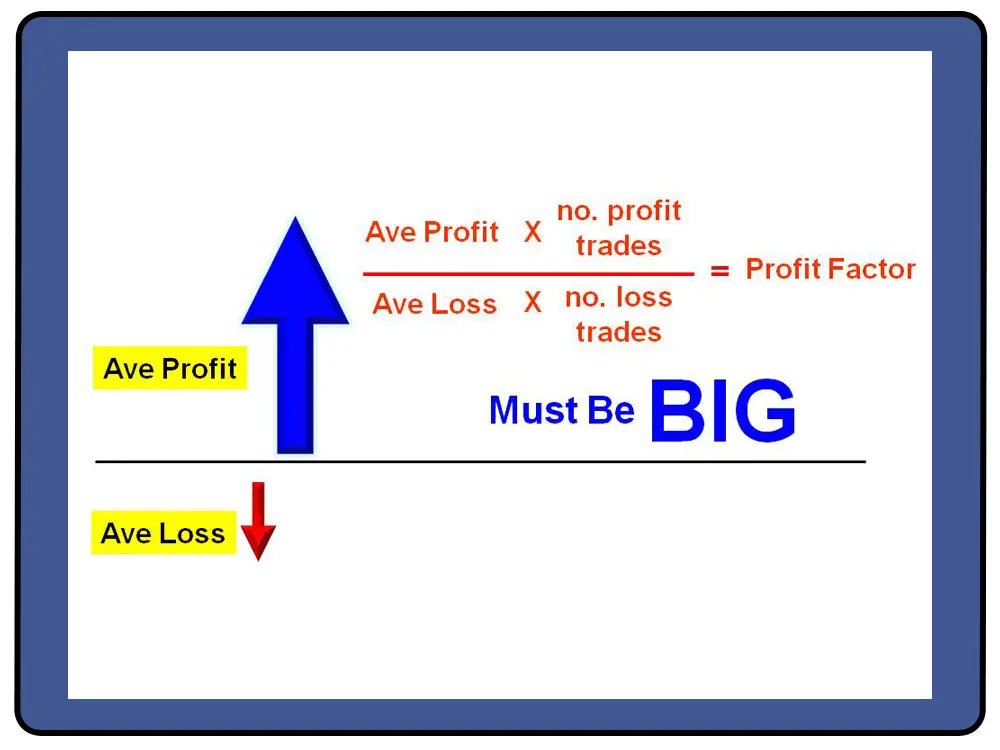

There is a common saying on Wall Street “Let winners run and cut losers short.” This quote tries to express the principle of creating big wins or small losses. Creating a high risk/reward ratio through the use of trailing stops for profitable trades and stop losses for unprofitable trades is the foundation of profitable trading. The primary reason the majority of the best traders are profitable is due to big winning trades and small losing trades not their win rate.

Letting winners run and cutting losses short is an edge in itself in creating asymmetric risk in your favor even if the entries are random, the trade management after entry is a big part of profitable trading.

Another popular saying on Wall Street, especially with new traders is “You can’t go broke taking a profit.”, this is not true. if your wins are small and your losses are big you will eventually lose all your money trading. The single biggest cause of unprofitable trading is big losses. Letting winners run and cutting losses short is an edge in itself in creating asymmetric risk in your favor even if the entries are random, the trade management is a big part of profitable trading.

After position sizing, stop losses are a trader’s most important risk management tool. Cutting your losses is both a science and an art. You want to use implied and historical volatility to calculate the math of your risk with any position. You also must create the best principles for setting your stop losses on any single trade or inside your system.

Here are ten tips for the art of cutting your losses.

- A stop loss price level must first be figured and set based on your position sizing and maximum account risk you decide on.

- A stop loss must be chosen before you enter into a trade when your thinking is clear, not after you are in and become biased and don’t want to accept a loss.

- Traders should be disciplined to take their stop loss when it is first triggered and not start hoping for a reversal. The longer a trade goes against you the more difficult it will be to exit and cut the loss as it grows bigger.

- A stop loss should be set at a price level where it shouldn’t go if the trade is going to work out.

- You must give a stop loss room to breathe and not set it at an obvious level that will likely be triggered inside normal price movement.

- Key support for long trades and key resistance for short trades are good levels to look at first for stop losses.

- Moving averages are good metrics for stop losses when used based on the trades time frame.

- Trend followers use new highs or new lows for a set number of days as initial stop losses for long or short positions.

- Swing traders and trend traders sometimes use a close below the low of the day of entry as a stop loss.

- Some traders use a set percentage of a position as their initial stop loss. If their trade drops 3% in value they exit and stop the loss.

The first step in trading is setting the stop loss so all losing trades are small. Once the art of the stop loss is mastered the next step for a trader is the art of the trailing stop to maximize the winning trades.