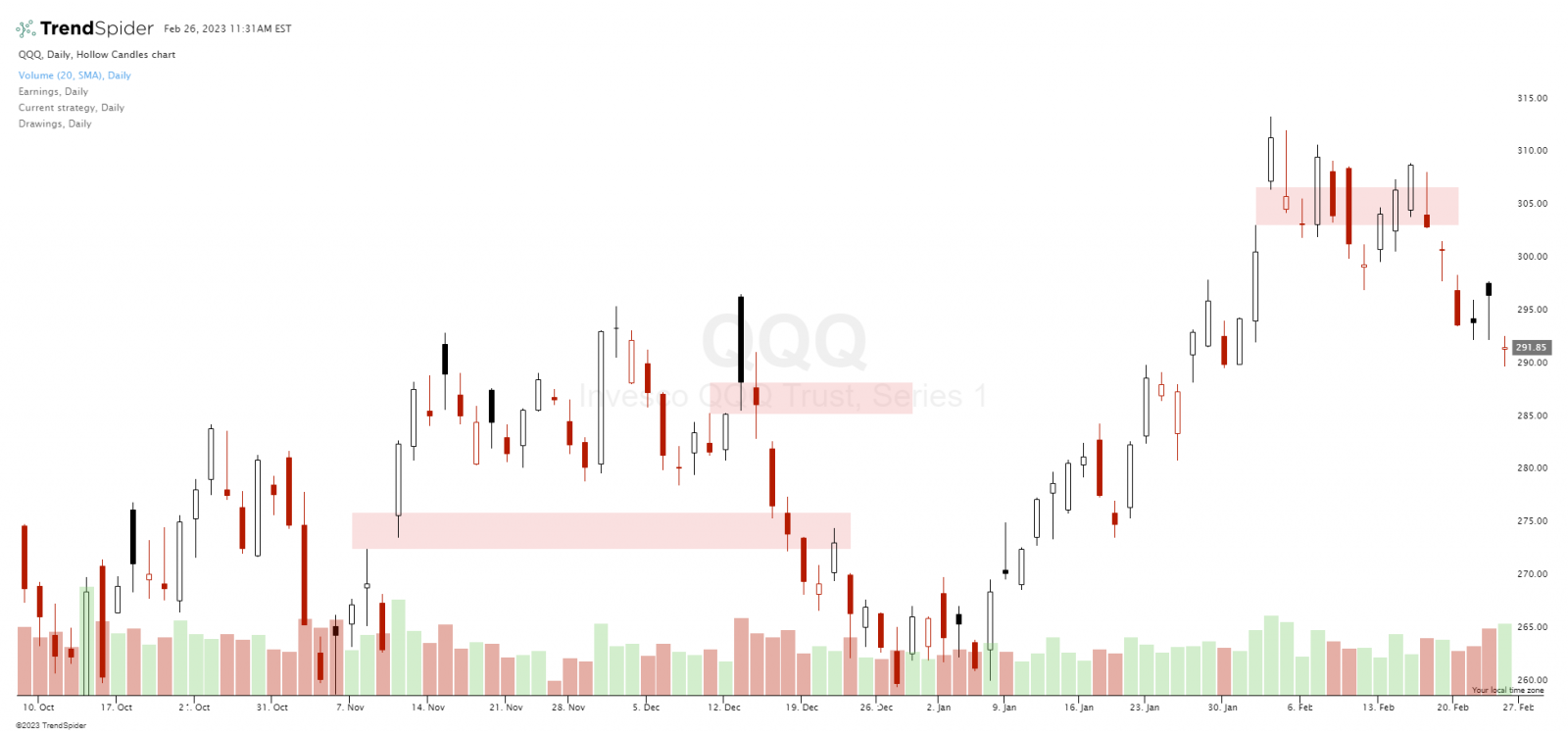

Gaps on a chart show that there were no buyers and sellers connecting at price levels on a chart. Gaps happen mostly when news comes out that instantly changes prices to much higher or lower prices than they were previously trading at. As the news event is instantly priced in by buyers and sellers a void is left in the chart.

The common sayings by traders is that “Gaps always get filled”, “Charts hate gaps” and “Mind the gap.”

What is a gap fill in stocks? What exactly does it mean that a gap has been filled on a stock chart?

A gap on a chart is considered to be filled when the price action moves back through the open gap area where transactions were missing. Price must retrace all the way to the closing price of the previous day before the gap. Once price has returned to where it was before the gap day it is technically filled. If price moves inside the gap area but does not move all the way through it, that is called a partial gap fill.

Gaps can give strong technical signals of momentum, trend continuation, or a reversal signal depending on when they happen on a chart.

- A gap up out of a price base to all time highs can be a new strong momentum signal to the upside.

- A gap down out of a price base to new all time lows can be a new strong momentum signal to the downside.

- During a trend in price a gap in the direction of the current move can be a signal of a continuation of the trend already in place.

- During a trend in price a gap against the direction of the current move can be a signal of the trend reversing that is currently in place.

- If a gap in the opening price doesn’t fill in the first hour of trading it tends to go in the direction of the gap for the rest of the trading day.

Gaps do eventually fill but that could happen after a strong move or trend takes place and can take a long time for the market to change direction.

The path of least resistance is generally in the direction of the gap in price action. There are few technical signals stronger than a gap in price. The bigger the gap the stronger the signal.

Chart courtesy of TrendSpider.com