Here are four of the best bitcoin trading strategies using moving average crossover signals to swing trade and trend trade the ^BTCUSD pair. These are examples of trading signals for capturing moves to the upside and going to cash if price starts moving down.

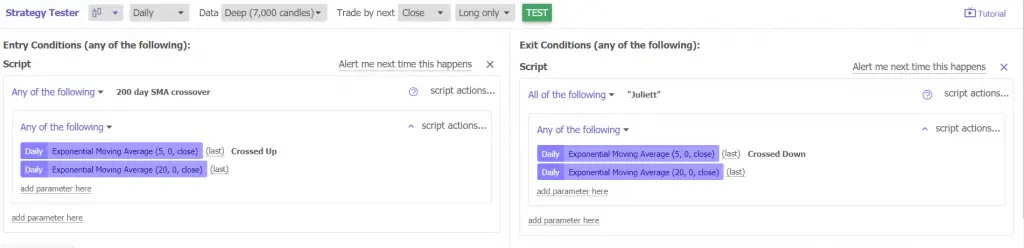

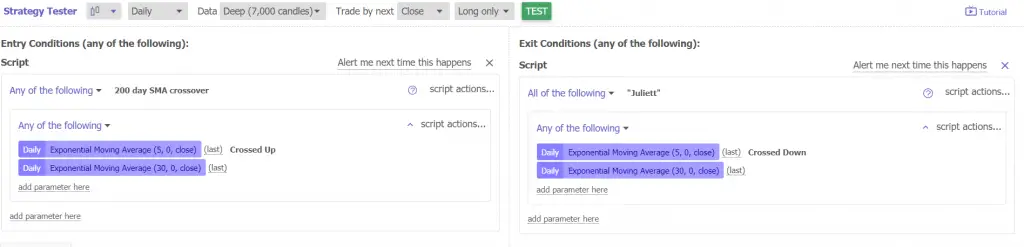

5 day / 20 day ema crossover: Flying Eagle

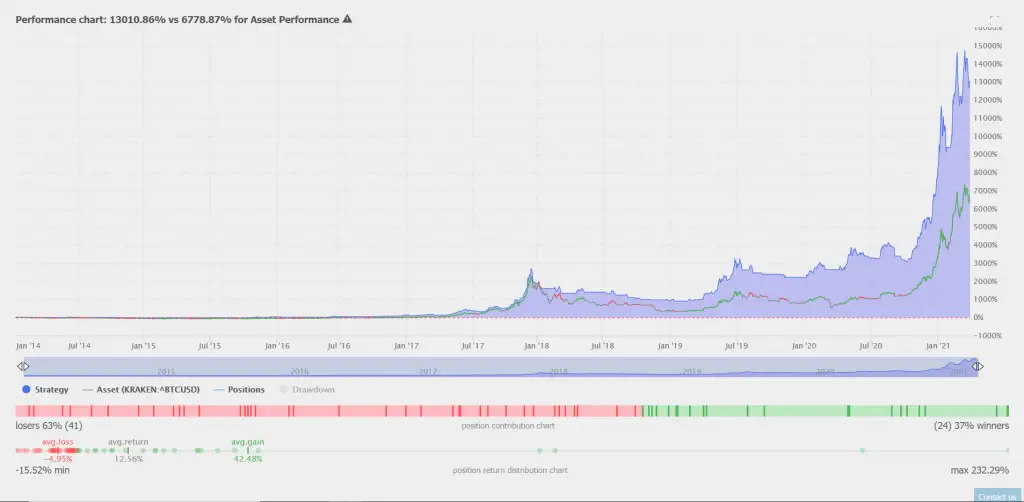

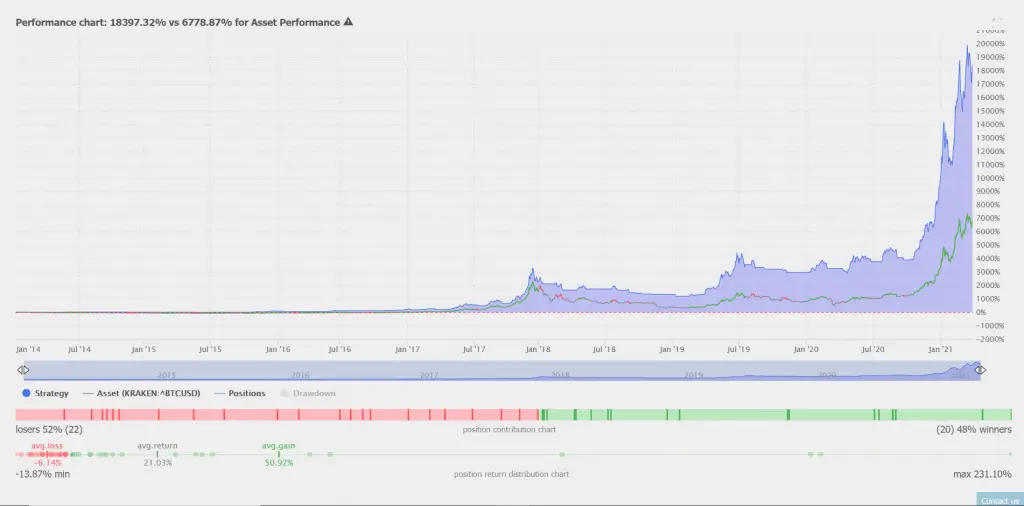

5 day / 30 day ema crossover: Flying Falcon

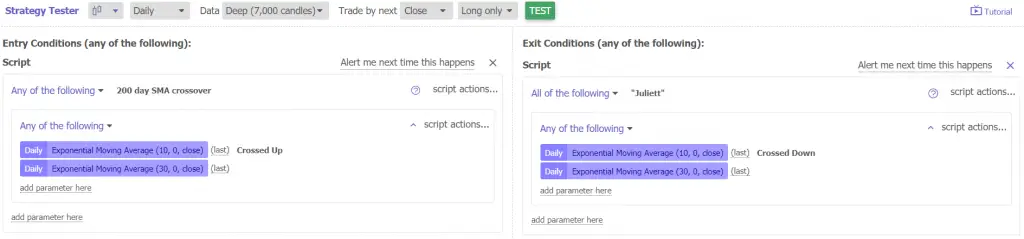

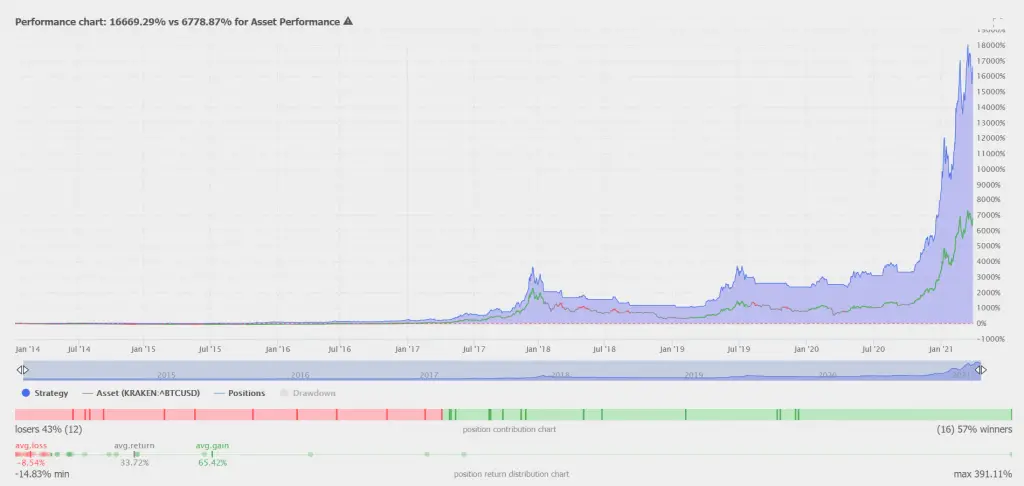

10 day / 30 day ema crossover: Flying Squirrel

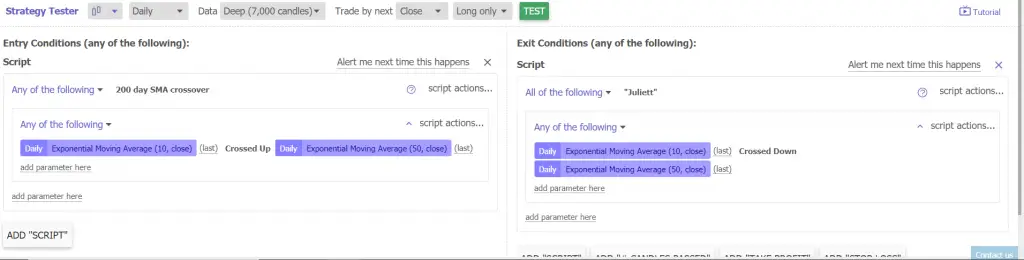

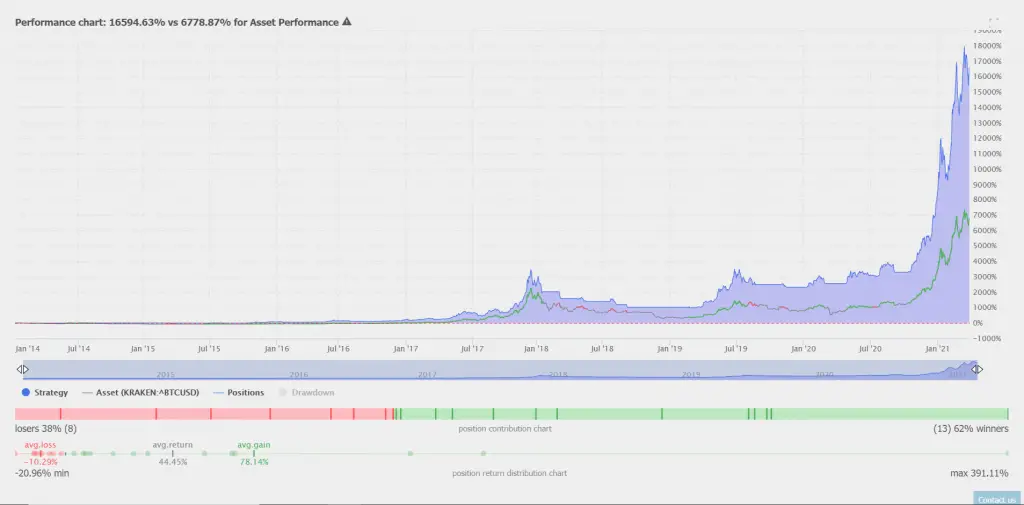

10 day / 50 day ema crossover: Flying Dragon

The above chart shows the Steve Burns Moving Average Ribbon and all of the following crossover signals.

Below is a backtest based on buying the ^BTCUSD when the 5 day EMA crosses and closes over the 20 day EMA and then selling when the 5 day EMA closes back under the 20 day EMA:

Below is a backtest based on buying the ^BTCUSD when the 5 day EMA crosses and closes over the 30 day EMA and then selling when the 5 day EMA closes back under the 30 day EMA:

Below is a backtest based on buying the ^BTCUSD when the 10 day EMA crosses and closes over the 30 day EMA and then selling when the 10 day EMA closes back under the 30 day EMA:

Below is a backtest based on buying the ^BTCUSD when the 10 day EMA crosses and closes over the 50 day EMA and then selling when the 10 day EMA closes back under the 50 day EMA:

(All charts and backtesting data courtesy of TrendSpider.com. Price data used from the Kraken platform).

These backtested signals show how Bitcoin can be a great asset for trend trading and used to diversify your trading system.

This post is for informational purposes and is not investment advice.