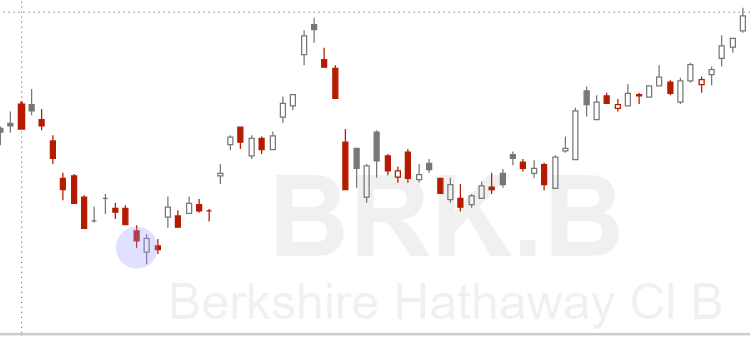

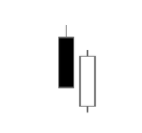

The piercing pattern candlestick chart is a two day price action pattern. It is created after one large down black or red candlestick followed by one large up white or green candlestick that opens below the low of the preceding candlestick but closes over halfway up into the previous black bearish body candlestick. This candlestick pattern is considered as a reversal signal when it appears near the bottom of an existing downtrend.

The piercing pattern happens during two days when the first candle is created by bearish lower prices and then the second candle takes prices first lower than the previous day but then buyers step in to push it back at least 50% up inside the previous day’s candle range. This reversal shows that the supply of shares from sellers at lower prices has been absorbed in the market by buyers. This sudden demand from buyers at lower prices visually shows that there is a high probability of a bullish reversal in the short term.

The piercing pattern candlestick chart typically only projects out momentum for approximately a five day timeframe.

The piercing pattern is also called the piercing line, bullish piercing, or piercing candle.

Chart Courtesy of TrendSpider.com