Click here for the Current Michael Burry Portfolio 2021 Q1 Update as of the 3/31/2021 13F filing.

Fund manager Dr. Michael Burry was made famous in the movie The Big Short after he bet big against the housing market using derivatives and made a fortune during the 2008 crash.

Here is the current Michael Burry portfolio as of 2021 based on his 4th quarter 13f filing at the end of December 2020.

He has $238 million of capital under management at his firm Scion Asset Management, LLC Holdings.

Here are a list of stocks in his portfolio going into 2021:

Stock/Percentage of portfolio.

Citigroup Inc. 14.4%

Pfizer Inc. 12.2%

Kraft Heinz Company 9.6%

NOW Inc. 6.3%

Discovery, Inc. Class A 5.2%

Designer Brands Inc. Class A 4.8%

RPT Realty 4.4%

Western Digital Corporation 4.3%

Wells Fargo & Company 3.9%

Uniti Group Inc 3.8%

Qurate Retail, Inc. Class A 3.8%

HollyFrontier Corporation 3.5%

Allstate Corporation 3.3%

CoreCivic, Inc. 2.9%

Molson Coors Beverage Company Class B 2.8%

Urstadt Biddle Properties Inc. Class A 2.7%

GEO Group Inc 2.6%

Kimball International, Inc. Class B 2.5%

Ingles Markets, Incorporated Class A 2.4%

MSG Networks Inc. Class A 2.3%

SunCoke Energy, Inc. 2.0%

Ares Capital Corporation 0.9%

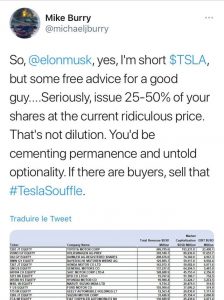

On November 2nd, 2020 Dr. Michael Burry tweeted out he was short Tesla and explained why based on fundamentals, he has since deleted the tweet for some reason. This may be his new big short.

Michael Burry was also reported to have tweeted this on February 15, 2021:

“$TSLA below $100/share by later this year will not crash the system. There is no reflexivity in such a fall. But it would trigger the end of an era for a certain type of investing.” – Cassandra @michaeljburry (The tweet has since been deleted).

Dr. Burry has thought to have been shorting Tesla stock or buying Tesla put options but the specifics are not known as the position is likely always changing.

He was widely talked about in the financial media in early 2021 as GameStop stock rocketed up to $438 a share after Burry was one of the biggest proponents of it as a value stock in 2020 holding a large percent of the stock as a position in his portfolio going into the fourth quarter of 2020.

In August 2019, Scion Capital announced that it had bought three million shares worth $16.56 million in gaming and electronics retailer GameStop. This means that Burry accumulated shares of Game Stop Stock at approximately $5.52 a share on average.

As Game Stop stock went parabolic after the Wall Street Bets short squeeze on the hedge fund Melvin Capital the media was so excited and happy for Burry’s huge win they started calculating how many hundreds of millions he likely made on the trade. Several media outlets started writing articles about his new big win. Finally, Bloomberg reported Burry said in an email interview on Tuesday January 26, 2021 that he’s now “neither long nor short.” He declined to comment on when he sold the stock and at what price.

Dr. Burry’s fund still held 1.7 million shares of GameStop (GME) with 4.3% of his total portfolio when he reported his third quarter investment positions at the end of September 2020. His fourth quarter 13f filings at the end of 2020 show zero GameStop shares as of December 31, 2020. GameStop stock was $18.84 at the end of 2020. So based in his public reporting, Michael Burry sold his Gamestop stock somewhere between October 1st and December 31st in the price range from the high of $22.35 to the low of $9.10.

While he did not capture the parabolic run up to $438 a share in January of 2021 he did accumulate his position in the low single digit prices so he likely doubled, tripled, or quadrupled his money at least whenever he exited in the 4th quarter of 2020. We don’t know when he exited in the fourth quarter but we do know he missed the entire Wall Street Bets/Reddit 2021 run up. He was very close to pulling off the ultimate big long and they would have had to make a new movie if Christian Bale was available again. He was likely very happy to have made the triple digit return on his exit in 2020 as that is the goal of a deep value investor which is his primary methodology.