The Bitcoin Whitepaper by Satoshi Nakamoto was published on October 31, 2008. It was on the cryptography mailing list at metzdowd.com describing a digital cryptocurrency, titled “Bitcoin: A Peer-to-Peer Electronic Cash System”.[1]

The Bitcoin Whitepaper discusses the following:

- The need to remove excess fees and costs of transactions using traditional banks.

- The problems with banks reversing transactions for irreversible goods or services after they are delivered.

- The elimination of third party intermediaries for transactions.

- To reduce fraud greatly the blockchain system uses cryptographic proof instead of trust.

- Cryptography involves the use of code and protocols to establish secure communications.

- Peer-to-peer payments over an online network.

- The elimination of third parties and replacing trust with verification.

- Transactions are irreversible to protect sellers from fraud. Escrow mechanisms can be implemented to protect buyers.

- A peer-to-peer distributed timestamp server generates mathematical proof of the chronological order of transactions.

- The blockchain system is secure as long as honest participants collectively control more computing power than attackers and hackers.

- A Bitcoin doesn’t exist in the traditional sense of a physical object. An electronic “coin” is a sequence of verified digital signatures in chronological order showing chain of custody.

- Timestamps are the key to preventing double-spending and fraud. It is virtually impossible to send duplicate coins because each individual coin contains different, chronologically-ordered timestamps.

- Proof-of-work is the safeguard of a blockchain network. Each hash created by a timestamp server is assigned a unique number that is also used to identify that hash inside the blockchain. Built into this unique number is a math puzzle that each computer must solve before the transaction can take place.

- As truthful and accurate CPUs in the blockchain network solve the math problem for each hash these computational puzzles create blocks that are bundled into a chain in chronological order.

How the block chain network functions:

- All new transactions are broadcast to all nodes/computers linked together in the network.

- Each node then collects all new transactions together to bundle into a new block in the chain.

- Each node works on finding and solving a difficult proof-of-work for its block.

- When a node finds a proof-of-work solution, it will broadcast the new block to all nodes in the network.

- Nodes will only accept the new block if all transactions listed in it match the existing full ledger and are valid and none have already been used by spending.

- If nodes accept the block they will express verification by starting to work on creating the next block in the chain, using the previous accepted hash as an accepted block in the universal chain ledger.

Compensation:

- The creation of new bitcoins rewards miners (nodes/computers) for supporting the network.

- Bitcoin mining is also a way to initially distribute new bitcoins into general circulation with no central banking authority to print them.

- The new bitcoins reward miners for their time, computer expense, and the electricity that makes the whole blockchain network function.

- Transaction fees are another reward for miners and will be the sole reward for the processers after all bitcoin are one day mined to the achieved limited 21 million supply.

- Being awarded new bitcoins also incentivizes miners to stick to the rules and be honest. The bitcoin awards also disincentives a network attacker due to the cost and resources they would have to expend to disrupt the system of honest nodes.

- Bitcoin miners are compensated for their work free from the dangers of monetary inflation.

The blockchain:

- Nodes can discard old data transactions, with the root of the discarded transaction remaining in the block’s hash.

- One defense against an attack of fake transactions on the blockchain is for the in network nodes to broadcast alerts when they detect invalid blocks. This should prompt nodes to download the full block along with the reported false transaction to confirm or deny the reality of the transaction.

- Bitcoin’s biggest edge is the efficiency of large transactions and the ability to scale size. It is easier and more efficient to send multiple Bitcoins in one transaction than to create multiple transactions for each individual Bitcoin, when sent to the same wallet address.

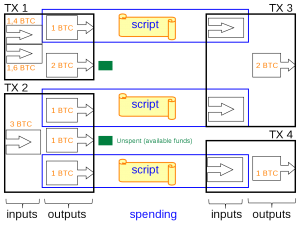

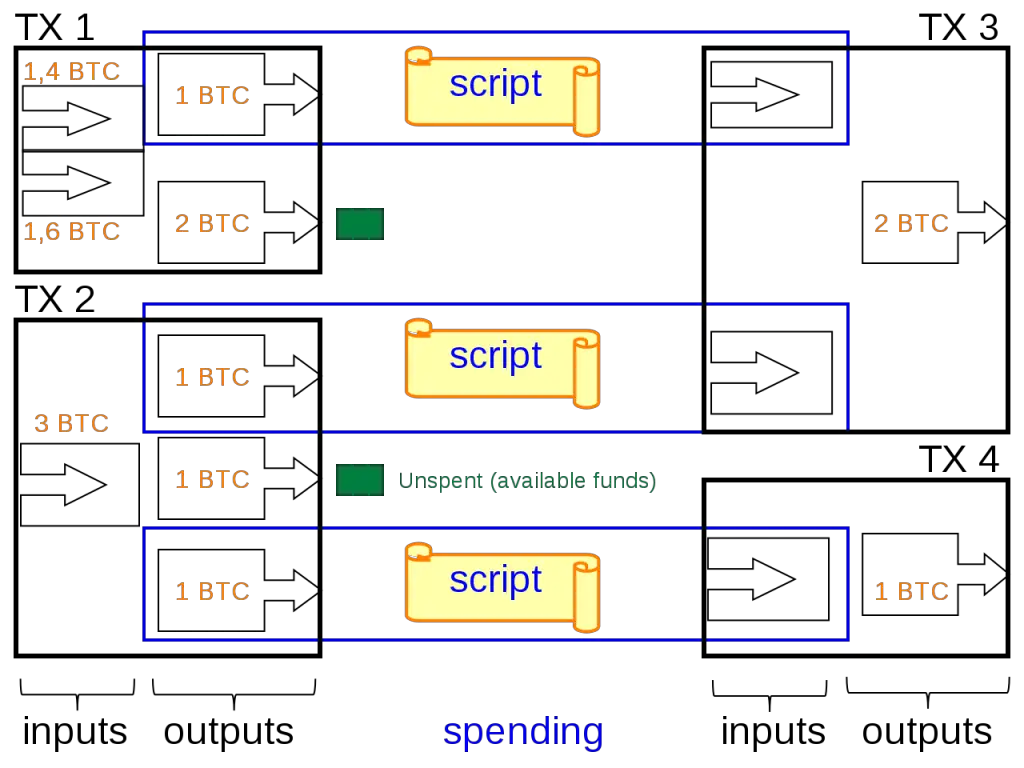

- This payment process enables payments to be sent with specific amounts. A payment can be sent with a Bitcoin to someone and they can get back their change when needed. It allows value to be split and combined, transactions can contain multiple inputs and outputs. Normally there will be either a single input from a larger previous transaction or multiple inputs combining smaller amounts, and at most two outputs: one for the payment, and one returning the change, if any, back to the sender.

- Public keys in the blockchain can keep users anonymous. Everyone can see the transactions in the public blockchain there is no identifiable information is linked to the blocks, transactions, or wallets.

- There’s a very high probability that honest nodes will solve proof-of-work puzzles and find a block faster than any group of attackers. It is nearly impossible for network attackers to solve several puzzles in a row faster than all the honest nodes.

“The network is robust in its unstructured simplicity.” – Satoshi Nakamoto