The Kelly Criterion is a scientific gambling method using a formula for bet sizing that mathematically calculates the proper position size for placing a bet based on the odds. The Kelly bet size is calculated by optimizing the projected value of the wealth logarithm, which is equivalent to maximizing the expected geometric growth rate of the capital being wagered. The Kelly Criterion is a formula used to bet a preset fraction of an account. It can seem counterintuitive in real time.

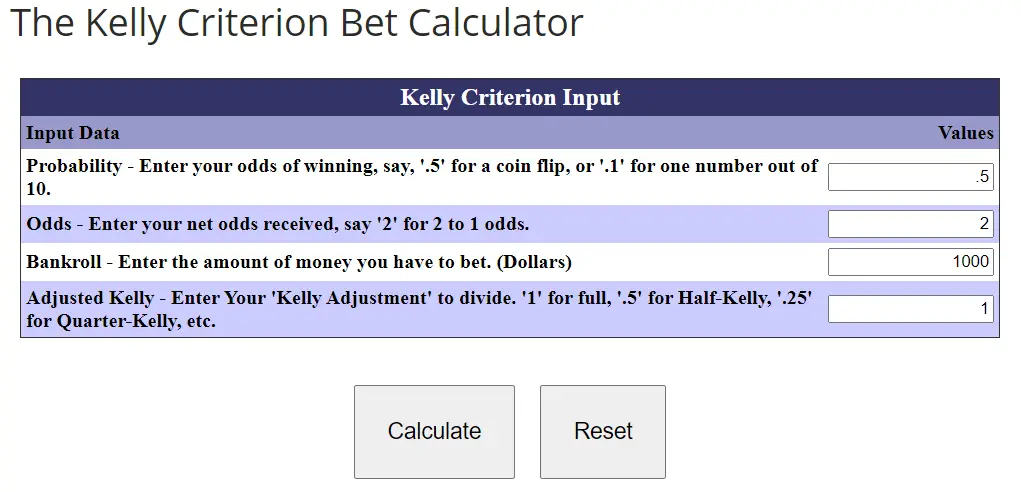

The Kelly formula is : Kelly % = W – (1-W)/R where:

- Kelly % = percentage of capital to be put into a single trade.

- W = Historical winning percentage of a trading system.

- R = Historical Average Win/Loss ratio.

Here are the statistics traders need to calculate the Kelly Criterion:

- You can use the data from your trading records or backtesting data for your system for calculating the Kelly Criterion.

- Your system’s winning probability is your “W”.

- Your system’s win/loss ratio is your “R”.

- These numbers are the input into Kelly’s equation above for calculating bet size.

- The Kelly percentage is what the equation returns.

For an even money bet, the Kelly criterion computes the wager size percentage by multiplying the percent chance to win by two, then subtracting one. So, for a bet with a 70% chance to win (or 0.7 probability), doubling 0.7 equates 1.4, from which you subtract 1, leaving 0.4 as your optimal wager size: 40% of available funds. – Wikipedia