The Commitments of Traders or COT report is a weekly report created by the Commodity Futures Trading Commission (CFTC) quantifying holdings in the U.S. futures and options contracts by different market participants. It is put together by the CFTC from traders disclosures of market positions and covers the futures on grains, cattle, financials, metals, energy, and other commodities along with options.

The CFTC issues a new report every Friday at 3:30 p.m. EST, and it reflects the commitments of traders on the previous Tuesday.

The COT report shows a summary of aggregate positions held by traders of different sizes that are classified as one of three types: commercial traders, non-commercial traders and non-reportable. Commercial traders are usually hedgers, buying or selling future contracts to hedge their company’s product. Non-commercial traders are many times large speculators like hedge funds, CTAs, or big money traders trying to profit from price action, fundamentals, or macro trading with little or no underlying interest in receiving physical commodities on delivery. The nonreportable group are thought to be almost all small speculators trading a few contrats trying to profit from short term price moves.

Many traders use the COT report to see how smart money and big money are positioned to help see the big picture of the trend and the possibility of it reversing. The report can be one filter speculators use to decide the direction they should take positions in whether long or short. One popular trading method is that small traders are the ‘dumb money’ and are usually wrong and the best odds of success is to position against the total net non-reportable positions direction. The other commonly held belief is that the commercial traders are the ‘smart money’ as they are experts in their commodity, industry, and market so it is best to trade in the same direction as their overall positions.

When using this report, traders should be very aware that it can take time and multiple attempts to benefit from attempting to fade a trade and go against or with either group. It is best used as a big picture view of the sentiment of different groups of traders and has value when used in confluence with other trading signals.

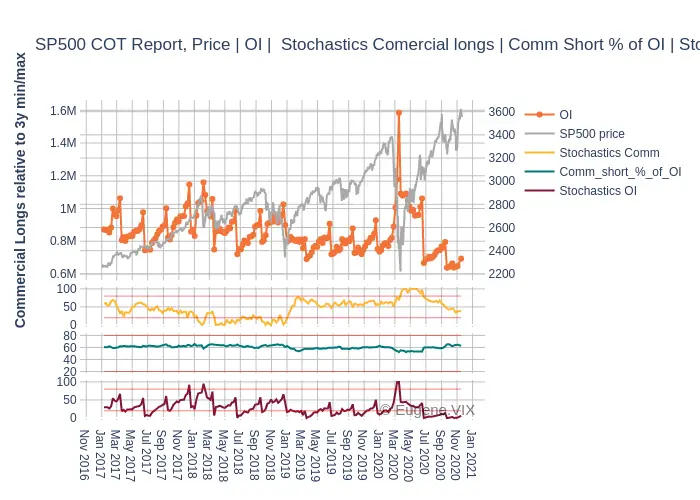

$SPY, $CME_SP1, $SPX COT Report, Comercial longs, OI, Stochasticks & Futures $SP500 pic.twitter.com/B14kTpeYqH

— Eugene.Vix (@EugeneVix) November 21, 2020

Friday’s COT positioning report showed ~flat aggregate fund flows into agriculture futures: corn, chicago wheat, and soybean outflows offset by sugar, coffee, cocoa, bean oil, and cattle inflows. Funds have likely been quiet since the Tuesday COT data cutoff. #corn #wheat #beans pic.twitter.com/3X8dD7xwWO

— Peak Trading Research (@PeakTrading) November 22, 2020

$GLD Cot report shows commercials short. pic.twitter.com/UvkSU4d1NR

— Singularity (@compoundin17) November 16, 2020