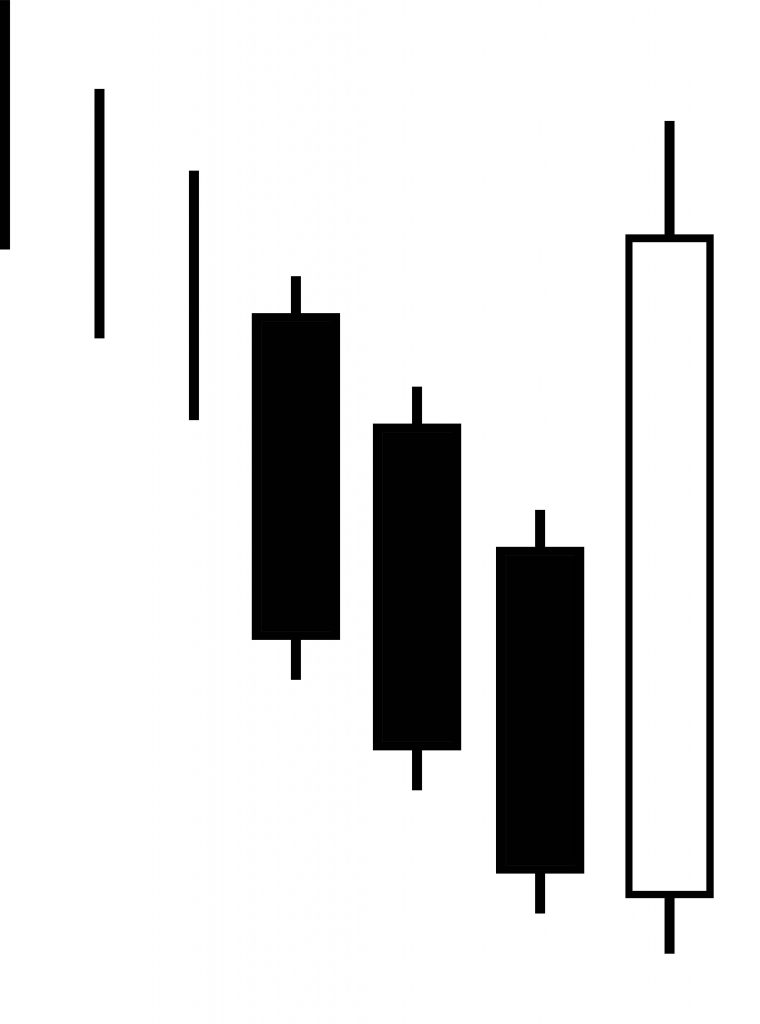

The bearish three line strike candlestick pattern is a signal that occurs when a large bullish candle follows three bearish candles during a downtrend in price. It is a four candle pattern where each of the three bearish candles has a lower low and closes near the price range low with small wicks. The fourth candle starts lower than the previous bearish candle but reverses with a big bullish move up above the three previous bearish candles to close higher than the first candle in the pattern. The fourth candle makes both the low and the high of the four candle pattern.

The three line strike candlestick pattern is can be powerfully bearish signal as it gives short sellers a chance to enter a short position as prices are likely bid up as the price temporarily and overcame all the selling of the previous three days. It signals that a possible second chance for long positions to exit could be happening on a chart in the current time frame. For short sellers waiting for a bounce before shorting the strong downtrend this gives a bearish signal as the fourth candle closes at a four day high in price. A common signal for this pattern to cover the short position is if price closes higher than the fourth bullish candle with a stop loss set with a above that candle.