The risk of ruin formula shows the probability a trader could lose enough of their trading capital that the return to even or being profitable is near zero for that account. The concept of the risk of ruin came from the world of gambling, but evolved to also show the risk to both traders in the financial markets and insurance companies in the underwriting business.

The risk of ruin formula calculation is ((1 – (W – L)) / (1 + (W – L)))U

Answer key:

W = The probability of a winning trade.

L = The probability of a loss.

U = The maximum number of trading risks that can be taken before the trader reaches their threshold for being ruined.

The risk of ruin formula shows the probability of ruin, the odds that a trading account will blow up based on the size of wins and losses and what sequence of straight losses would bring the account down too low to recover the lost capital.

The easiest way to see an example of the risk of ruin is the example of a coin toss. If a trader has a 50% chance of winning on a trade and they bet 100% of their trading capital on heads and flips the coin, their risk of ruin is 50%. As one time landing on tails ruins them and they have a 50/50 chance of it landing on heads. One out of two coin flips on average the trader will be ruined.

The risk of ruin depends on win rate and risk per trade.

Three key questions must be answered.

What is your win rate? What is your risk of loss per trade? What are the odds of your longest losing streak?

The win rate is the expectancy of how many times you will have winning trades based on backtesting of a system or your historical trading record if you are a discretionary trader. Trade management after entry with stop losses, trailing stops, and profit targets is the primary creator of your risk/reward ratio.

Your potential for risk of loss per trade is based on your position sizing and your stop loss placement. It is measured by a percent of total trading capital at risk. If you are trading a $100,000 account, with $10,000 position sizing, and a 10% stop loss on each trade then your risk of loss per trade is a maximum of 1% of total trading capital or $100,000 / $1,000 = 1%.

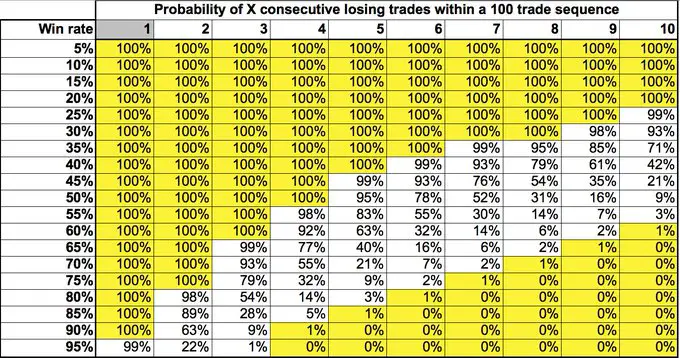

The longest losing streak projection is based on the odds you will eventually lose money over and over again in a row over a large sample size of trades considering your win rate. This is called a drawdown.

The smaller the percentage of your trading capital you risk on any one trade the lower the risk of ruin.

The odds are that a trading strategy or system will eventually have a 60% win rate or less over a sequence of 100 trades and then see a losing streak of 10 trades in a row. Whether you can survive that 10 trade losing streak determines your survival rate as a trader over the long term.

The risk of ruin formula determines a trader’s long term survival rate.