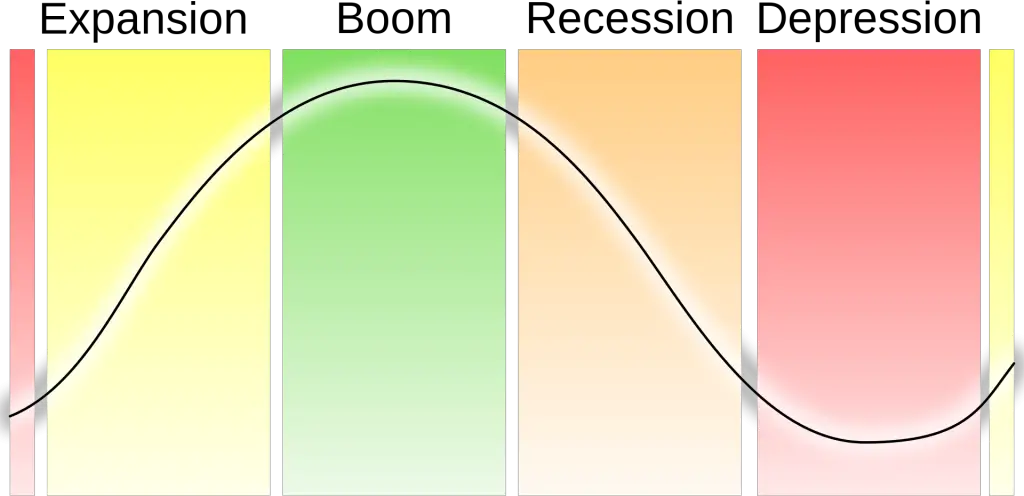

A cyclical stock is one that has its price driven by the overall macroeconomic environment of the economy. A cyclical stock price trend primarily follows the cycles of an economy through stability, growth, boom, and bust. The majority of stocks that are considered cyclical are for companies that sell discretionary consumer goods that have sales and earnings correlated with consumers ability to buy because they are doing well with employment and pay. These companies do well as economies are expanding and their sales decline as economies are contradicting. Cyclical stocks sell their products and services to consumers when they have extra spending money after their rent, utilities, and food is paid for. The products of cyclical companies are bought primarily with the leftover discretionary money after basic living expenses are paid for.

Cyclical stocks are the best example of the inverse of defensive consumer staple stocks. Cyclical stocks are best described as discretionary product companies, like Tesla or Home Depot, while consumer staple stocks are more like Walmart and Procter and Gamble. They are above and beyond wants versus basic needs. To own a full basket of discretionary cyclical stocks an investor can buy the exchange traded fund $XLY, the defensive consumer staple exchange traded fund is $XLP. The holdings of these two ETFs shows what stocks are considered to be in each sector.

The stock market tends to see capital rotate out of cyclical stocks and into defensive names during times of declining economic data for growth and jobs as part of a normal cycle. At the end of a bear market when economic data is improving capital tends to rotate back into discretionary cyclical names on better earnings hopes after improving consumer data.

Some of the most popular cyclical stocks:

AMZN Amazon.com, Inc.

TSLA Tesla Inc

HD Home Depot, Inc.

MCD McDonald’s Corporation

NKE NIKE, Inc. Class B

LOW Lowe\’s Companies, Inc.

SBUX Starbucks Corporation

TGT Target Corporation

BKNG Booking Holdings Inc.

TJX TJX Companies Inc

GM General Motors Company

DG Dollar General Corporation

F Ford Motor Company

ROST Ross Stores, Inc.

EBAY eBay Inc.