How do you backtest a trading strategy even if you can’t code? Use backtesting software that doesn’t require coding, just simple inputs of entry and exit signals for markets you want to see the results for.

You don’t need to code you just need access to user friendly backtesting software. In 2020 there is plenty to choose from with most being very affordable and web based.

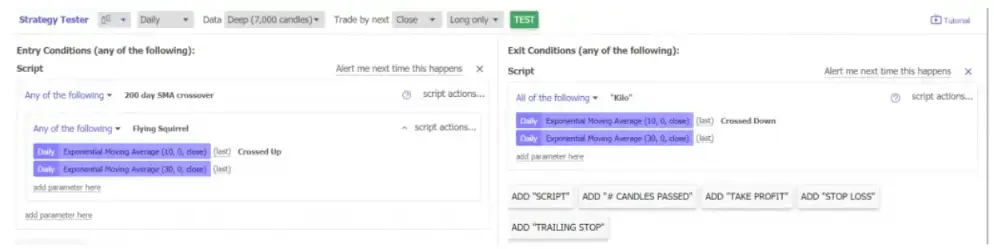

With good backtesting software the computer coding is in the background and you just input your signals to be tested directly in with no coding required.

Chart Courtesy of TrendSpider.com

Good backtesting software allows you to use technical indicators like moving averages, RSI, MACD and others as signals for when to get in and when to get out of a trade. Software can also set stop losses, profit targets, and trailing stops for entry signals to see how each scenario plays out for profits.

A basic backtest will include:

- Historical market price data of a stock, currency, commodity, or index selected for the backtest.

- An entry signal that defines the parameters for when you will enter a trade.

- An exit signal that defines the parameters for when you will exit a trade.

- An input of these parameters in backtesting software will output the signal performance for the time period used.

- All of these can be done on web based backtesting software.

Different software programs have different learning curves so it is important to find one that is intuitive and is easy to get started with.

Another option is downloading historical price data into an Excel spreadsheet and the writing formulas for technical indicators and price action to determine trade outcomes around different entry and exit signals. Excel is good for backtesting simple outcomes based on price action alone but gets more complex when technical indicators formulas are used. This is an option instead of coding depending on your own expertise in Excel and the complexity of what you are trying to backtest.

The last option in place of coding is called eyeballing charts. Going bar by bar on a past charts price action and seeing how your signals would have played out over a time period. This is possible with a simple strategy like day trading the opening 30 minute price breakout on a 1 minute chart with a .50 cent stop loss and then a .50 trailing stop as an example. Backtesting this strategy on 20 charts is reasonably doable. But this is a very time consuming strategy for more active strategies.

How to backtest a trading strategy even if you can’t code: use backtesting software that doesn’t require coding, Excel spreadsheets, or backtest on a chart manually.

The last option is if you are really serious about backtesting complex strategies and you want to do this on a professional level then learn to code.