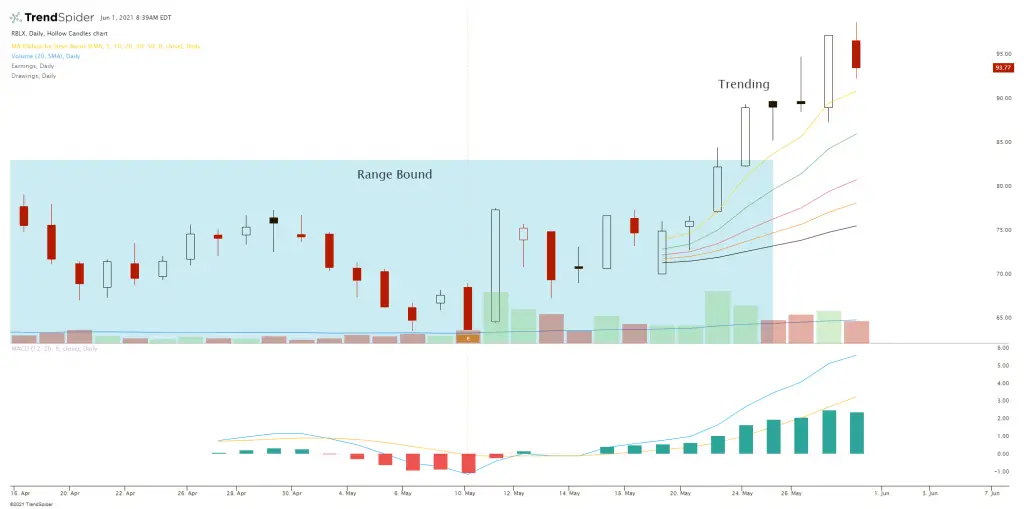

Trending stocks are ones that are moving strongly in one direction whether up or down.

Here are trending stock checklists:

Stocks in an uptrend:

- Making higher highs and higher lows.

- Price is above key moving averages.

- The chart has moving average crossover signals.

- Price is near all time highs.

- Price is near 52-week highs.

- Volume is increasing with price.

- Technical indicators are bullish.

- Technical indicators are showing momentum to the upside.

- Sentiment is bullish for the chart.

- A breakout of a trading range to the upside.

- High percentage gain in price on the chart.

- High revenue and sales are projected for the company.

Stocks in a downtrend:

- Making lower highs and lower lows.

- Price is below key moving averages.

- The chart has moving average crossunder signals.

- Price is near all time lows.

- Price is near 52-week lows.

- Volume is increasing as price goes lower.

- Technical indicators are bearish.

- Technical indicators are showing momentum to the downside.

- Sentiment is bearish for the chart.

- A breakout of a trading range to the downside.

- High percentage loss in price on the chart.

- Low revenue and sales are projected for the company.

These parameters are time frame dependent for the trader or investor. A buy and hold investor will quantify a downtrend differently than a day trader. The more that a chart meets the above metrics the greater the strength of a trend is likely to be.

“The answer to the question, What’s the trend? is the question What’s your timeframe?” – Richard Weissman