Most new traders never make it through the learning curve and traders that are successful early on at making money only discover that they were lucky and did not have the skill they thought they did. Traders go through many stages in their development and they can’t skip a step, they must learn the lessons from the markets and discover their own weaknesses.

Most new traders never make it through the learning curve and traders that are successful early on at making money only discover that they were lucky and did not have the skill they thought they did. Traders go through many stages in their development and they can’t skip a step, they must learn the lessons from the markets and discover their own weaknesses.

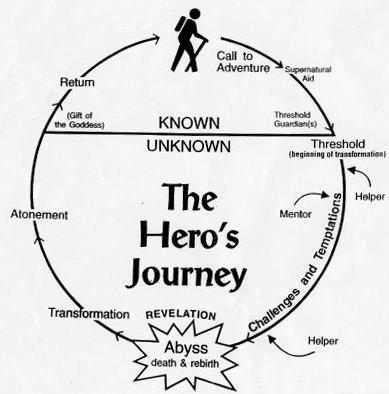

On the journey from new trader to successful trader there are many steps, here are the main ones that everyone goes through.

Stage 1: A new trader knows nothing.

A new trader has zero knowledge about how the markets work or how traders even make money. In the beginning stage most new people think profitable traders can predict future price action and make money by always being right about every trade. A novice believes that traders make consistent returns daily and weekly and there is a Holy Grail of trading that makes money in every market. They believe traders create for themselves regular paychecks with few losses and no drawdowns in capital.

At this stage a new trader knows nothing and is ignorant of their own ignorance.

Stage 2: A new trader pays to learn.

There are two directions to go in at Stage 2. A serious new trader will begin to educate their self through reading books, studying charts, taking eCourses, and learning system development and backtesting. There are also endless free sources online to learn the basics of trading from. They are on the right path.

The other direction that many new traders choose is to jump right into trading with real money. Every trader will pay for their education in time, study, experience, and trading losses. It is better to learn as much as you can about trading before putting real money at risk. A book on risk management is less expensive than trading with too large a position size. It is ignorant, arrogant, or both to think you can start trading with no plan or system and that you will beat other traders consistently.

You will pay to learn how to be a trader and you get to choose how expensive you want the lessons to be.

Stage 3: The reality check stage.

At this stage the new trader has studied enough to know the right questions to ask, or they blew up their first account and are now ready to study trading seriously. After a new trader realizes that trading is not the easy money they thought it would be, this is the crossroads of quitting or doing the work.

If a trader has put real money at risk or studied system win rates and drawdowns they begin to realize that trading is a professional endeavor of risks and rewards not a place to go grab some easy money.

When the reality of trading sets in the trader will choose to do the work needed to become successful or go looking for easy money somewhere else.

Stage 4: The information overload stage.

At this stage a trader gets all the information they need to start trading but they know so much that it begins to become conflicting information.

A momentum trader says to buy the breakout while a swing trader says to sell short into resistance. A day trader says overnight risk is too dangerous and a trend trader says holding overnight and for days and weeks is where the big profits are. Some systems rely on high winning percentages and other systems focus on a few big wins and manage several small losses.

Once a new trader understands price action trading, reactive technical analysis, and risk/reward ratios they need to start choosing what is the right trading method for them. What time frame will they trade? What is their target win rate and risk/reward ratio? What will be their edge?

When a new trader has all the information they need the next step is filtering out the right information that applies to them.

Stage 5: Developing your own trading edge.

In this stage a new trader decides to become a real trader. The trader filters through all their knowledge and chooses what they will implement to start creating their own trading system.

Many times a trader will try to create the perfect system looking for the Holy Grail strategy that never loses. This can be a trap a traders spends a lot of time and energy in until they realize it doesn’t exist, then they can stop looking for a perfect trading system and just develop a profitable trading system.

The trader chooses a trading method that fits their own screen time, risk tolerance, return goals, personality, and belief system. They choose the markets they will trade whether stocks, forex, options, futures, or crypto. They have filters for building their watch list. The trader has completed large backtests and historical chart studies to find an edge in price patterns. They now have signals that have a profit factor over large sample sizes of data.

The trader has an edge over other traders as they know what types of trade setups typically work out to be profitable over time if they cut losses short and let winners run.

Stage 6: Finally some profitable trading.

The profitable trader has created a trading system with a positive expectancy over time. He trades it with discipline and consistency. The trader doesn’t get emotionally moved with losses and drawdowns as they are just part of any winning system not a reflection of a bad process or that something is wrong.

A good trade becomes one that was executed within the system with discipline and a bad trade is one that didn’t follow the trading plan. The trader becomes a servant of the price action and just trades their own signals. They go in the path of least resistance and manage trades to be small wins, small losses, break even, or big wins. Big losses have been removed from possible outcomes. Money becomes a side effect of good trading.

At this stage the trader has faith in their system and their ability to execute it. He will stay within risk management guidelines for stop losses and position sizing so every trade is just one of the next one hundred trades and shouldn’t have any large emotional impact or hurt the trader’s ego.

In the final stage the trader is a manager running their trading system like a business and letting their edge play out over the long run.