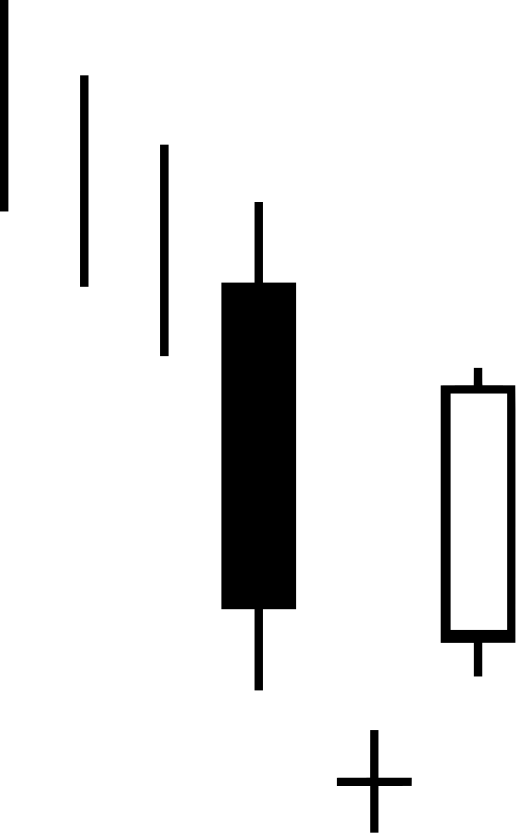

The bearish abandoned baby is a three-candle pattern following an upswing in price. It is created by a big bullish up candle, followed by a gap up doji, and then a big bearish candle after a gap down in price.

It gets its name from the look of the doji candle getting ‘abandoned’ by the two larger surrounding candles due to the gap up and then back down separating the doji from the other two candles.

This pattern shows that buyers have lost momentum as price stops going up as the doji is formed, volatility contracts, and then sellers step in and bid down the price on the next candle. This pattern signals a high probability of the end of an uptrend in price and the potential for a move down in price action. This pattern can be followed by either a swing back down in price or a new trading range forming after the reversal off the highs. Price should not rally back above the high of the last bearish candle in the pattern or it will invalidate the downside signal.

The common sell signal for this pattern is at the end of the third bearish candle. This can be a take profit signal on a long position or even a possible short sell signal. If this leads to a short sell signal then a stop loss could be set above the high of the bearish candle that followed the doji.

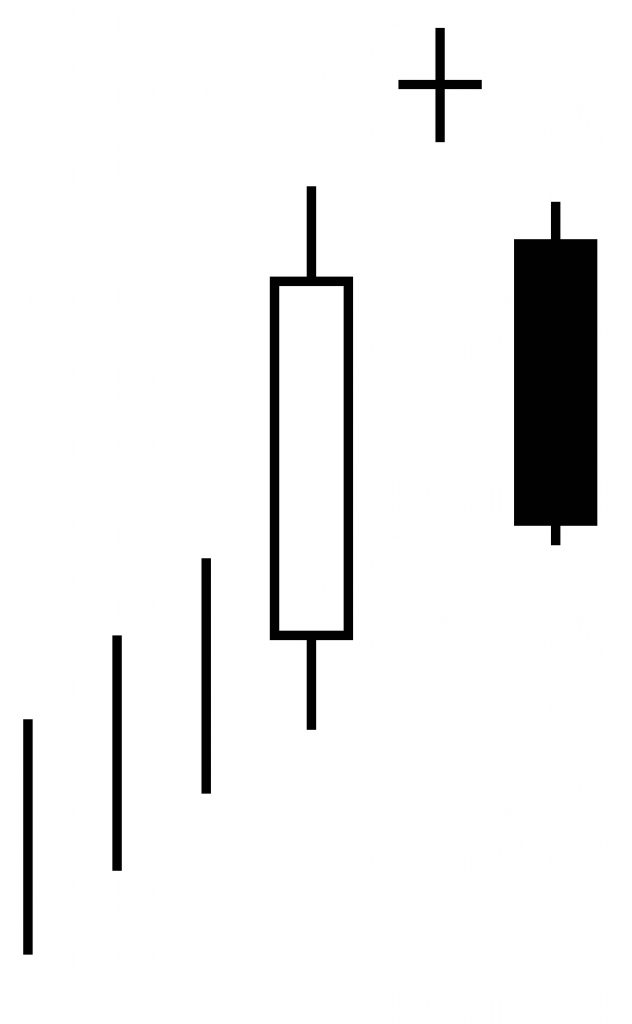

The bullish abandoned baby is a three-candle pattern following a downswing in price. It is created by a big bearish down candle, followed by a gap down and doji, and then a big bullish candle after a gap up in price.

It gets its name from the look of the doji candle getting ‘abandoned’ by the two larger surrounding candles due to the gap down and then back up separating the doji from the other two candles.

This pattern shows that sellers have lost momentum as price stops going down as the doji is formed, volatility contracts, and then buyers step in and bid up the price on the next candle. This pattern signals a high probability of the end of a downtrend in price and the potential for a move up in price action. This pattern can be followed by either a swing back up in price or a new trading range forming after the reversal off the lows. Price should not drop under the low of the last bullish candle in the pattern or it will invalidate the signal.

The common buy signal for this pattern is at the end of the third candle that is bullish with a stop loss set below the low of that candle.