The tweezer top candlestick pattern is created by two or more candles with matching highs in price. A tweezer top happens when two candlesticks form back to back or near each other with exactly or almost the same highs. This pattern is more meaningful when it happens near overbought levels or key price resistance on a chart. It shows an absence of any buyers at higher prices of the two candles for two days after two attempts.

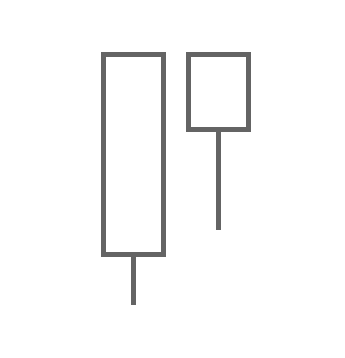

Tweezer top candlestick pattern

Protious, CC0, via Wikimedia Commons

The two candles that create this pattern don’t have to be in consecutive order and the size and colors can be different. The tweezer top candle signal is a high probability reversal signal that is more meaningful when it happens at a confluence of other signals on a chart like oversold, at the top of a Bollinger Band, key price resistance, or near a key overhead moving average. This pattern has additional confirmation when it is followed by a bearish candle pattern.

The tweezer bottom candlestick pattern is a sell signal for longs or can even be a sell short signal as it shows a high probability or a reversal to the downside to happen as consecutive high prices hold as resistance and are rejected with at least two candles. A tweezer top can be separated by a few candles but the most popular classic version of this pattern happens over two consecutive candles.

While any color candles can create the pattern it is most likely to see a reversal if the second candle of the tweezer top is bearish and down.

This pattern signals that longs should take profit at the end of the second candle and shorts can step in and bet on lower prices at the end of the second candle as buyers are absent at any higher prices.

Chart Courtesy of TrendSpider.com