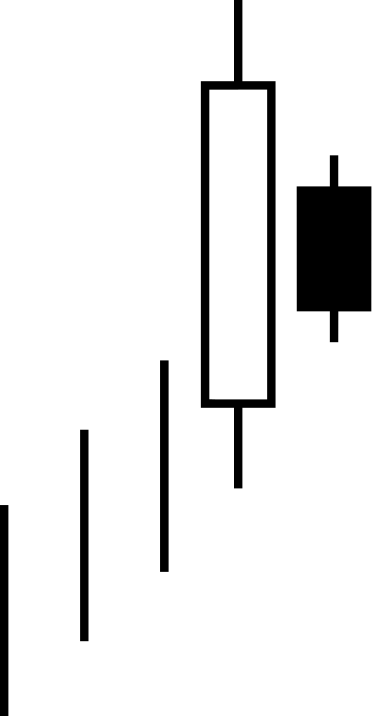

A bearish harami candlestick pattern is created by two candles, first a large bullish candle then next a small bearish candle. The full trading range of the opening and closing prices of the second smaller bearish candle must be completely engulfed inside the body of the first large bullish candle. This formation signals the probability that a reversal is about to occur during an uptrend as this pattern is bearish.

Own work, CC0, via Wikimedia Commons

The size and range of the second bearish candle can be an indicator on the likelihood of a reversal. The smaller the bearish candle the higher probability of a reversal happening as it shows buyers are absent at higher prices and that price has lost momentum and stopped moving .

The bearish harami can be a signal to lock in profits for long positions during uptrends as it shows the uptrend may have ended with the rejection of higher prices for two straight days. The second bearish candle confirms the first that the high on the chart may be in for now. A short position trade can be taken at the end of the second bearish candle signal with a stop loss on a move above that bearish candle.

The probabilities of this signal working out are increased if it occurs near the overbought 70 RSI on a chart or at three or more standard deviations from the 20 day moving average. This pattern has additional confirmation if the next candle after these first two is a bearish candle.

This is a bearish reversal candlestick pattern in an existing uptrend.

The inverse of the bearish harami is the bullish harami.