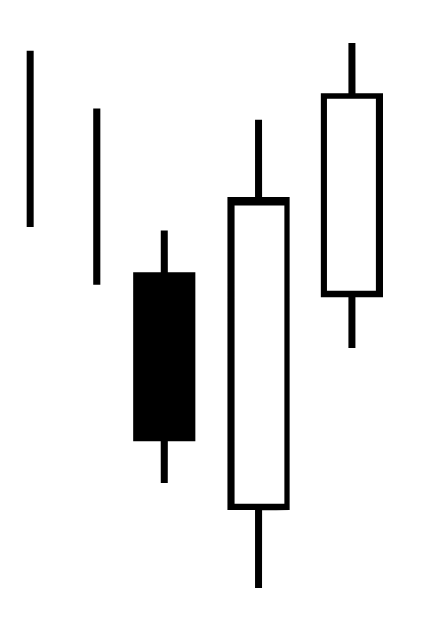

The bullish three outside up candlestick pattern is a three three-candle reversal signal that can appear on charts during downtrends in price. It is formed by a bearish candlestick followed by two bullish candles.

The three outside up pattern is created by one bearish candlestick first then followed by two bullish candlesticks in sequential order with no interruptions with the first candle down, second candle up and last candle up. This pattern shows a quick shift in market sentiment from bearish selling to bullish buying and shows a possible bounce during a downtrend back into an upswing in price. If the bullish candle buying starts in confluence to a key price support level or important moving average on the chart it increases the odds of this reversal playing out as a profitable buy signal.

Three outside up candlestick pattern summary:

The chart is in a downtrend of price action.

The first candle to start the pattern is bearish.

The second candle is bullish with a long body and completely engulfs the first candle.

The third candle is bullish with a higher high and higher low that also closes higher than the second bullish candle in the pattern.

This pattern gives a buy signal on the second straight bullish candle that confirms the pattern, a potential stop loss could be set on the loss of the support of the second bullish candle under the lowest price. It can be a good practice to cover short positions if you are short and see this pattern form on the chart.