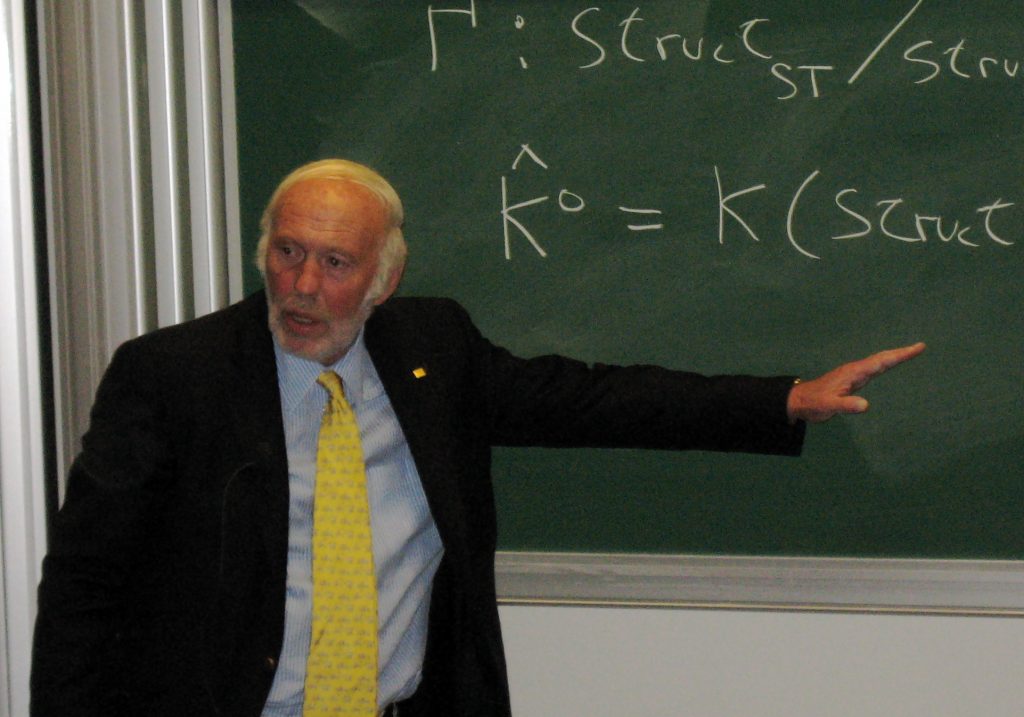

Jim Simons was one of the most successful hedge fund managers in history. He was a trained mathematician and quantitative trader and the founder of Renaissance Technologies. His hedge fund specialized in diversified system trading using individual quantitative models derived from statistical analyses of historical price data. His primary models were on pattern recognition. Jim Simons was a mathematics professor from 1968 to 1978, and chair of the mathematics department at Stony Brook University. He started in the hedge fund industry in 1982. His net worth was approximately $23.5 billion near his death.

His Renaissance Technologies flagship Medallion fund is one of the best performing funds in history in both magnitude and duration of compounding returns on capital. How good is his fund at making money? They had to close the Medallion fund to outside investors due to compounding the capital under management to such a size they had trouble scaling the signals on markets that could not handle the volume without moving prices as they entered and exited.

“Since 1988, his flagship Medallion fund has generated average annual returns of 66% before charging hefty investor fees—39% after fees—racking up trading gains of more than $100 billion. No one in the investment world comes close. Warren Buffett, George Soros, Peter Lynch, Steve Cohen, and Ray Dalio all fall short.” – ‘The Man Who Solved the Market ‘by Gregory Zuckerman 2019

Five trading lessons from Jim Simons:

Quantify your edge through backtesting.

Backtesting past historical price data can give you an edge in trading current price action. Markets are traded and invested in by people with emotions and opinions who create patterns. Price action patterns can repeat, learn to find a way to trade those patterns with an edge.

Trade your system with discipline.

“We don’t override the models.” – Jim Simons

After you create a trading system with an edge, you have to trade it consistently with discipline. No trading system will work if it is not followed long enough to let it play out and be profitable. All systems have drawdowns and losing streaks even the ones used by the Medallion fund, all traders have times when they want to override their trading plan, even Jim Simons did this a few times. In the long run all profitable trading requires discipline.

Trade a diversified watchlist for more opportunities.

Be open to looking for trading signals across all liquid asset classes. On a side note, avoid illiquid stocks, options, futures, and crypto currencies due to the dangers of losing money in the bid/ask spreads, not being able to trade with size, and not being able to get in and get out when you want.

Trading different types of signals on a diversified watchlist of markets, stocks, and currencies that backtest well can increase your opportunities to make money in different market environments.

You don’t need a high win rate to make big returns.

“We’re right 50.75 percent of the time… but we’re 100 percent right 50.75 percent of the time. You can make billions that way.” – ‘The Man Who Solved the Market

Jim Simmons models did not need a high winning percentage to make money. If you have a 1:2 or 1:3 risk/reward ratio you can make large returns as long as you don’t have any big losses.

Example of a 1:2 risk/reward with a 50% win rate:

$100+$100+$100+$100+$100-$50-$50-$50-$50-$50=$250 profit

Example of a 1:3 risk/reward with a 50% win rate:

$150+$150+$150+$150+$150-$50-$50-$50-$50-$50=$500 profit

It is the magnitude and frequency of both wins and losses that determine profitability not just win rate. A small edge can make a lot of money over the long term as long as you keep the losses small.

There are universal principles of profitable trading.

No trading system works all time in every market but the principles of profitable trading stay valid. Profitable trading comes down to math, the math of risk management, the math of position sizing to avoid the risk of ruin, modeling of a trading system with a positive expectancy, along with cutting losses short and letting winners run.

The biggest lesson from Jim Simmons is that profitable trading is built on the foundation of math but a human has to have the discipline to follow the math without allowing bad emotions to unplug a good system.