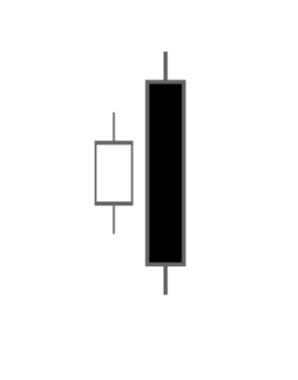

A bearish engulfing candle forms on a chart when a small body candle is inside the range of the next large down candle which can be black or red depending on chart settings. When a two candle bearish engulfing pattern happens near the top of an uptrending chart or when a chart has an overbought technical reading like a 70 RSI or 3rd standard deviation from the mean price it is considered a major reversal signal.

Wikipedia

Wikipedia

A bearish engulfing candle shows that buyers rejected higher prices from the previous day and sellers stepped in to push prices all the way down under the previous days support. This is a double bearish candle as buyers couldn’t hold the breakout to new highs over the previous day’s range or hold the previous day’s low price. This shows both the end of buying pressure and selling pressure on the same candle.

The bigger the bearish candle is versus the previous candle the more meaning it can have. The bearish engulfing candle has less meaning in volatile and choppy charts.

There is a higher probability of a short sell working with the bearish engulfing signal if the trader waits for the next candle to confirm the reversal with a follow through bear candle.

The context of where the engulfing bearish candle appears is crucial as it’s meaning is more clear at the end of an uptrend than inside of an existing trading range.

The more confluences of other bearish technical signals that occur with the engulfing bearish candle the greater the odds of it marking a top on a chart.

Chart Courtesy of TrendSpider.com