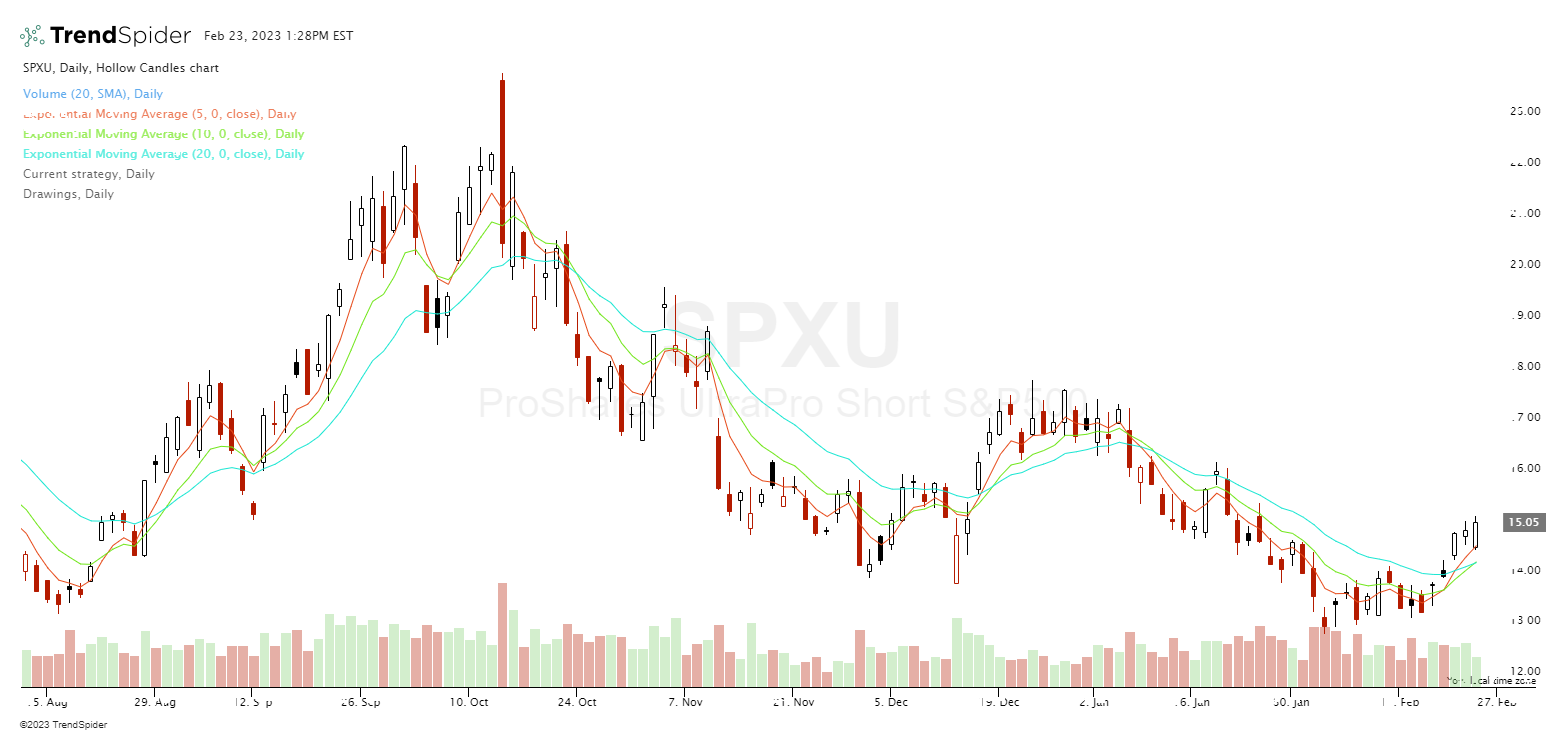

The 3 moving average crossover strategy is a technical trading technique that uses three exponential moving averages of different time lengths to create signals on a chart.

The three moving averages we will look at are the 10-day EMA, 30-day EMA, and 50 day EMA.

- 10-day EMA is the momentum indicator.

- 30-day EMA is the value zone.

- 50-day EMA filters for the longer term trend.

Price over all three averages is a strong confluence showing both an uptrend and rising momentum in all three time frames.

When the 50-day EMA is above both the 10-day and 30-day the chart can be considered to have lost short term momentum, if price falls below the 50-day EMA then that is a signal that the longer term uptrend is reversing into a possible downtrend.

Price under all three moving averages is a strong confluence showing both a downtrend and falling momentum in all three time frames.

The 10-day EMA crossing over the 30-day EMA above the 50-day EMA is a potential long entry signal.

The 10-day EMA crossing below the 30-day EMA below the 50-day EMA is a possible short selling signal.

The 10-day EMA crossing over the 30-day EMA below the 50-day EMA can be a potential signal of a reversal in the longer term trend from down to back to an uptrend.

The 10-day EMA crossing below the 30-day EMA above the 50-day EMA can be a potential signal of a reversal in the longer term trend from up to the beginning of a new downswing in price.

The three moving averages can be used together as filters for price action showing the best entries and exits to go with the flow of the current momentum and trend on the chart. The 10/30 day EMA and 10/50 day EMA crossover signals can be backtested on charts to create mechanical entry and exit signals. The 30-day ema can be used to signal a value zone on the chart for potential reversion to the mean trades when price gets too far extended from this line stretched too far like a rubberband the odds that it will eventually snap back.

Three moving averages simply show the current direction of momentum on a chart and can be used to create good risk/reward ratios at entry through the use of stop losses, trailing stops, and profit targets.

Three moving averages on a chart can visually show traders both the direction of the long term trend and whether the short term trend still has momentum in the same direction. The shorter term moving averages can confirm the longer term moving average or show a divergence. Price over the 50-day EMA at the same time price is under the 10-day EMA can be a warning sign of a reversal in a trend.

A triple moving average crossover of all three moving averages at the same time can be one of the most bullish signals on a chart when it happens. A triple moving average crossunder of all three moving averages at the same time can be one of the most bearish signals on a chart when it happens.

The 3 moving average crossover strategy can give price context on a chart in relation to the three different lines.

Chart Courtesy of TrendSpider.com