A power earnings gap is a technical trading signal created by @traderstewie at theimpatienttrader.blogspot.com. It is also called a PEG for short. A great fundamental earnings report is not enough to get on Trader Stewie’s PEG list, it also requires a large gap up in price after the earnings are reported. He is looking for confirmation of strong earnings in the price action and a gap area where no one was willing to sell their stock at between the after earnings open and the previous closing price before earnings was announced.

Good earnings reports can lead to lower prices and bad earnings reports can lead to higher prices as the basis of the move is more about expectations than results. An earnings move can be tapered by the expectations already being priced in and a move happens when the report is different from what is expected.

A true power earnings gap will gap up in price on open versus the last closing price and hold the gap. It will go higher through the day and then close with a strong bullish candle to confirm the daily move higher. It should close near the highs of the day and have a huge volume day much bigger than average showing accumulation. This type of move can show the footprints of institutional buying.

This is a momentum signal to get into what could be a strong uptrend in the coming days, weeks, and sometimes months. Many times an earnings power gap will emerge and break out of an existing chart pattern like a bull flag, bull pennant, or wedges. Buying early as it breaks out or gaps up is key to getting a good entry early on in the trade.

The power earnings gap is similar to what is called a gap and go, which is usually driven by a positive headline event. Buying a gap after the earnings event helps avoid the risk of holding through the earnings event itself which could lead to a large loss on a gap down.

This strategy tries to combine a strong fundamental earnings report with strong technical price action for a high probability trend higher. This set up works better during bull markets and if the stock has high short interest going into earnings. This type of strategy must be combined with a key technical stop loss on entry like a close back inside the gap. Also an exit strategy is needed like a profit target at extremely overbought levels or a trailing stop using a key short term moving average.

The power earnings gap is one way to trade earnings in a strong growth stock.

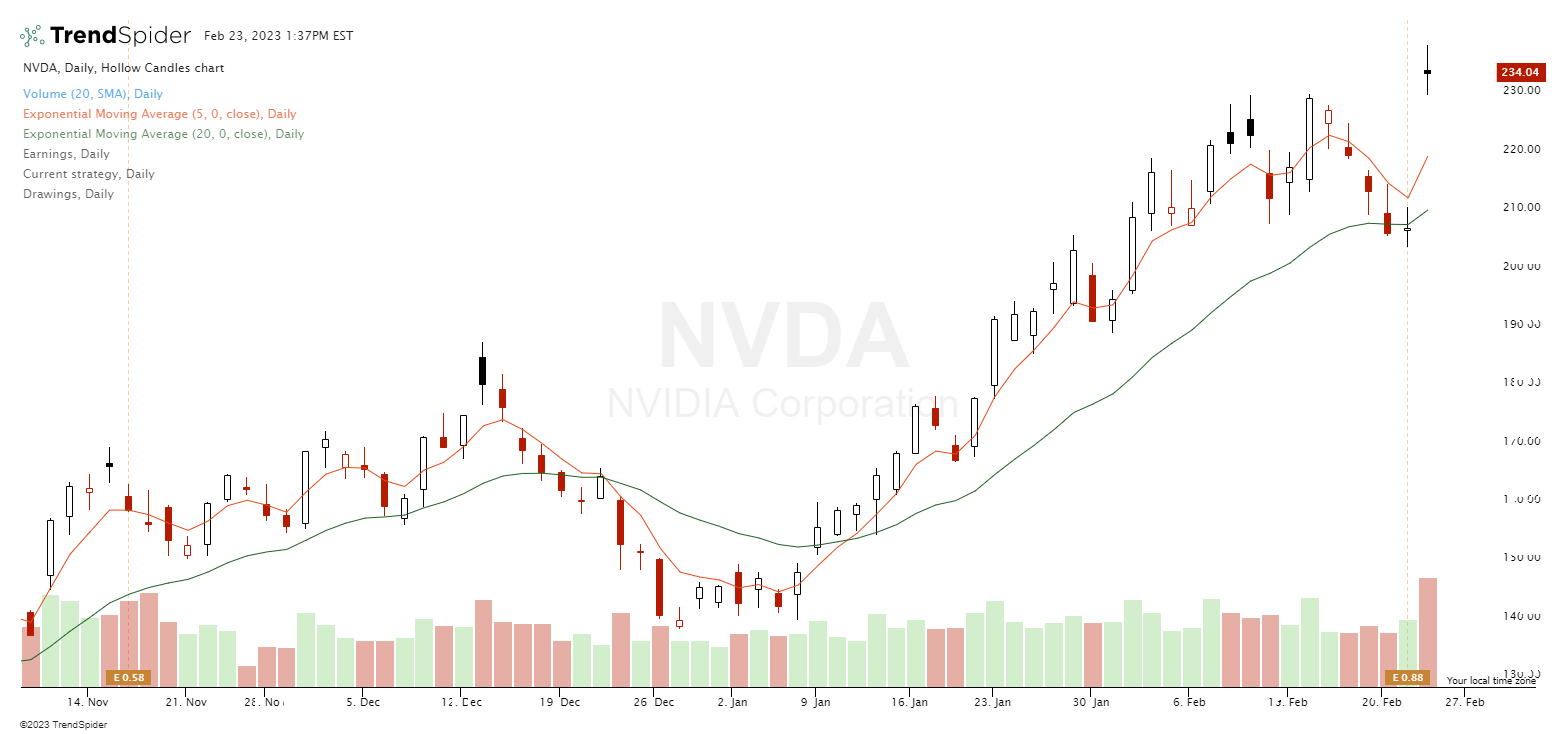

Chart Courtesy of TrendSpider.com