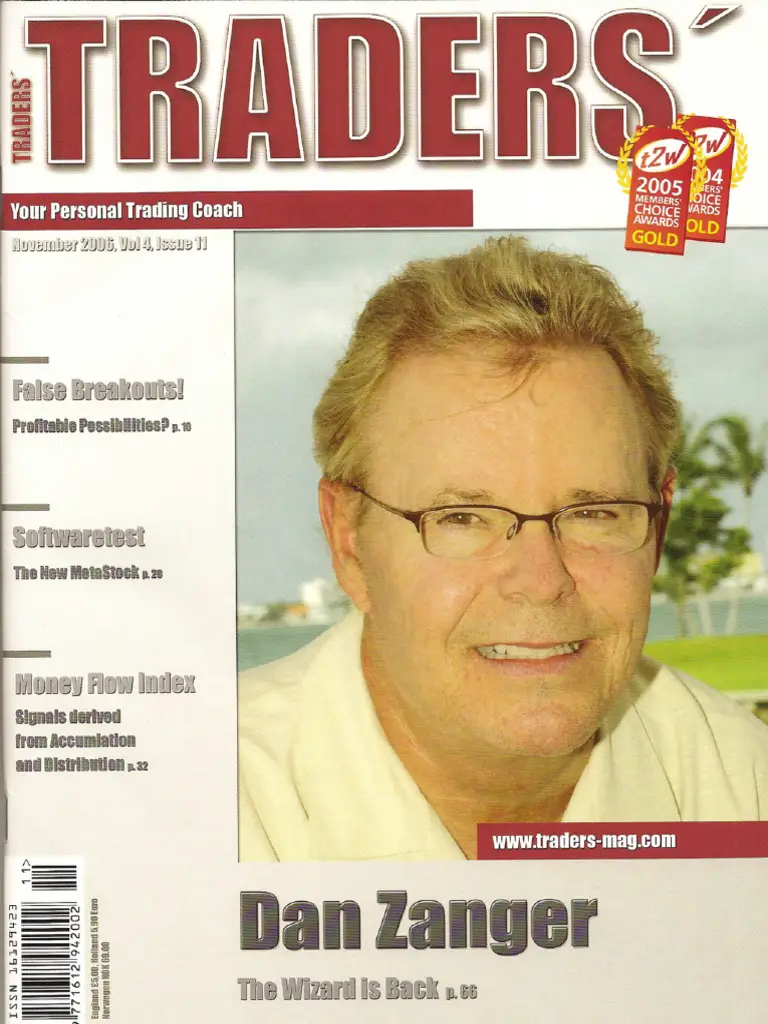

Dan Zanger is a modern day legend in the trading world. His mother Elaine loved the stock market and as a child Dan would often watch the business channel with her. One day in 1978 Dan saw a stock make a big move on the ticker tape at the bottom of the screen hitting $1. He made his first purchase and sold the stock a few weeks later at over $3. From that sale on, he was hooked on the price action of stocks.

Dan Zanger is a modern day legend in the trading world. His mother Elaine loved the stock market and as a child Dan would often watch the business channel with her. One day in 1978 Dan saw a stock make a big move on the ticker tape at the bottom of the screen hitting $1. He made his first purchase and sold the stock a few weeks later at over $3. From that sale on, he was hooked on the price action of stocks.

As an adult he could be seen carrying a quotetrek with him to stay tuned into stock prices on his jobs in the 1980s in Beverly Hills as an independent contractor building swimming pools. He attended a seminar led by William J. O’Neil in the 1990s and this was a major turning point in his ability to select winning stocks.

Dan studied chart patterns 25 to 30 hours per week learning to select stocks that would make big moves. As technology and internet stocks took center stage in the stock market in 1997, Dan began to see powerful moves underway. He sold his Porsche for approximately $11,000 to have the necessary capital to jump fully into the market. Over the next year, he parlayed the $10,775 into $18 million with the knowledge acquired over two decades playing the market and re-reading the works of William J. O’Neil. With this success, Dan was able to become a rich full time trader and leave contracting behind to manage his own capital and start chartpattern.com.

Dan Zanger holds a world record for his trading on his one-year stock market portfolio appreciation, gaining over 29,000%. In under two years, he turned $10,775 into $18 million. Fortune magazine, wrote an extensive article on Zanger, covering his trading results after reviewing his IRS tax returns and trading records.

Here are Dan Zanger’s 10 Golden Trading Rules:

- Make sure the stock has a well formed base or pattern.

- Buy the stock as it moves over the trend line of that base or pattern and make sure that volume is above recent trend shortly after this “breakout” occurs. Never pay up by more than 5% above the trend line. You should also get to know your stock’s thirty day moving average volume, which you can find on most stock quote pages.

- Be very quick to sell your stock should it return back under the technical buy area or breakout point by $3 to $5. The more expensive the stock, the more leeway you can give it. Some people employ a 5%-7% stop loss rule. This may mean selling a stock that just tried to breakout and fails in 20 minutes or 3 hours from the time it just broke out above your purchase price.

- Sell 20 to 30% of your position as the stock moves up 15 to 20% from its breakout point.

- Hold your strongest stocks the longest and sell stocks that stop moving up or are acting sluggish quickly. Remember stocks are only good when they are moving up.

- Identify and follow strong groups of stocks and try to keep your selections in these groups.

- After the market has moved for a substantial period of time, your stocks will become vulnerable to a sell off, which can happen so fast and hard you won’t believe it. Learn to set new higher trend lines and learn reversal patterns to help your exit of stocks. Some of you may benefit from reading a book on Candlesticks.

- Remember it takes volume to move stocks, so start getting to know your stock’s volume behavior and then how it reacts to spikes in volume. You can see these spikes on any chart. Volume is the key to your stock’s movement and success or failure.

- Many stocks are mentioned in the newsletter with buy points. However just because it’s mentioned with a buy point does not mean it’s an outright buy when a buy point is touched. One must first see the action in the stock and combine it with its volume for the day at the time that buy point is hit and take keen notice of the overall market environment before considering purchases.

- Never go on margin until you have mastered the market, charts and your emotions. Margin can wipe you out.

You can check out Dan’s website at and chartpattern.com. subscribe to his newsletter.