Support and resistance price levels on charts can show where buyers and sellers are located at different price levels. Support is created when there is buying demand at a certain level on a chart. Resistance is created at a price level where there are plenty of sellers waiting to exit when that price is reached. Buyers and sellers are always equal in any transaction, it is the price that changes.

Resistance and support are a way to measure and quantify whether a chart is currently in an uptrend, downtrend, or going sideways in your timeframe. Horizontal support and resistance around a price area over and over again shows sideways price action on a chart. Support and resistance ascending to higher highs and higher low price levels shows that a price is in an uptrend. Support and resistance descending to lower highs and lower low price levels shows that a price is in an downtrend.

A repeated lower price level that is revisited but has dip buying and where the chart stops going lower in an area is considered the chart support. A repeated higher price level that is revisited but has profit taking and the chart stops going higher due to selling pressure in an area is considered the chart resistance.

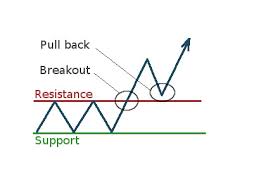

Horizontal support and resistance areas show that a chart is trading in a price range. This condition remains until either support is broken to the downside or resistance is broken to the upside opening the possibility for a new trend to emerge.

Support and resistance is not an exact number, it is a zone of prices as you see in the above image. There is more of a support and resistance zone than a price to watch. To be valid there should be repeated tests of the upside or downside of a price area for it to be considered a valid area of support or resistance. The longer a chart trades in a price range the more valid the areas become. Also the longer the price range the more powerful the eventual break out can be.

Many times a trader will see the old resistance become the new support or the old support become the new resistance as people will buy or sell at a second opportunity at an old key price level.

Horizontal support and resistance zones on a chart are visual ways to quantify, identify, and track the trend on a chart by identifying price levels of interest on a chart.

Support and resistance zones on a chart can also be vertical showing buying and selling interest at price levels identified by ascending or descending moving averages or trend lines.

Ascending support areas happen during uptrends as traders buy dips and pull backs to a key short term moving average or vertical trend line. Ascending resistance areas happen during uptrends as traders sell rallies and into moves higher at a key overhead vertical trend line.

Descending resistance areas happen during downtrends as traders sell into rallies back to a key short term moving average or vertical trend line above overall price action. Descending support areas happen during downtrends as traders buy dips during sell offs into moves lower to a key vertical trend line of support.

Support price levels are created when buyers decide at what price level they will buy the dip and then can overcome the selling pressure on the chart at that point stopping any move lower. Resistance price levels are created when sellers decide at what price level they will sell into a rally on a chart and then they overcome the buying pressure at that point stopping a move any higher.